Matthew Sigel, Head of Digital Assets Research at VanEck, has recently made comments regarding the potential of Bitcoin to become a global monetary standard, similar to gold, which have sparked controversy. This viewpoint is gathering momentum, particularly as the debate regarding a US Strategic Bitcoin Reserve intensifies.

The Future Of Finance: The Role Of Bitcoin

Sigel stated that Bitcoin has the potential to significantly influence the future of global finance. He asserts that the establishment of a crypto strategic reserve by the United States government, with an estimated quantity of 1 million BTC, could establish the leading crypto asset as a new form of currency.

This concept is reminiscent of historical periods in which nations accumulated gold in order to fortify their economic capabilities. Sigel posits that this could catapult the US to become the flag-bearer of the new era of finance.

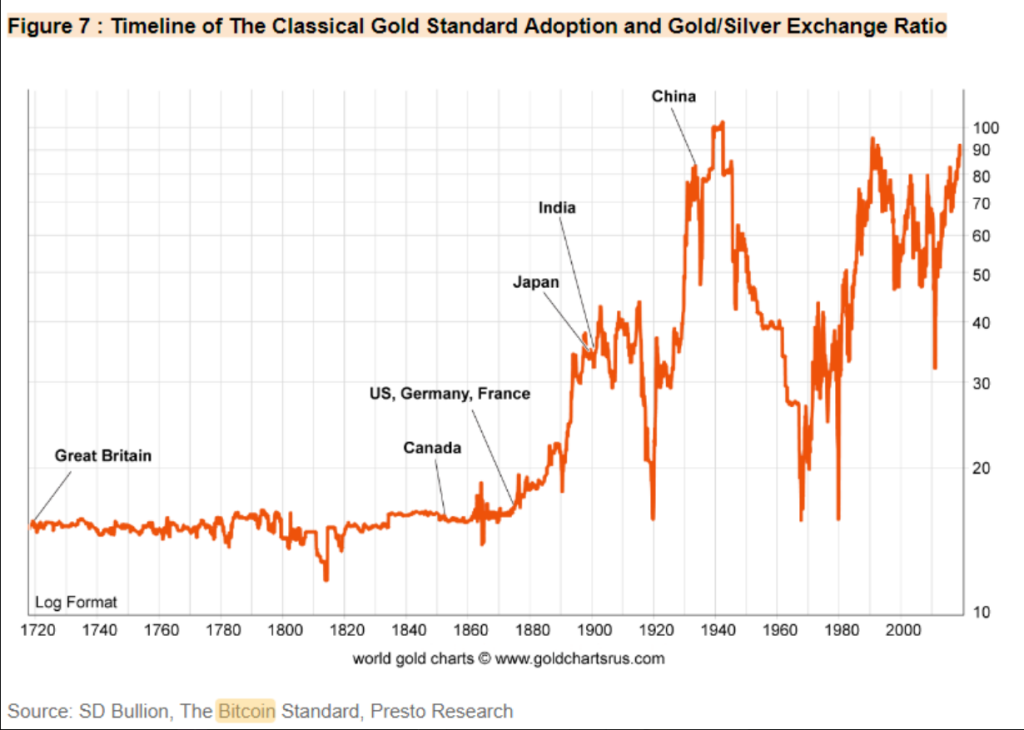

The gold standard once defined reserve assets.

Now, Bitcoin presents the opportunity to converge on a ‘Digital Standard’ for money.

It could very well echo gold’s role in reshaping global finance. pic.twitter.com/e1ogPe947R— matthew sigel, recovering CFA (@matthew_sigel) January 10, 2025

Gold Vs. Bitcoin: Lessons From History

The comparison of crypto to gold is not new, but it has gained traction recently as more governments experiment with digital currencies.

Gold is often seen as a safe haven and a reliable store of wealth, but Bitcoin offers unique benefits that no other commodity does. It is essentially a digital asset, thus unlike gold, transfers are fast and considerably more portable. This digital nature makes it less vulnerable to physical theft and facilitates cross-border transactions.

While mining helps to produce gold, Bitcoin is intrinsically rare since its supply is limited at 21 million coins. For those trying to offset economic uncertainty and inflation, this planned scarcity could make BTC a tempting substitute.

Global Perspectives & Reactions

There is a growing global buzz about the potential of Bitcoin. Due to recent political shifts in the US, countries like El Salvador have made Bitcoin legal tender, and leaders in other nations are trying to put similar policies into place. However, given the erratic character of Bitcoin and the steady purchasing power of gold, some economists believe that this movement should be rejected.

Although Bitcoin offers contemporary benefits like decentralization and immunity to governmental intervention, its price volatility, according to critics, may be a barrier to its widespread adoption as a medium of exchange. As a result, the two assets differ in the crucial factors that investors and decision-makers need to take into account.

Sigel’s words reflect a new interest in how Bitcoin might reconfigure financial systems around the world. As conversations continue about whether it will eventually become a global standard, standing alongside gold, both proponents and detractors will be watching how this story develops over the coming years. Perhaps the future of money depends on how these two assets evolve and interact in an increasingly digital economy.

Featured image from Pexels, chart from TradingView