Meta stock fell after the company’s Q3 2024 earnings announcement despite reaching record revenue. The Meta Q3 earnings showed strong growth, but heavy spending plans caused investor concern.

The company’s financial results highlighted significant expansion in its user base and technological capabilities, while market sentiment reflected caution about future investments in Meta stock.

Also Read: Bitcoin: MicroStrategy Announces $42B Plan For BTC Purchase

How Meta’s Q3 Earnings Reflect Record Revenue and Future Spending Plans

Financial Performance and AI Progress

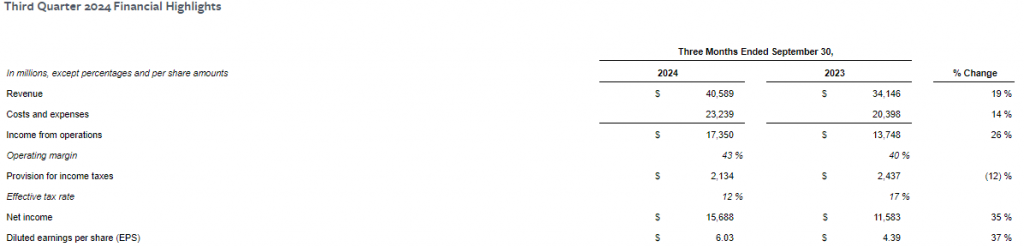

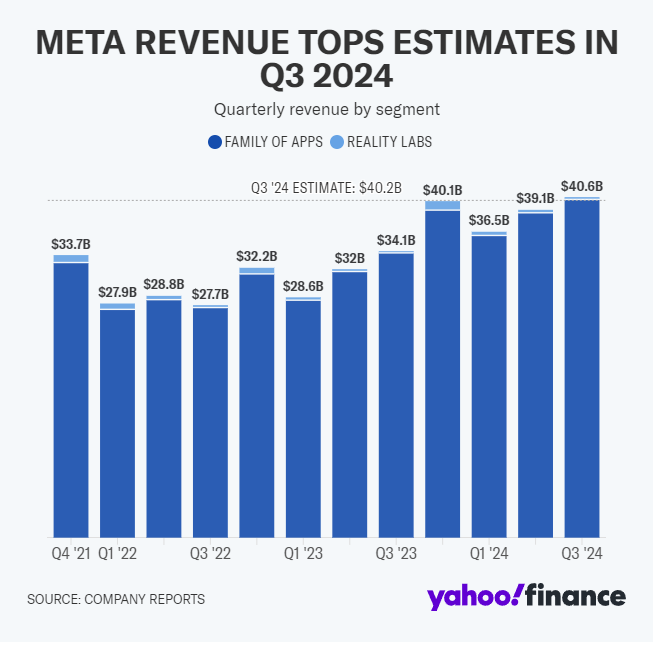

Meta’s Q3 earnings set new records with $40.58 billion in revenue, up 19% from last year. Profits jumped 35% to $15.69 billion, earning $6.03 per share versus the expected $5.25. CEO Mark Zuckerberg emphasized their technological progress:

“We had a good quarter driven by AI progress across our apps and business.”

The company demonstrated strong momentum across its core advertising business and emerging technologies, positively affecting Meta stock performance.

Capital Expenditure Plans

CFO Susan Li outlined the heavy spending plans: “We anticipate our full-year 2024 capital expenditures will be in the range of $38-40 billion, updated from our prior range of $37-40 billion.”

She added: “We continue to expect significant capital expenditures growth in 2025. Given this, along with the back-end weighted nature of our 2024 capital expenditures, we expect a significant acceleration in infrastructure expense growth next year as we recognize higher growth in depreciation and operating expenses of our expanded infrastructure fleet.”

These investments focus primarily on AI infrastructure and computing capabilities, which is anticipated to influence Meta stock in the long term.

Also Read: Cryptocurrency: Top 3 Memecoins For Big Gains In November ’24

Reality Labs Performance and Innovation

Reality Labs earned $270 million but lost $4.43 billion in operations. They launched Orion, which Meta described as “the most advanced pair of AR glasses ever made.”

Meta stated that it’s “a product combining the convenience and immediacy of wearables with a large display, high-bandwidth input and contextualized AI in a form that people feel comfortable wearing in their daily lives.”

Despite current operational losses, the division continues prioritizing long-term innovation, which could impact Meta stock.

User Growth and Platform Expansion

Meta’s apps now have 3.29 billion daily users, up 5% from last year’s 3.27 billion. The record revenue helped fund AI growth, with Meta Movie Gen coming to Instagram in 2025.

User engagement metrics consistently improved across all major platforms, supporting the company’s content delivery and advertising strategies and contributing to Meta stock’s performance.

Also Read: 3 PolitiFi Tokens That Could Explode Like MAGA, TREMP if Trump Wins US Election

Market Response and Future Guidance

Meta stock declined 3% after the report despite solid numbers. The company expects Q4 2024 revenue of $45-48 billion. Meta continues pushing AR/VR through deals like its Blumhouse partnership for Movie Gen testing.

While spending heavily on AI and infrastructure shows long-term commitment, markets reacted cautiously to these investment plans. The company’s strategic focus on emerging technologies and platform development indicates a clear vision for future growth despite short-term market volatility impacting Meta stock.