They say ‘money does not grow on trees’, but the fact is ‘money does not grow with leverage’ either. The crypto crash today saw top coins crumbling like a pack of cards as Bitcoin fell to $33,000. The market is showing no signs of recovery and is expected to dip further.

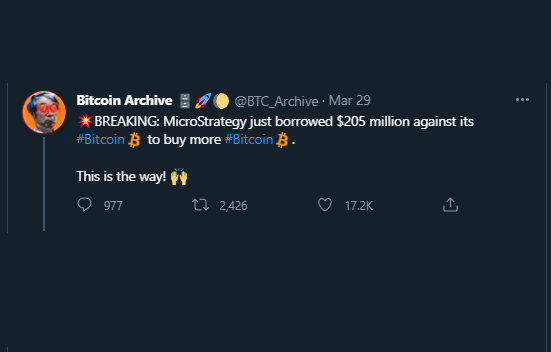

Today is a prime example to warn investors about the dangers of opting for the ‘leverage’ option to grow your wealth. For the uninitiated, ‘leverage’ is a financial tactic in an order to multiply gains by ‘borrowing capital’ on existing assets. Several platforms allow investors to use leverage to grow their portfolios with borrowed capital.

However, while leverage can be used to grow wealth, it also acts as a hacksaw blade that cuts both sides. The sound while cutting in the downward direction is much louder since the pressure is more when compared to it cutting in the top direction. Therefore, the answer lies right there that the blade cuts the sharpest during its downward trim and thus breaks the object.

Read More: Crypto Crash: Bitcoin & Ethereum Fall Below 50% From All-Time High

Crypto Investors Must Avoid The Dangers of Leverage

Source: Pixabay

While leverage multiplies growth, it equally multiplies losses too. A multiplied loss is not just a financial loss but comes with the additional baggage of distress, anxiety, and pain. In short, all dreams of making ‘good money goes down the drains when the market unexpectedly crashes, as it did today.

Another disadvantage of taking leverage is that you shell out money that you didn’t gain in the first place when the market collapses. When the market is up, you grow your wealth with borrowed leverage, but when the market is down, you need to offset the losses from your own pocket.

Read More: Robinhood Crypto Wallet: How to Transfer your Crypto From Robinhood

Taking leverage is a good option for financial institutions as they are backed with millions of dollars. They are capable of making a recovery in the next cycle. However, that’s not the case with retail investors as leverage can swallow up all their savings or even more. The risk of leverage is too high for an average retail investor and gaining a recovery in the next cycle is out of the question.