Cardano’s (ADA) price has decreased by roughly 18% in the last seven days, aligning with the broader market condition after a period of consistent upswing. But besides the price, Cardano network activity has also felt the heat.

This overall decline around the project has raised concerns about the altcoin’s short-term performance. According to this on-chain analysis, those concerns may be valid.

Cardano Encounters Major Roadblock

On December 8, Cardano’s price rose to a yearly high of $1.22. But today, the cryptocurrency’s value is down to $0.88 due to notable sell-offs. While ADA holders might anticipate a bounce within a short period, the In/Out of Money Around Price (IOMAP) shows that it could be challenging.

The IOMAP is an indicator that spots on-chain support and resistance. To do this, the indicator looks at the addresses currently in unrealized profits compared to those in losses.Typically, the higher the volume at a price range, the stronger the support or resistance.

According to IntoTheBlock, the major resistance for ADA lies around $0.92. In this area, 58,470 Cardano addresses accumulated 951.02 million tokens, which is higher than the token in the money between $0.74 and $0.88.

Should buying pressure remain low, then ADA’s price might find it challenging to rise above the current price. Instead, the token might experience an extended correction.

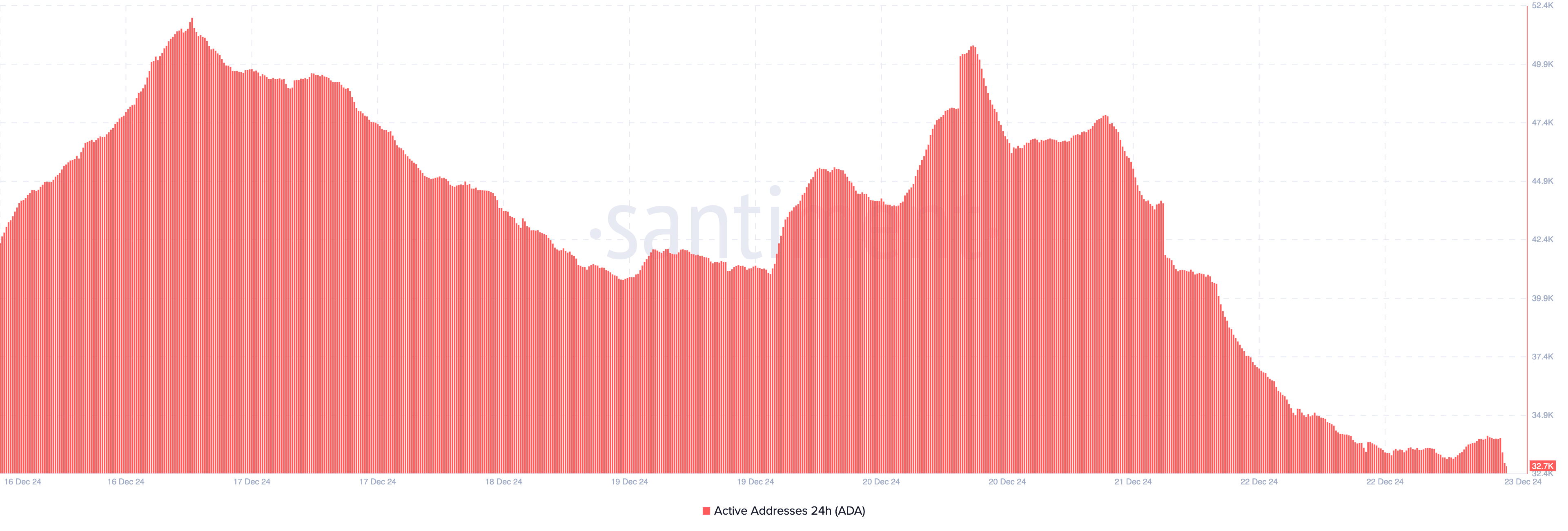

Data from Santiment supports this sentiment, highlighting a significant drop in Cardano’s network activity. On December 16, the number of 24-hour active addresses stood at over 51,000, but at press time, this figure had fallen to 32,700.

An active address is defined as a wallet involved in a successful transaction—either as a sender or receiver—over a given period. This metric serves as a strong indicator of daily user activity on the blockchain.

A rise in active addresses signals increased user engagement, which is typically bullish for price action. Therefore, the ongoing decline in this metric suggests a bearish sentiment surrounding ADA.

ADA Price Prediction: Extended Correction Unavoidable

From a technical perspective, the Exponential Moving Average (EMA) suggests that Cardano’s price could continue to decline. The EMA is an indicator that measures the trend around a cryptocurrency.

On the daily chart, the ADA price has dropped below the 20 EMA (blue). Dropping below the EMA suggests a bearish outlook. Also, the token’s value is around the same spot as the 50 EMA (yellow).

This position indicates that Cardano is on the verge of losing the support at $0.88. Should this remain the same, ADA’s price might decrease to $0.77. In a highly bearish scenario, the altcoin’s value might fall to $0.55.

However, if Cardano network activity rises, this trend might change. In that scenario, the cryptocurrency’s value could jump to $1.33.

The post Cardano (ADA) 18% Decline Raises Alarm Amid Weak Network Activity appeared first on BeInCrypto.