Uniswap (UNI) price is down 20% in the last 24 hours, continuing its bearish trajectory after losing the $10 billion market cap it held just days ago, now sitting at $7.2 billion. The sharp decline has pushed UNI into a critical zone, with technical indicators reflecting strong downward momentum and the potential for further losses.

A looming death cross in the EMA lines signals a possible deeper correction, with key support levels at $9.64 and $8.5 being closely watched. On the upside, a reversal could see UNI targeting resistance levels at $13.5 and $16.2, with the possibility of rising toward $19 if bullish momentum gains traction.

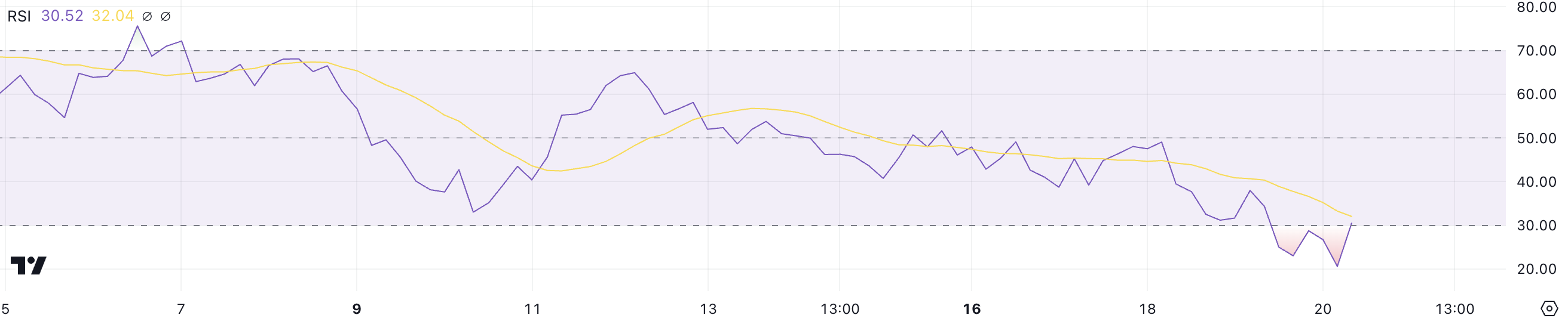

Uniswap RSI Is Recovering From Oversold Zone

The RSI (Relative Strength Index) for Uniswap currently stands at 30.5, a slight recovery from levels around 20 seen a few hours ago. An RSI below 30 is considered oversold, indicating excessive selling pressure and the possibility of short-term undervaluation.

UNI recent dip into oversold territory suggests intense selling activity. Still, the slight rebound to 30.5 signals that selling momentum could be easing, with the potential for buyers to re-enter the market gradually.

The RSI measures the strength and speed of price movements, oscillating between 0 and 100. Its thresholds help interpret market conditions: an RSI below 30 signals oversold conditions and potential for a price rebound, while an RSI above 70 indicates overbought conditions and possible selling pressure.

With Uniswap RSI hovering just above the oversold threshold, the price may attempt to stabilize or see a mild bounce. However, if the RSI fails to rise meaningfully above 30, it could indicate continued bearish pressure and limited recovery in the short term.

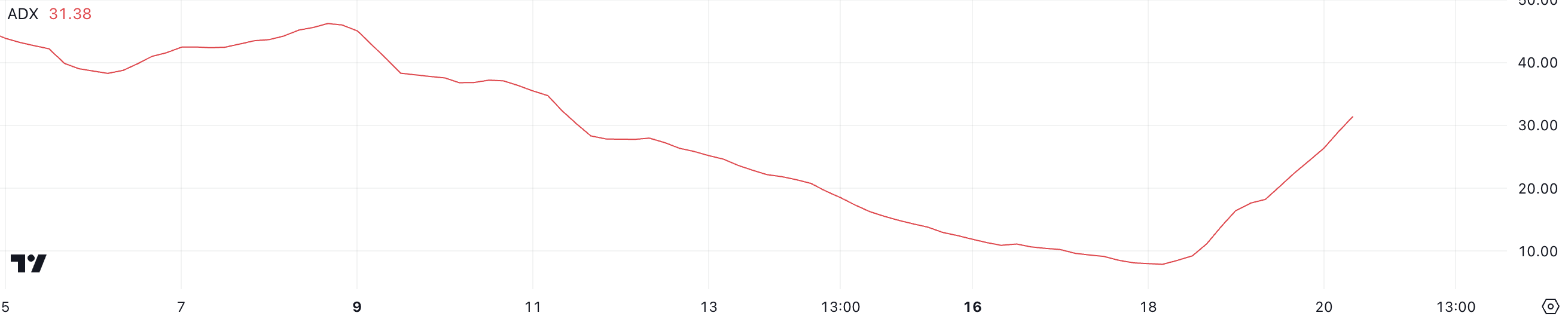

Uniswap Downtrend Is Very Strong Right Now

The ADX (Average Directional Index) for UNI is currently at 31.38, a significant increase from below 10 just two days ago. This sharp rise indicates that the strength of the current trend has intensified considerably over a short period.

Since UNI price is currently in a downtrend, the elevated ADX suggests that bearish momentum is gaining traction, making further downward price movement likely in the near term.

The ADX measures the strength of a trend, regardless of its direction, on a scale from 0 to 100. Values below 20 indicate a weak or directionless trend, values between 20 and 40 suggest a moderate trend, and values above 40 signify a strong trend.

With UNI’s ADX at 31.38, the current downtrend is moderately strong and still building momentum. In the short term, this level implies continued pressure on UNI price unless buyers step in to counter the prevailing bearish trend.

UNI Price Prediction: The Altcoin Can Fall Below $10 Soon

UNI’s EMA (Exponential Moving Average) lines currently display a bearish setup, with the shortest-term EMA nearing a potential cross below the longest-term EMA. This pattern, known as a death cross, often signals intensified bearish momentum and could trigger a sharper correction.

If the death cross occurs, Uniswap price may test the support level at $9.64. If this level fails to hold, it could fall further to $8.5, marking a deeper decline.

However, if UNI price can reverse the bearish trend and build a strong uptrend, it could first challenge the resistance at $13.5.

A successful break above this level could pave the way for a move to $16.2, with the potential to rise further toward $19 if bullish momentum persists.

The post Uniswap (UNI) Price Plummets 20%, Market Cap Shrinks to $7.2 Billion appeared first on BeInCrypto.