Osmosis, a decentralized exchange (DEX) built for the Cosmos blockchain ecosystem, has opened a bridge to the Bitcoin network, as part of a pivot toward the world’s largest cryptocurrency.

The decentralized autonomous organization (DAO) that governs Osmosis <a href=”https://www.coindesk.com/tech/2024/06/21/cosmos-dao-osmosis-to-adopt-fee-free-bitcoin-bridge” target=”_blank”>voted in favor of adopting Bitcoin bridge Nomic</a> in June. The integration went live on Tuesday.

Nomic’s bridge now enables users to deposit their BTC on the Bitcoin network in return for a token called alloyed BTC (allBTC) on Osmosis.

“In leveraging Nomic’s decentralized custody engine and offering zero-fee transactions, Osmosis is becoming a decentralized Bitcoin exchange,” a spokesperson told CoinDesk in a Telegram message.

The project’s aim is to give traders the user experience of popular centralized exchanges but with decentralized custody of BTC.

Osmosis is one of several projects attempting to leverage the value tied up in BTC, which is by far the largest cryptocurrency by market cap, to bring liquidity to the broader crypto world.

Bitcoin dominance – a measurement of what percent of the total crypto market BTC accounts for – <a href=”https://www.tradingview.com/symbols/BTC.D/” target=”_blank”>hit 60% last month for the first time since March 2021</a>, highlighting the massive wealth of bitcoin reserves compared to that which exists in any other asset.

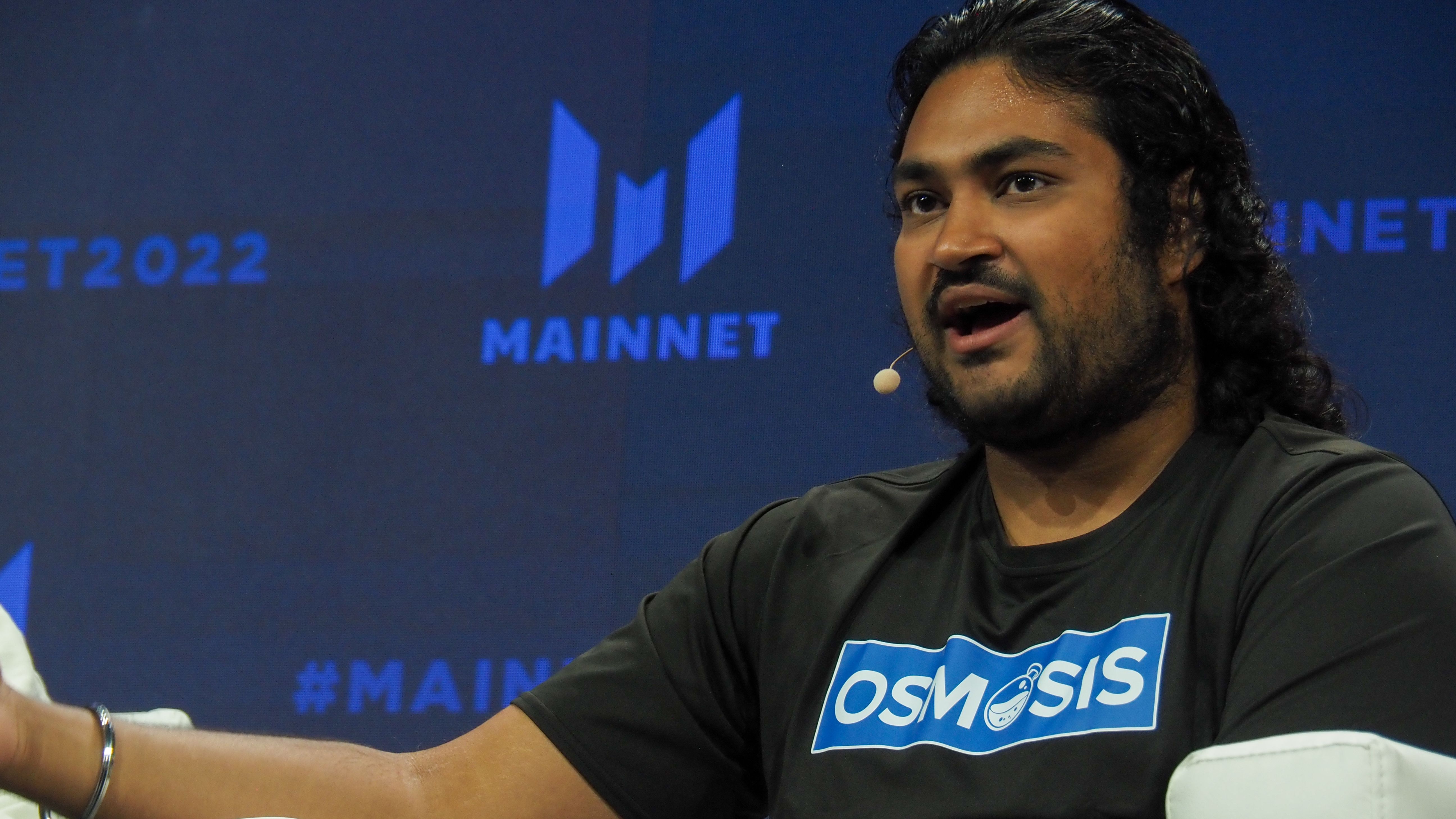

“I’ve always personally been pretty Bitcoin maxi,” Osmosis co-founder Sunny Aggarwal said in an interview with CoinDesk.

Bitcoin “maxi,” an abbreviation of “maximalist,” is a term for people who believe BTC is the only cryptocurrency (or currency of any kind) that is needed.

“I’m bullish on bitcoin dominance. That’s the biggest market and so we want to take a big chunk of it,” Aggarwal said.

Aggarwal describes Osmosis as a DEX for assets that don’t have their own native DEXs, as opposed to tokens that are built on Ethereum or Solana, where there are plenty of native decentralized exchanges to choose from.

“We’re one of the primary DEXs for app chains and most of them were probably built using the Cosmos stack, so we have about a 95% share of DEXs in the Cosmos ecosystem,” he told CoinDesk.

“That’s why we’re looking at what other assets don’t have their own DEXs, and the obvious one is bitcoin, so BTC is going to grow to be more and more a core piece of our strategy.”

Read More: <a href=”https://www.coindesk.com/tech/2024/09/12/build-on-bitcoin-trend-imports-another-concept-from-ethereum-the-dao” target=”_blank”>Build-on-Bitcoin Trend Imports Another Concept from Ethereum: the DAO</a>