As the stock still attempts to rebound from underwhelming Q2 earnings data, Intel (INTC) is bracing for its steepest revenue drop in five quarters as it continues to struggle within the AI sector. Despite the booming market, the company has failed to capitalize on its position, with the chipmaker floundering.

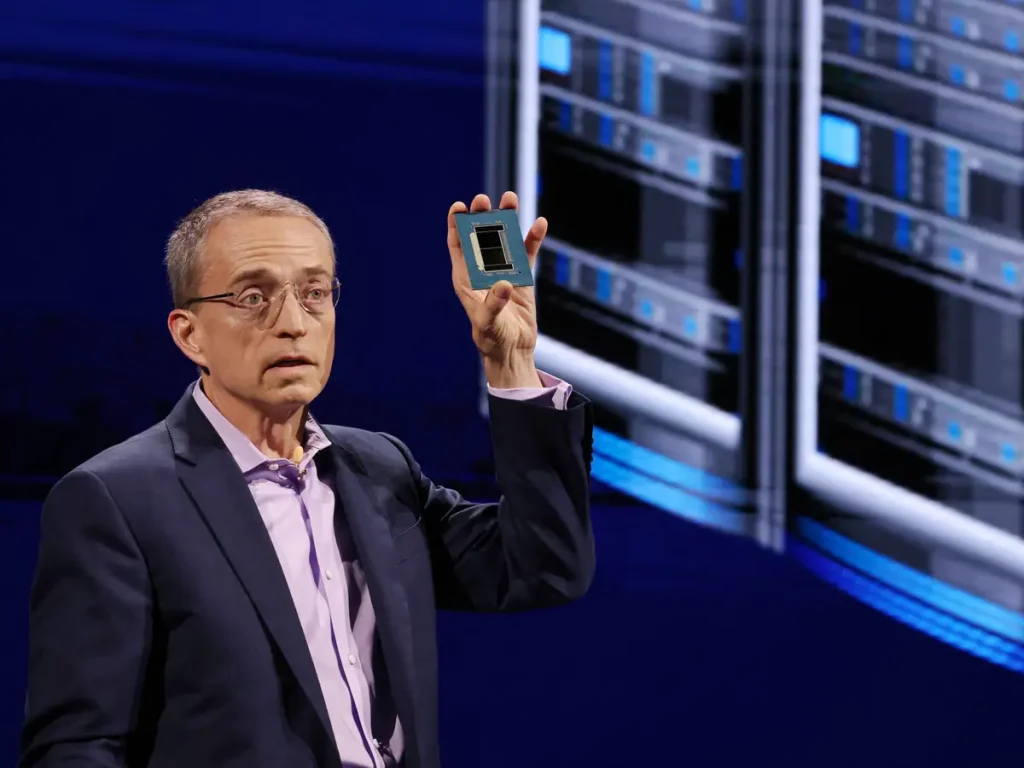

The company is set to announce its most recent quarterly earnings on October 31st. There is the hope that it would drive interest, but a negative outcome could hinder any attempt at a bounceback for the firm. All eyes are now on Intel CEO Pat Gelsinger to orchestrate a plan to drive competition once again.

Also Read: Intel: Is Quantum Computing Key to an INTC Comeback?

Intel Struggles Continue as INTC Poised for Massive Revenue Drop

The last two years have seen the stock market’s information technology sector thoroughly embrace AI. With the meteoric rise of OpenAI’s generative chatbot, ChatGPT, demand for the tech has skyrocketed. Moreover, its potential applications have driven every company to seek a place for it within their operations.

That has certainly hindered the growth of Intel, as INTC is bracing for its steepest revenue drop in five quarters amid its ongoing AI struggles. The company has failed to compete with the growing market. It missed the boat when it passed up on acquiring OpenAI in 2017 and is still floundering.

Also Read: Intel: Ex-CEO Nearly Bought Nvidia in 2005: NVDA Nears $3.5T Market Cap

Recent data compiled from LSEG indicates an 8% drop in revenue for Intel. That would place the INTC revenue figure around $13.02 billion. Moreover, it arrives with the company losing notable ground in both data center and personal computing markets. With continued downsides for the company, investors are growing weary of Gelsinger’s plan to turn INTC around since he took on the position of CEO in 2021.

reboundThis year, Intel stock has fallen more than 50%. Additionally, it has seen its market cap also drop, falling below the $100 billion mark. With uncertainty abounding, there are few avenues for a rebound left. That is especially true with competition closing in from all sides.