Surging bearish sentiments have led to a sustained downtrend in crypto market activity. This is reflected in the decline in the total crypto market cap (TOTAL) and Bitcoin’s (BTC) price over the past 24 hours. Stellar’s XLM is the altcoin with the most losses during that period.

In the news today:

- President-elect Donald Trump is considering establishing an “AI czar” role to oversee federal AI policies and advancements, emphasizing his commitment to maintaining US technological leadership.

- A US federal appeals court overturned Treasury Department sanctions on Tornado Cash, a crypto-mixing service that anonymizes cryptocurrency transactions.

Market Activity Continues To Drop

The total crypto market capitalization has dropped by $57 billion over the past 24 hours. TOTAL currently stands at $3.15 trillion, just above support formed at $3 trillion.

The recent market downturn has triggered significant liquidations in the past 24 hours. According to Coinglass, 172,500 traders have been liquidated, with total losses amounting to $484.65 million. Long traders have suffered the most, accounting for $361 million of the liquidations.

If this downward trend persists, TOTAL will attempt to breach the $3 trillion support level. If this critical level fails to hold, total crypto market capitalization risks plunging toward $2.82 trillion, a level last observed on November 15.

On the other hand, if selling activity wanes and the market witnesses a resurgence in buying pressure, this may push TOTAL toward reclaiming its all-time high of $3.36 trillion.

Bitcoin Poised To Extend Decline

Bitcoin trades at $93,158, noting a 2% price decline over the past 24 hours. Readings from its daily chart confirm the possibility of a sustained short-term decline.

For example, according to its Moving Average Convergence Divergence (MACD) indicator, selling pressure currently outweighs buying activity as the MACD line (blue) remains below the signal line (orange). This indicator tracks an asset’s price trends and highlights potential reversal points. When the MACD line crosses below the signal line, it suggests bearish momentum, indicating a potential downward price trend or weakening of upward momentum.

If this downward trend persists, BTC’s price may fall below $90,000 to exchange hands at $88,762.

However, an influx of new demand for the crypto king coin could set it on a trajectory to reclaim its all-time high of $99,588.

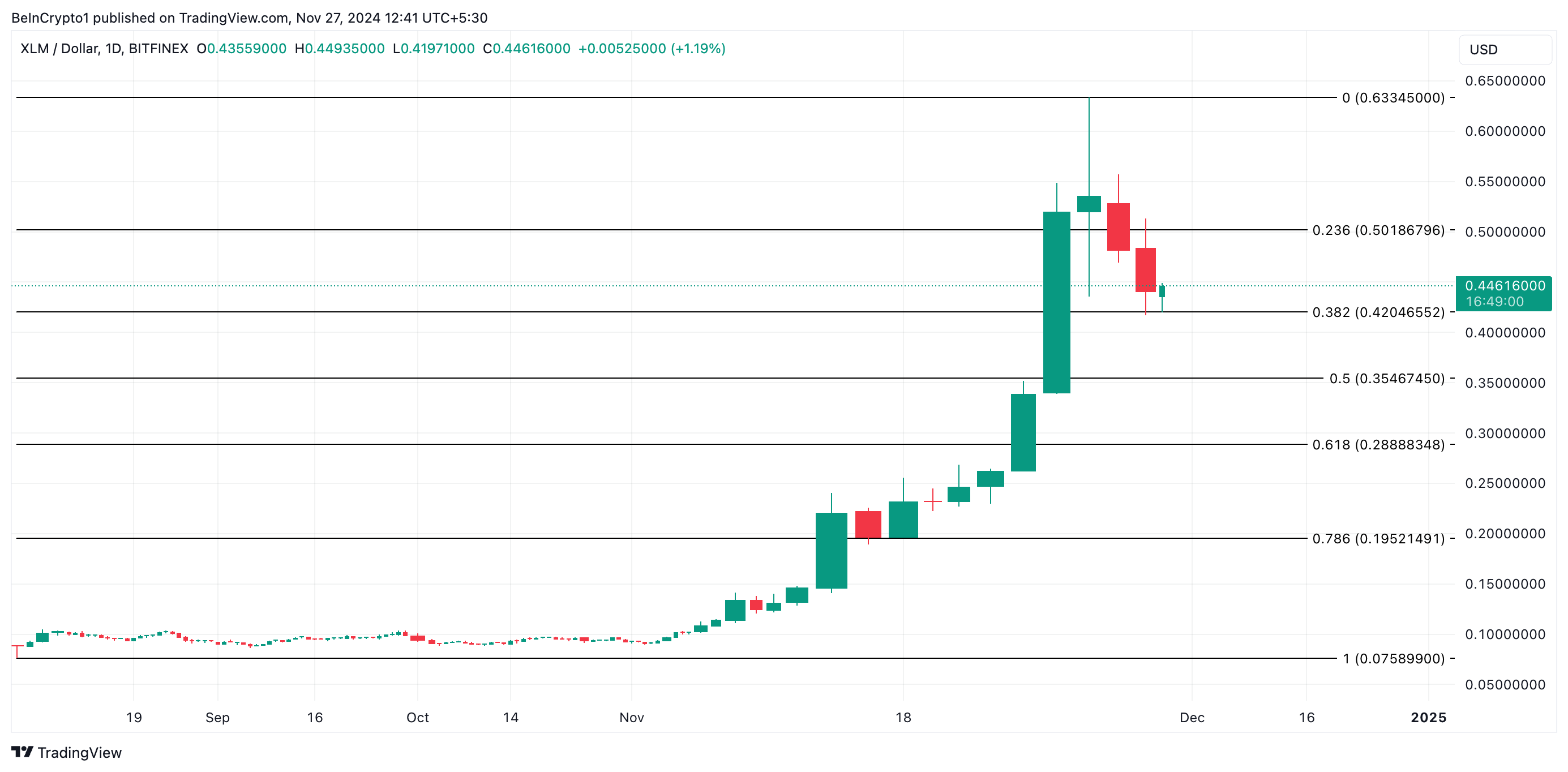

XLM Is the Market’s Top Loser

Stellar’s XLM ranks as the altcoin with the most losses in the past 24 hours. It currently trades at $0.44, shedding 9% of its value during the review period. This price decline is driven by the uptick in selling pressure as market participants take profits following the altcoin’s recent highs.

If selling activity continues, XLM’s price will plummet further to $0.42. If this support fails to hold, the token will drop below $0.40 to trade at $0.35.

On the other hand, if buying activity recommences, this bearish outlook will be invalidated. In this scenario, XLM’s price may climb toward $0.50.

The post Why Is the Crypto Market Down Today? appeared first on BeInCrypto.