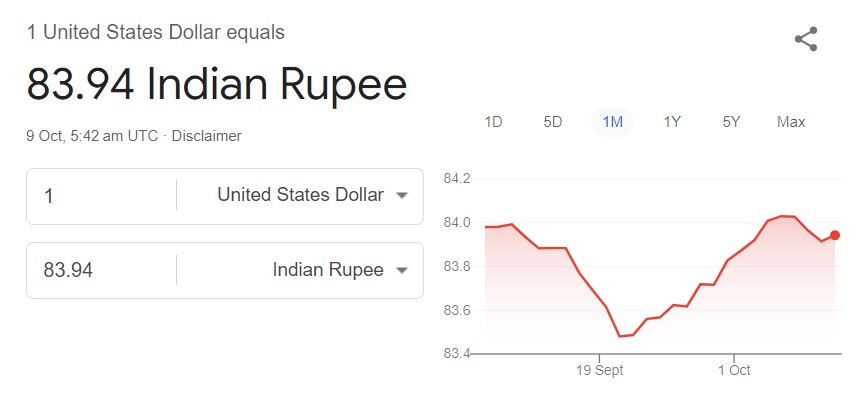

The Indian rupee is weaker as the US dollar strengthens in the currency markets. The INR is close to falling to the 84 mark, as its price is currently hovering at 83.94. A new report suggests that the Reserve Bank of India (RBI) has intervened in the currency markets to keep the INR from crashing against the USD.

Also Read: HBO Documentary Claims Peter Todd is Bitcoin creator Satoshi Nakamoto

Market participants said on the condition of anonymity that the RBI has likely intervened via non-deliverable forwards (NDF). The RBI also leveraged the local spot and currency futures markets to keep the rupee from falling against the US dollar. All these moves from the RBI prevented the INR from dipping below the 84 level.

Source: Bloomberg / Business Standard Research

Traders believe the rupee might not fall below 84 against the USD in the short term as the RBI is actively monitoring the developments. The timely RBI interventions prevent the INR from further dips against the US dollar in the currency markets.

Also Read: US Stock That Surged 2,646% Projected to Print Further Gains

Currency Markets: India Interferes in the Rupee & US Dollar Trade

Source: compareremit.com

This is not the first time India has been accused of interfering in the currency markets over the rupee and US dollar trade. They have been called out twice in a year for meddling to keep the INR safe against the USD. In October 2023, traders accused the RBI of stepping in to defend their local currency. Read here to know more details about the development.

Also Read: Goldman Sachs Revises Gold Price Prediction For 2025

In April this year, trade insiders said that the RBI dumped the US dollars to keep the rupee from falling. The rupee briefly spiked in April, but the surge was unnatural, as accused traders.

Not just India, China, and Japan have regularly intervened to keep their local currencies from crashing against the US dollar. Official authorities are now timing the currency market to save their national tenders.