Roam, a leading DePIN project focused on building a decentralized global open wireless network, currently boasts 2.3 million app users and nearly 2 million self-built WiFi nodes across 190+ countries and regions. As it transitions from the Pilot “Burning” phase to the TGE, Roam’s co-founder YZ delves into the project’s economic system and its potential to bridge Web2 and Web3. YZ’s article offers insights into Roam’s tokenomics, highlighting its sustainability-driven flywheels and deflationary models. This offers an insightful exploration for anyone looking to understand how Roam’s design could set a precedent in the rapidly evolving DePIN space. Here is the full article for a detailed exploration.

Over the last three years, @weRoamxyz has evolved from #MetaBlox into its current form. Despite facing numerous challenges, we are grateful for the unwavering support from our community and the accolades from industry peers. Many see Roam as a project combining cutting-edge technology with practical, real-world applications. At the very least, with Roam, global travelers need not worry about connectivity. We extend our heartfelt thanks to our 2 million users for their support and affection for our product.

As we wrap up the pilot “burning” phase and are entering the airdrop and TGE official “burning” phase, I’d like to share insights into the design of Roam’s economic system. From my perspective, this has been a pivotal focus of my work over the past three years. In the current climate, where venture-backed coins often find themselves unsupported and Meme PVP runs rampant, many industry experts are disillusioned. Together, let’s explore whether Roam’s economic system can serve as a valuable reference point and identify areas for improvement.

Before diving into the economic system, let’s touch on our business model briefly. Roam is a global open wireless network, dedicated to building secure, seamless, and free connectivity through a Decentralized Physical Infrastructure Network (#DePIN ). Our core strategy involves operating a network using an internet hyperscaler’s business model, driving growth through the Web3 flywheel, and dismantling data barriers with an open network approach as we advance into the AI era.

Currently, our business model operates on a dual-engine system, with plans to evolve into a triple-engine system in the future.

1.0 Roam’s economic flywheels

Roam’s economic system ensures sustainable development and growth through three key flywheels: the User Flywheel, the Node Flywheel, and the future AI Data Flywheel.

User Flywheel:

-

Attract users through Web3 incentives.

-

Initially solidify the user base by providing WiFi #OpenRoaming services via a mobile app.

-

Further expand the user base through Web3 community driven operations.

-

Reduce eSIM data costs and increase advertising and referral income once the critical mass is achieved, winning better commercial terms.

-

Implement dual-track customer acquisition with WiFi #OpenRoaming and global smart eSIM, while maintaining positive cash flow.

-

Acquire more users, adding values to the token and enhancing the Web3 incentive effect, further reducing costs. Return to step 3.

Node Flywheel:

-

Sell WiFi miners or upgrade community WiFi through Web3 incentives.

-

Provide broader network coverage, enhancing consumer satisfaction.

-

Help the User Flywheel increase the number of users, with more users’ check-in, miners receive more passive income.

-

Onboard CDN and IP application clients once the number of nodes reaches the requirement.

-

Generate cash returns for mining participants and introduce a miner lease program to expedite the growth.

-

Improve the business client satisfaction with a fast expanding node network. Return to step 2.

Future AI Data Flywheel::

-

Generate a large amount of DID-labeled location and time data with privacy protection through Web3 incentives.

-

Bring more ecosystem project data via the Roam Discovery Program.

-

Upgrade the connectivity for WiFi smart devices with DID-based OpenRoaming.

-

Support AI agents or avatars using these devices. (Steps 3 and 4 occur in parallel with steps 1 and 2)

-

Facilitate edge AI computing and distributed models with the Roam node network

-

Allow AI to provide services through the Roam App and smart devices.

-

Further generate new data and expand new nodes, returning to steps 1 and 3.

Through these flywheel models, Roam is dedicated to creating a sustainable ecosystem that drives innovation and development in global wireless networks.

2.0 Roam Tokenomics Analysis

2.1 Distribution:

-

Hard cap: 1 billion $ROAM。

-

120 million team tokens, vesting in 6 years.

-

280 million for past and future investors, including airdrop tokens.

-

600 million tokens will be generated via mining after TGE.

2.2 Design Principle:

Inspired by the so-called Impossible Trinity principle, Roam’s tokenomics design fixes only two fundamental parameters, leaving everything else to the market to ensure the system’s sustainability and maintain market stability.

Points:

-

Within the Roam ecosystem, transactions are settled using points rather than directly using tokens. Points circulate only within the system, much like Tencent’s Q-coins or airline miles, with a constant value and no cap. When ecosystem vendors provide services, they earn points instead of tokens to avoid the unnecessary selling pressure caused by token price increases and to maintain reasonable pricing.

-

The fixed value of points serves as the first fundamental anchor parameter.

Tokens:

-

The token release curve is similar to Bitcoin’s exponential decay. Initially, approximately 0.6% is released monthly, decreasing to 0.35% after five years, 0.2% after ten years, 0.05% after twenty years, and finally 0.001% after fifty years.

-

The pre-fixed release curve serves as the second fundamental anchor parameter.

2.3 Key Mechanisms:

Conversion Between Points and Tokens:

-

Points are converted to tokens through a “burning” process, with the conversion rate determined by the market.

-

Tokens can also be converted back into points, which involves the destruction of tokens.

Cycle Mechanism:

-

The conversion process operates based on Cycles (virtual blocks), with each Cycle lasting 1000 seconds.

Difficulty Adjustment :

-

In homage to Bitcoin, Roam’s token generation includes a difficulty adjustment mechanism. The token release curve is adjusted according to network activity (check-in numbers) to ensure token value stability and prevent a death spiral. When network activity declines, the token release speed is reduced accordingly to maintain token value. This process helps eliminate low-value nodes and increase the yield of high-value nodes, akin to the hash rate upgrades in Bitcoin mining.。

Mining and TGE:

Roam’s TGE marks the formal launch of the conversion between points and tokens. Before and after the TGE, mining participants consistently receive points not tokens as the rewards..

Through these mechanisms, Roam is committed to establishing a stable and sustainable economic ecosystem to support the long-term development of its global open wireless network.

2.4 Reward Mechanism

2.4.1 Point Generation

Roam’s tokenomics focus on rewarding participants who contribute to the three core flywheels: the User Flywheel, the Node Flywheel, and the AI Data Flywheel.

Node Owners

Node owners are a vital component of Roam’s system, receiving daily point rewards. As the system evolves, these rewards will transition from equal distribution to differentiated allocation based on each node’s service capabilities, such as CDN and VPN. This approach ensures that rewards are supported by real cash flow. Additionally, nodes can produce a limited number of high-tier stickers daily, which node owners can choose to distribute or keep.

Community Validators

Community validators, or app users, earn point rewards by verifying node operations. They connect to nodes and perform network verification, commonly known as “check-ins.” After each check-in, both the validator and node owner receive corresponding points. The validator receives a sticker as well. This check-in process is a core activity supporting the development of Roam’s three economic flywheels.

Future AI Data Flywheel

Looking ahead, Roam plans to introduce a similar incentive mechanism for point generation related to the AI Data Flywheel in the second half of 2025. This initiative aims to further enhance contributions to the AI Data Flywheel, fostering growth and innovation within the ecosystem.

In addition to the aforementioned components, Roam encourages community users to integrate third-party WiFi networks, particularly those compatible with OpenRoaming. These users can earn point rewards akin to those for mining nodes, albeit with relatively smaller amounts. Both validators who check-in on these devices and the device registrants receive rewards.

Furthermore, within Roam’s ecosystem projects, such as GameFi initiatives, users have the opportunity to earn additional point rewards through participation, enhancing the system’s playability. Importantly, Roam and its Discovery ecosystem projects are designed to maintain the overall stability of the system by not altering the total number of points in circulation.

2.4.2 Analysis

Roam’s reward system is meticulously designed to encourage genuine effort and meaningful contributions. Users can earn substantial passive incomes by adding more nodes or actively engaging in network activities. Many users have profited from “owning” community WiFi and assisting in its #OpenRoaming upgrades. Top participants can earn tens of thousands of points daily, which translates into significant income, allowing many to enjoy a comfortable lifestyle.

The enthusiasm for network expansion within the Roam community is palpable. Some users liken Roam to #StepN, earning rewards through daily walking and WiFi check-ins. In Southeast Asia, there are users riding motorcycles with the ambition of owning the network of an entire city by validating and registering as many public WiFi networks as possible. For those unable to participate in daily activities, investing in miners offers a stable source of passive income.

Whether through financial investment or active participation, these efforts contribute to the robust construction of Roam’s network. This drives the development of the three flywheels and generates real-world income, standing in stark contrast to crypto projects that rely solely on on-chain TVL without delivering tangible value.

2.5 Other Assets

Beyond points and tokens, Roam’s economic system includes two additional significant assets: #NFTs and stickers.

NFTs:

In Roam, NFTs symbolize ownership of cloud mining machines. Roam prioritizes rewarding networks that genuinely provide WiFi OpenRoaming services, meaning that miners in high-traffic areas can generate higher income. However, not everyone has the opportunity to set up miners in such prime locations. To address this, Roam allows users to benefit from these ideal setups through NFT cloud mining, facilitated by Roam’s deployment team, enabling them to earn substantial income.

Stickers:

Stickers serve as crucial credentials for network validation within the Roam ecosystem. Network validation is a frequent user engagement activity and a core component of the ecosystem. This function not only ensures the quality of network services but also strengthens user connections and generates relevant data, making Roam a frequently used app. In Roam, stickers determine the “burning” capacity in the sticker pool. In the future, stickers can be combined in a game-like manner to synthesize staking accelerator cards, becoming tools in #GameFi and #SocialFi projects, and even acting as discount coupons.

By integrating NFTs and stickers, Roam enhances the diversity and innovation of its economic system, offering more ways for users to participate and laying a solid foundation for the sustainable development of the entire ecosystem.

3.0 Points “Burning”

Starting on January 24, 2025, Roam initiated a pilot “burning” process that exceeded the team’s expectations and provided valuable data to refine its tokenomics.

The “burning” process is divided into three pools: the Mining Pool, the Sticker Pool, and the Regular Pool. Tokens are generated from these pools at a ratio of 5:3:2.

Mining Pool: This pool is dedicated to “burning” points generated by miners. For example, if a user has 1 million points, with 100,000 points from miners and the remaining 900,000 points from community WiFis and check-ins, the user would have a “burning” capacity of only 100,000 points in the Mining Pool.

Sticker Pool: The “burning” mechanism in this pool requires users to use stickers to establish their “burning” capacity. Roam provides four types of stickers: Common (burns 50 points), Rare (burns 100 points), Epic (burns 250 points), and Legendary (burns 1,000 points). Users can use up to 50 stickers at a time, but each sticker can be used only once.

Regular Pool: Any remaining points can be burned in the Regular Pool.

In each cycle, the amount of tokens a point can earn from burning depends entirely on the total number of points participating in the burn during that cycle. For example, if a cycle can produce 648 tokens and 10,000 points are burned, each point would earn 0.0648 tokens.

After 1,930 cycles, the burn results are as follows:

In just a little over ten days, Roam has burned a quarter of the points generated over the past 19 months. The popularity of the entire burning process is evident. After the initial ramp-up, more than 10,000 people participated online at any cycle.

The average conversion rate in the Mining Pool is 54.5 points per token, while the Sticker Pool averages 139.1 points per token, and the Regular Pool averages 523.3 points per token. The favorable conversion rate in the Mining Pool ensures stable returns for miners, while the higher conversion rate in the Sticker Pool rewards frequent check-ins, encouraging ongoing user participation.

4.0 The Value Support of $ROAM and ROAM Points

The ultimate success of an economic system often relies on the stability and growth of its token price. So, what supports the value of $ROAM? There are two primary factors: the intrinsic value increase due to network expansion and the appreciation of individual token value through a deflationary mechanism. These elements work together to ensure the sustained value and appeal of $ROAM in the market.

4.1 Intrinsic Value Growth:

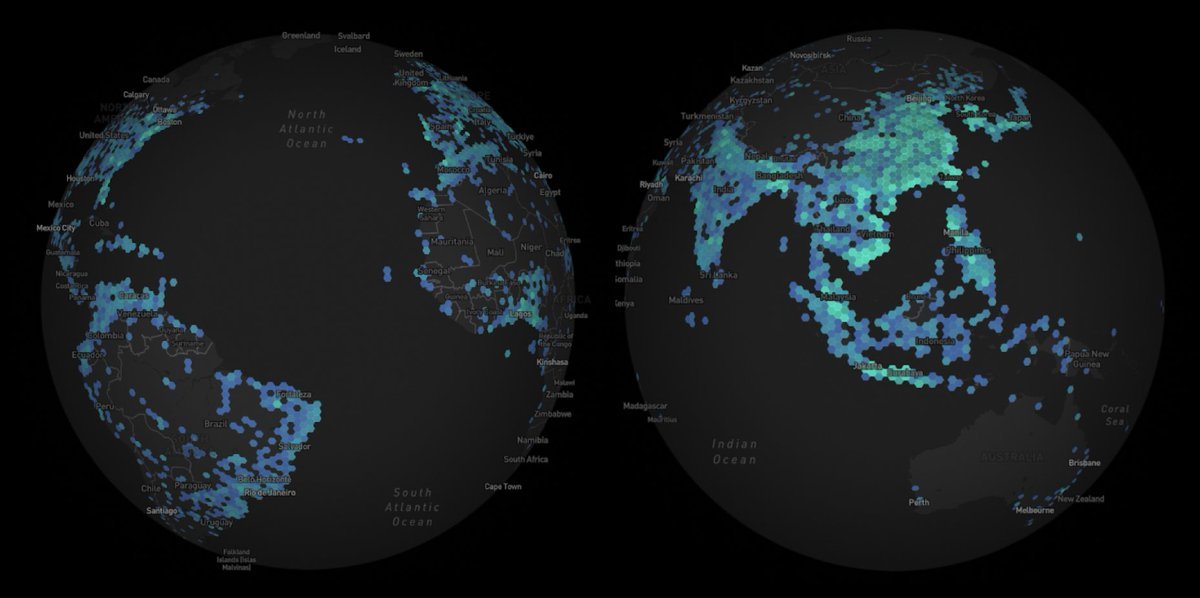

The growth of the Roam network has been thoroughly demonstrated through data provided by the Roam Explorer – Real-Time Updates on Roam Network’s Expansion, making further elaboration unnecessary here.

4.2 Token Consumption and Deflation Mechanism:

4.2.1 Hard Deflation: Token “Burning”

Tokens are permanently removed from circulation through “burning”, reducing the total supply. This increases the value of each remaining token by creating scarcity.

4.2.1.1 Arbitrage-Driven Token-to-Point Conversion

After the TGE, Roam will introduce a reverse conversion mechanism where users can convert tokens into points based on the weighted average value between the Sticker and Regular Pools for the targeted cycle. One token could be converted to an average of 292.78 points based on data from the past 1900 cycles. The tokens converted in this process will be burned, effectively removing them from circulation.

-

This process presents an arbitrage opportunity for users with sufficient stickers, motivating them to convert a token into points and then earn more tokens through burning (with the current Sticker Pool rate at 139.1 points per token).

-

The lower burn volume in the Sticker Pool, compared to the Regular Pool, is due to sticker availability being the limiting factor, as stickers are only obtainable through core activities like check-ins. While this reverse conversion process might reduce the conversion rate in the Sticker Pool, the sticker quantity remains the bottleneck, not the point quantity. Therefore, reverse conversion continues to facilitate token burning.

-

This mechanism enhances user engagement with the app, increasing the value of data, advertising, and traffic, which in turn drives more cash income.

4.2.1.2 Utility-Drives Token-to-Point Conversion

In Roam’s ecosystem, points are essential for various applications, including games, social interactions, and AI services. For instance, the popular @0xBitbang game within the Indonesian community and the forthcoming @MoJoGoGo_AI Twitter Management Agents require points for participation. Users who lack sufficient points can either engage in more #OpenRoaming build-out tasks or convert their tokens to meet the demand, thereby promoting token burning. This conversion process not only supports active user engagement but also enhances the utility of points within the ecosystem.

4.2.1.3 $ROAM Buyback

Currently, the Roam ecosystem has generated 3 billion points, with over 1 billion already “burned”. This includes 700 million points consumed in pilot-burning and 300 million points reclaimed and burned through Roam’s network revenue. After the TGE, Roam can also opt to use some of its network profit to directly purchase tokens from the market and retire them, further reducing the circulating token supply.。

4.2.2 Soft Deflation: Token Supply and Demand Imbalance

In the market, when the demand for tokens exceeds the supply, the token price typically increases.

4.2.2.1 Metcalfe’s Law and the Exponential Decay Token Release Curve

As a network that connects people, Roam’s value aligns with Metcalfe’s Law, being proportional to the square of the number of network nodes. However, Roam’s token release curve mirrors Bitcoin’s, adhering to an exponential decay pattern. As the network expands with more participants and nodes, the token supply grows at a slower pace than the demand. This natural imbalance leads to an increase in token value, as scarcity meets rising demand.

4.2.2.2 Increased Demand from Expanded Token Use Cases

Even if the number of tokens remains unchanged, expanding their use cases can lead to deflation. For example, if 100 tokens were initially used for two scenarios, expanding to ten scenarios significantly reduces the number of tokens available for each use. If the rate of token circulation doesn’t increase, deflation occurs. Following Roam’s TGE, tokens can be used in a variety of scenarios beyond the ecosystem, such as topping up credit cards for spending, exchanging them for other Discovery project tokens, and purchasing phone numbers and eSIM data. Each new use case effectively contributes to token deflation by increasing demand and thus enhancing their value.

4.2.2.3 Reducing Token Circulation Speed

Reducing the circulation speed of tokens also produces a deflationary effect. By locking Roam tokens to gain benefits like free global roaming data or to participate in staking pools, the number of tokens in active circulation is effectively reduced, thus increasing their value.

4.2.3 Conclusion

These mechanisms ensure that Roam maintains the relative scarcity of its tokens while boosting demand across diverse application scenarios. This strategic approach promotes the healthy development of the overall economic system and helps secure the long-term value of Roam tokens.

4.3 ROAM Points

The value of ROAM Points is relatively easier to manage since they only circulate within the Roam ecosystem. The pilot “burning” process has demonstrated that ROAM Points have entered a slightly deflation mode already, indicating that maintaining a constant value of the ROAM Points just need a simple tweak on point emission speed.

5.0 Roam Airdrop Strategy

For many projects without tangible products, on-chain interaction airdrops are often used as a technical means for exchange listings. However, these airdrops typically fail to retain users, who tend to sell off tokens quickly, thus increasing selling pressure. As a result, some projects secretly reduce the number of tokens distributed, leading to controversies over insider trading.

In contrast, Roam uses airdrops as a more cost-effective customer acquisition channel compared to traditional methods like SEO and SMM. In addition, Roam does not only airdrop tokens, it airdrops global roaming data as well!. These airdrops are conducted within the app, specifically targeting valuable and new users to ensure that resources are efficiently utilized. This strategy not only improves user quality but also sustains the harmonious atmosphere within the Roam community.

By employing this precisely targeted airdrop approach, Roam effectively attracts and retains genuinely valuable users, laying a strong foundation for the product’s long-term development.

6.0 When Bear Market Comes

In a bear market environment, token prices are typically under pressure, and market liquidity may be lacking. However, Roam’s economic system has multiple strategies to address these challenges and maintain token value stability.

Method 1: Difficulty Adjustment and Deflation Acceleration

When participation decreases and network activity declines, Roam’s difficulty adjustment mechanism activates, reducing the token generation rate. This accelerates the deflation process, providing support for token prices.

Method 2: Token/Point Arbitrage to Accelerate Burning

As network activity decreases, the total number of stickers drops, lowering the difficulty of arbitrage for active players. Increased arbitrage activity speeds up token burning, thereby supporting token prices.

Method 3: Token Lock-up and Stable Returns

Users can earn APY by staking their tokens or locking them up to receive free telco services. This reduces the circulation speed of tokens, creating a soft deflationary effect that supports token prices.

Pathway 4: Bear Market Benefits for Low-Cost Services

Bear markets often drive more users to seek low-cost services, potentially leading to a shift from traditional telecom operators to Roam. This transition not only boosts Roam’s profits but also provides opportunities for token buybacks, burns, or treasury replenishment, further supporting token prices.

Through these methods, Roam not only maintains stability during bear markets but also optimizes its economic mechanisms to ensure long-term token value growth. Roam is actively exploring additional strategies to address future challenges in token prices and liquidity.

7.0 Summary:

Crypto has reached a pivotal turning point, and for teams accustomed to traditional business models, this shift might seem daunting. However, for teams experienced in the competitive landscape of the Web2 internet, this new environment presents a wealth of opportunities. It offers fertile ground for innovation and growth, perfectly aligning with the skills and experiences honed in the traditional internet industries. For these teams, the transition to the crypto space can be nothing short of a paradise, offering a chance to leverage their expertise in novel and impactful ways.

Disclaimer: This is a sponsored article and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.