Bitcoin has recently shown signs of a rounding top pattern, marked by a 6.4% decline over the last 24 hours. This pattern was validated when BTC fell to $90,000 during an intra-day low, triggering panic selling.

Despite the market’s reaction, one key cohort suggests that this drop may be short-lived.

Bitcoin Investors Panic

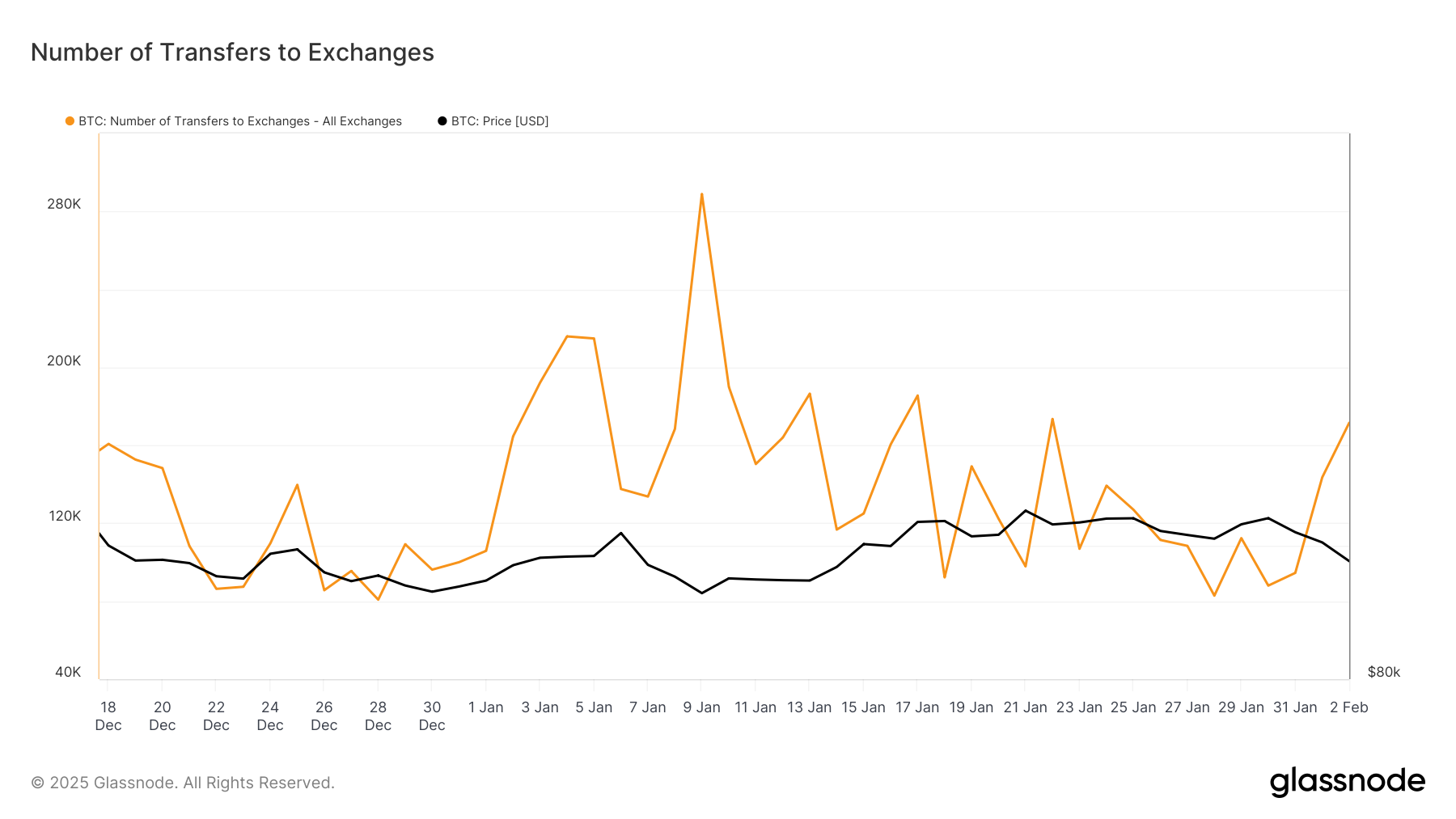

In the past two days, Bitcoin deposits to exchanges saw a sharp uptick, with over 80,000 BTC, worth approximately $7.5 billion, moved onto exchanges. This increase is often viewed as a sign of impending selling, as investors seek liquidity during market downturns.

However, this large movement of BTC could simply reflect panic selling rather than a long-term shift in market sentiment. Investors tend to move assets to exchanges in times of uncertainty, but this behavior is not always an indication of a sustained bearish trend.

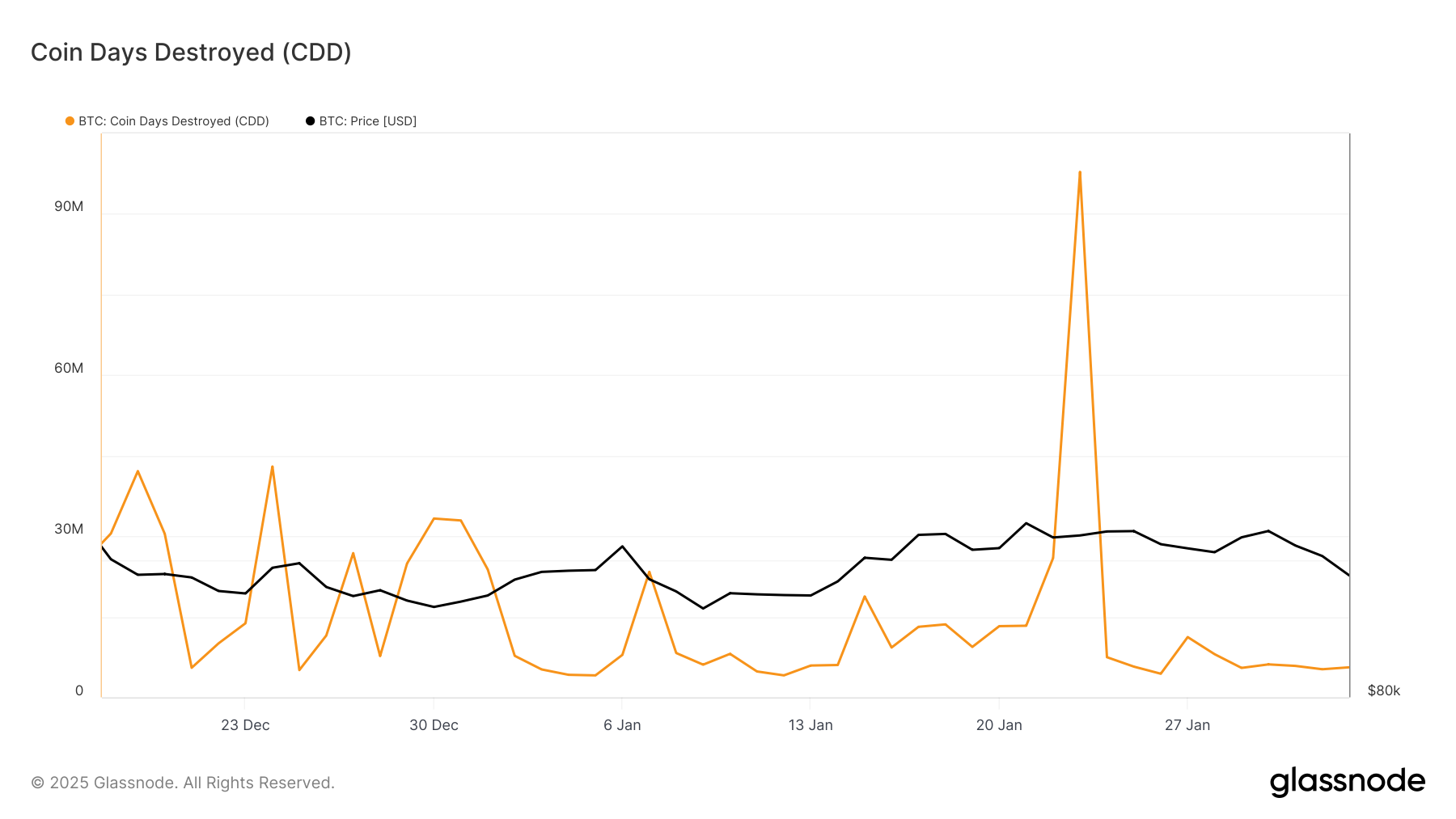

The Coin Days Destroyed (CDD) metric, which tracks the movement of long-term holders’ coins, provides insight into market sentiment. Spikes in CDD are typically associated with market sell-offs. Interestingly, despite Bitcoin’s sharp decline to $90,000, long-term holders (LTHs) remained largely inactive.

This resilience suggests that LTHs are confident in recovery, signaling that the market’s short-term volatility may not deter them. The inactivity of LTHs indicates they are holding firm, and this decline may just be a temporary blip rather than the beginning of a long-term bearish phase.

BTC Price Prediction: Delaying A Drop

Bitcoin has formed a rounding top pattern, but it’s possible that this could transition into an inverse cup and handle pattern. The bearish momentum currently isn’t as intense as it could be, providing BTC with a chance to bounce from the support at $93,625.

If Bitcoin successfully bounces back, it could rise toward $100,000 after breaching $95,668. This would mark a critical recovery and likely see a return of investor confidence. However, if the bearish pattern persists, Bitcoin may see a further drop to $92,005 in the near term.

A successful breach and flip of the $100,000 resistance into support would invalidate the bearish outlook. This could potentially trigger a rise to $105,000, marking a recovery from recent losses.

The post Bitcoin Price Crashes to $90,000, But One Cohort Signals At Quick Recovery appeared first on BeInCrypto.