Going live?

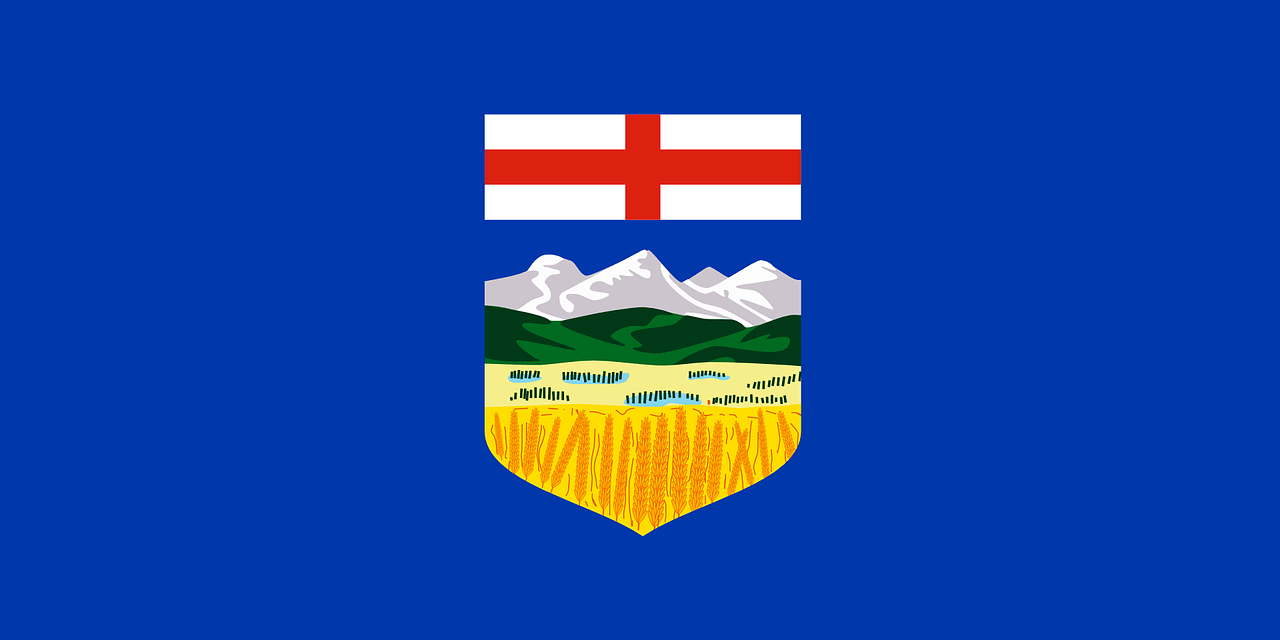

It is official. Alberta will be Canada’s second province to establish a fully regulated, legal gambling market. The expectation was that it would go live in early 2025, but then there were rumours that it could open by Christmas 2024. Whenever it does throw open its virtual doors, it will be one of North America’s larger markets and top international operators are indicating that they intend to be in on the action and apply for licenses.

Obviously, they will need to carry out all the relevant due diligence procedures, but this promises to be a win-win opportunity for gamblers and online gambling platforms alike. The province is also expected to profit from it handsomely too, and advocates are always keen to point out that a well-regulated market drives out rogue operators and helps to protect citizens from potential gambling harms. The Albertan government has seen Ontario’s success and is looking to it for guidance when drafting its own legislation.

Using the Ontarian model

Earlier in the year, the provincial government confirmed it had broad plans to open up its market in line with Ontario’s, which has seen online gambling inject an estimated CA$ 2.7 billion into its economy. An independent administrator will be appointed, and it is reported that there will be First Nation involvement in the development of the online market too.

Alberta’s Minister for Red Tape Reduction, Dale Nally, claimed,

“It’s going to be very similar to Ontario. We’re following their model as they built the roadmap. We’ll massage it a little bit, but it’s been inspired by the experience in Ontario. It’s going to be an open and free market.”

At the moment, Alberta only has one officially regulated online gambling site – Play Alberta, which offers sports betting, casino-style games, and limited live dealer games. While the service is relatively limited compared to what is available in Ontario, there are still great games. The best ones in Alberta allow gamblers to pay in various ways, including using fiat and cryptocurrencies. Operated by the Alberta Gaming, Liquor and Cannabis Authority, and it will be interesting to see how the province balances the path between operators and regulator.

In May, the Red Tape Reduction Statutes Amendment Act (also known as Bill 16) passed, allowing the provincial government to regulate and oversee iGaming. It was widely regarded as the green light for commercial gambling operators to set up in the province

Commercial interest

In August, NorthStar Gaming Chairman and Chief Executive Officer Michael Moskowitz was reported as saying that they regard the Alberta market as a very attractive opportunity. He indicated that his company expects the rollout to be treated in a similar way to how Ontario did it. As one of North Star Gaming’s objectives is to build the customer base and brand outside of Ontario, it is keeping a watching brief on developments in Alberta. It is also expected that Betway, PointsBet Canada and DraftKings will be early entrants to the market.

Why is Alberta of interest to gambling majors?

Canadians love to gamble, and this makes the country an attractive market for online casinos and sports betting sites. Regulated markets are particularly attractive as having an official license is an extra stamp of approval or a Trustmark for the operator. Online casinos must collect and verify sensitive, personal data, so this approval helps customers gain trust in the site.

While Alberta is not as populous as Ontario (or British Colombia, to be pedantic), it is probably the wealthiest of the Canadian provinces on a per capita basis. The population is also a bit younger, which will make it a different market from Ontario. At the moment Ontario has more operators and platforms than just about any other regulated market in the world.

While Alberta’s citizens are younger and wealthier, the market could not support such a broad operator base and will, therefore, not be as competitive. In addition, Play Alberta will not want to lose out on its market share and revenue. There will need to be careful consideration not to kill the golden goose as Play Alberta is of significant financial importance to the province’s revenue flows.

How will it be structured?

As yet, the market has not been clearly defined, and there is no clear picture of how it will look. The questions that will need to be addressed alongside considerations about the number of operators that the market can support include:

How will it impact First Nations?

What will be the rules around sports betting and advertising?

What will the tax rate be?

How will the regulated market deal with the grey market?

Weaning people away from offshore sites

According to AGLC, Play Albera has captured around 45% of the province’s gamblers, with most iGamers still playing at offshore sites. What other markets have aimed to do is to bring players across from the illegal operators to those who are licensed to operate, and this is what the Albertan regulator will be aiming to do. Play Alberta currently contributes $1.5 billion in gambling revenue to government coffers to support programs and services. The provincial government is ideally hoping to double that figure by capturing the whole market potential.

Opportunity cost

While the opportunity for increased revenues is attractive to the province’s government, gambling revenues are not free money.

Regulation incurs costs in terms of negotiating the agreements, establishing the gaming authority, and establishing the structures to collect fees and revenues. If the regulator promises to offer consumers and operators enhanced protection from rogue operators, they need suitable staff to support both the gambling sites and their customers. They must also have easily accessible, safe gambling tools and services in place. In Ontario, the platforms were tasked with setting up their own self-exclusion programmes, but the general consensus is that a single programme would be more beneficial.

Full steam ahead?

While everyone is pumped, it now seems very unlikely that the market will be operational this year or even in early 2025. An industry insider is reported as saying,

“Things have gone pear-shaped in Alberta. A proposal went to cabinet, but that’s been shot down twice. It’s gone sideways.”

Whether sideways or full steam ahead, government and industry are playing their cards pretty close to their chests, and everyone is keeping their ears pinned back for the latest news.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.