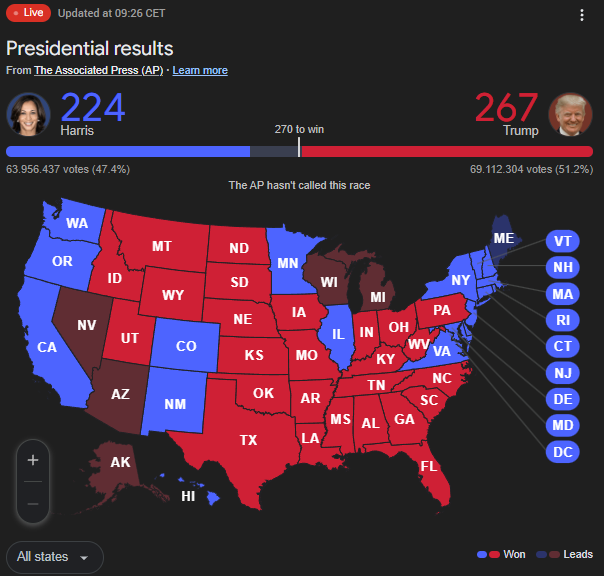

The US election caused major shifts in financial markets on Wednesday. Donald Trump’s win pushed Bitcoin to $75,255, a new record high. Stocks and other cryptocurrencies also rose sharply. Trump’s support for crypto and pledge to make the US a “Bitcoin superpower” led to a 10% rise in digital assets. “Crypto investors had been eagerly awaiting the presidential election for months, convinced that a victory for the former President Donald Trump would be good for Bitcoin and other digital assets.”

Also Read: Donald Trump Wins 2024 Presidential Election

How Trump’s Victory Impacts Stocks, Crypto, and Market Dynamic

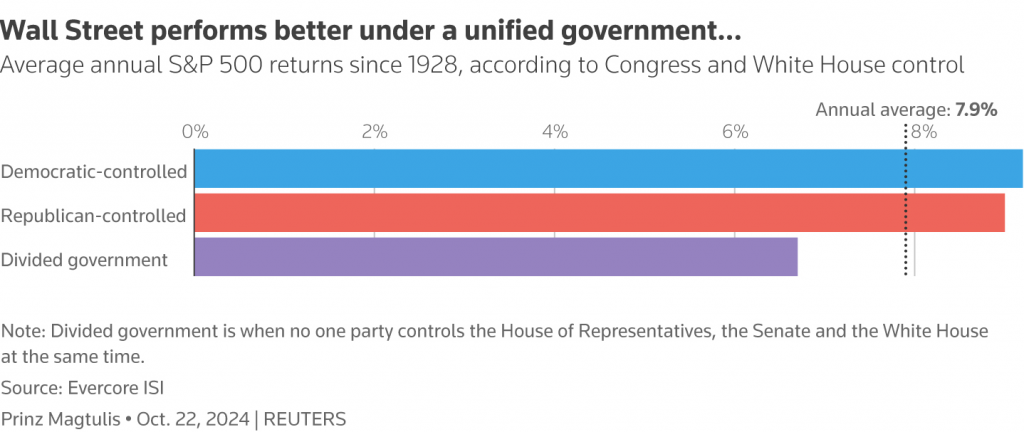

Stock Markets Rally on Election Results

Stock futures moved up strongly. The S&P 500 rose 1.1%, and the Dow Jones gained 1.3%. Bond yields also increased, with 10-year Treasury rates climbing to 4.4% from 4.28%. “The markets are scrambling to figure out what happens next, but for the time being, the market is pricing in a higher growth and higher inflation outlook,” stated Peter Esho of Esho Capital. Crypto investor Nic Carter wrote on X: “All of the libs clutching their pearls about the pro-crypto lobby were right. We are to be feared. We will do it again next cycle.”

Crypto Markets Embrace Trump’s Agenda

The rise in Bitcoin sparked gains across crypto markets. Dogecoin jumped 30%. Uniswap grew by 23%. Solana, Cardano, and Shiba Inu each rose 10-15%. The total crypto market value grew 11% to $2.5 trillion. Trading volume increased 77% to 138.48 billion in 24 hours.

Also Read: US Election Frenzy Could Send Bitcoin (BTC) To $100K, Here’s When?

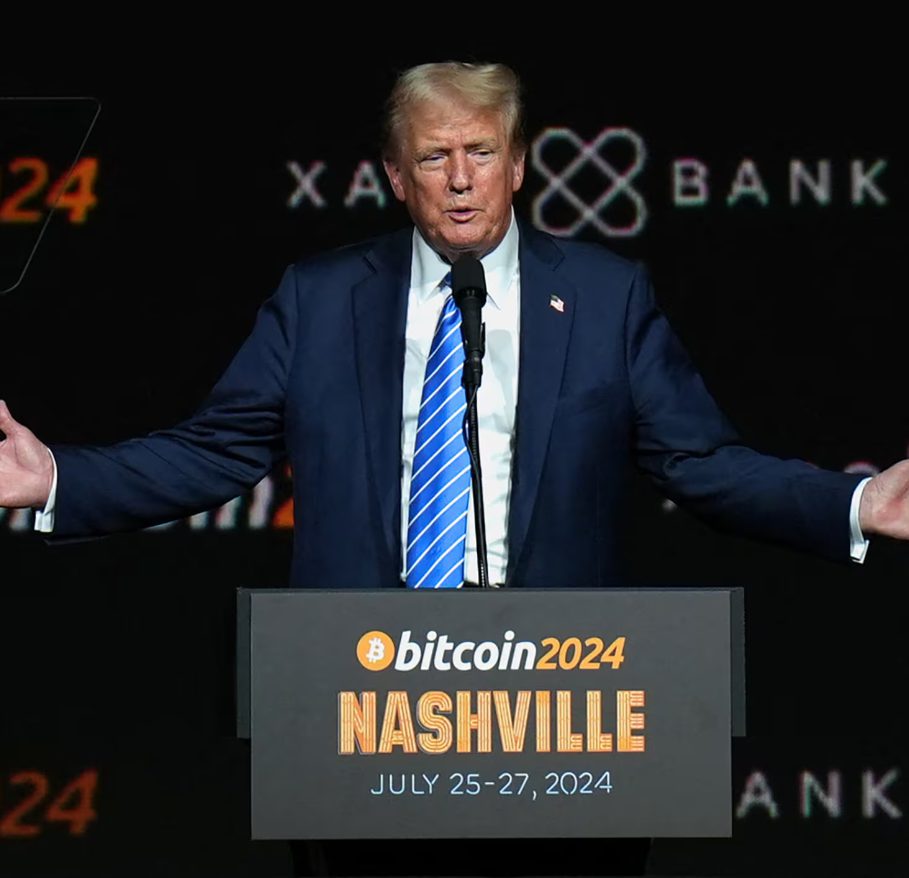

Trump’s Crypto Vision and Campaign Promises

Trump spoke at the Bitcoin 2024 conference in Nashville. He promised to create a Bitcoin reserve and remove SEC Chair Gary Gensler. “If you’re in favour of crypto you’re gonna vote for Trump,” he said at Mar-a-Lago. His campaign got strong crypto industry backing. The Fairshake PAC collected “more than $162 million” from Coinbase, Ripple, and Andreessen Horowitz.

Global Market Response

Asian markets had mixed results. Japan’s Nikkei 225 rose 2.6%, but Hong Kong’s Hang Seng dropped 2.6%. Anderson Alves of ActivTrades said, “Positive outcomes for Harris are expected to boost Asian assets, while Trump gains may exert downward pressure.” CoinDCX co-founder Sumit Gupta noted that “Bitcoin’s consistent upward trajectory underscores its resilience and enduring appeal as a long-term asset.”

Also Read: Ripple: XRP Projected to Rise 35% After US Election Results