Ethereum, like most other coins, has been bearing the brunt of the broader market dump. On the daily chart, the alt leader has been making lower lows. In fact, it has already registered 5 back to back red candles.

As a result, ETH’s depreciation totaled up to 4% over the past 24-hours and 14% over the past week. At press time, the second-largest crypto was seen exchanging hands at $2.44k.

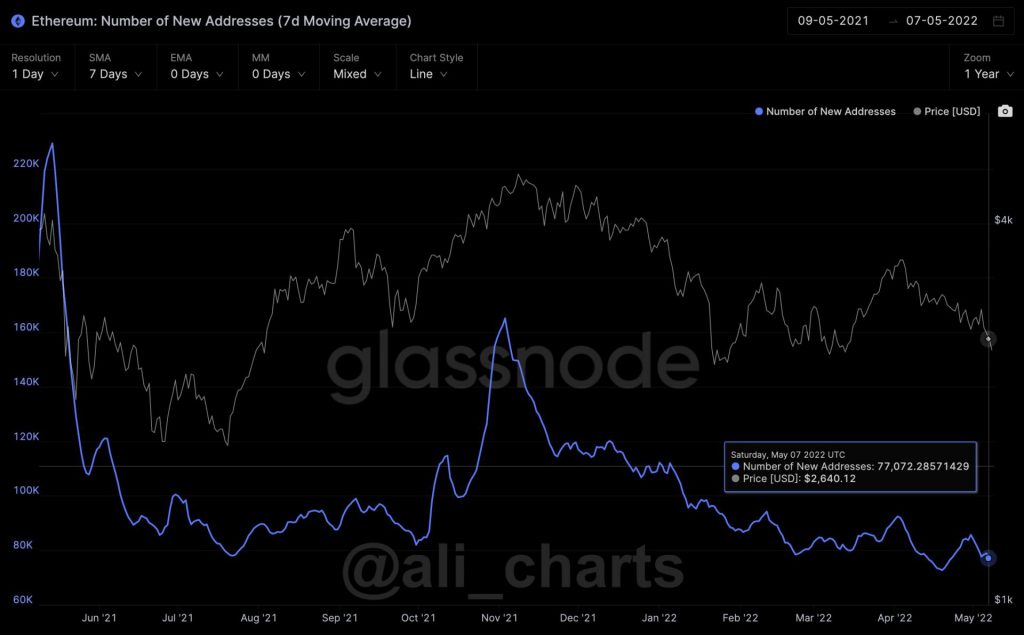

During these adverse times, the number of new addresses added to the ETH network continues to decline. Per Glassnode’s data, this metric has been hovering in and around 70k of late, when compared to last November’s 170k peak. Thus, it can be inferred that not many new retail investors have stepped into the market.

Source: Ali Martininez/Glassnode

Alongside, market participants have been abandoning their tokens by keeping up with the selling trend. Per Santiment’s data, in just the past two weeks, close to 330,000 ETH worth approx. $825 million have been sent to exchanges.

Make it or break it moment for Ethereum

At this stage, it is critical to note that Ethereum has a strong support band extending from $2369 to $2441. In the said range, over 650k addresses HODL more than 13.69 million ETH tokens.

Source: ITB

When chalked out on the price chart, the same band has acted as an effective demand zone a couple of times in 2022. In simpler words, whenever ETH has dipped its toes into the said range, it has been able to pull off a decisive uptrend right after.

So, over the next few days, if Ethereum collects liquidity in the said price band, it would be able to move up with much greater thrust than before. However, a breach of this vital support would encourage traders to exit their positions. As a result, Ethereum would be triggered to stoop lower on its chart.

Source: TradingView

In such a scenario, Ethereum could visit the reigns of its next major demand zone around the psychological $1700 level to collect liquidity. So, it is quite crucial for Ethereum to stay afloat in its current zone to shield itself from another meltdown.

Source: TradingView