The world’s largest cryptocurrency, Bitcoin (BTC), had a notable couple of months. The king coin managed to rise all the way to a high of $109,114.88. The asset did not trade at this level or even maintain its position over $100,000. This was followed by a massive downfall that caused chaos in the entire market. BTC’s dip below $90,000 came as a shock to the community. Will the king coin redeem itself in March 2025?

Also Read: M2 Money Supply Goes Parabolic—Is a Massive Bitcoin Rally Incoming?

Bitcoin’s Current Market

Bitcoin witnessed a massive drop of 8% throughout the past seven days. The asset went from trading at a high of $99,000 last week to a low of $86,008.23 just yesterday. At the time of writing, BTC was trading at $88,332.94, following a 1.70% drop in the last 24 hours. Due to this plummet, the asset is currently 19% below its peak.

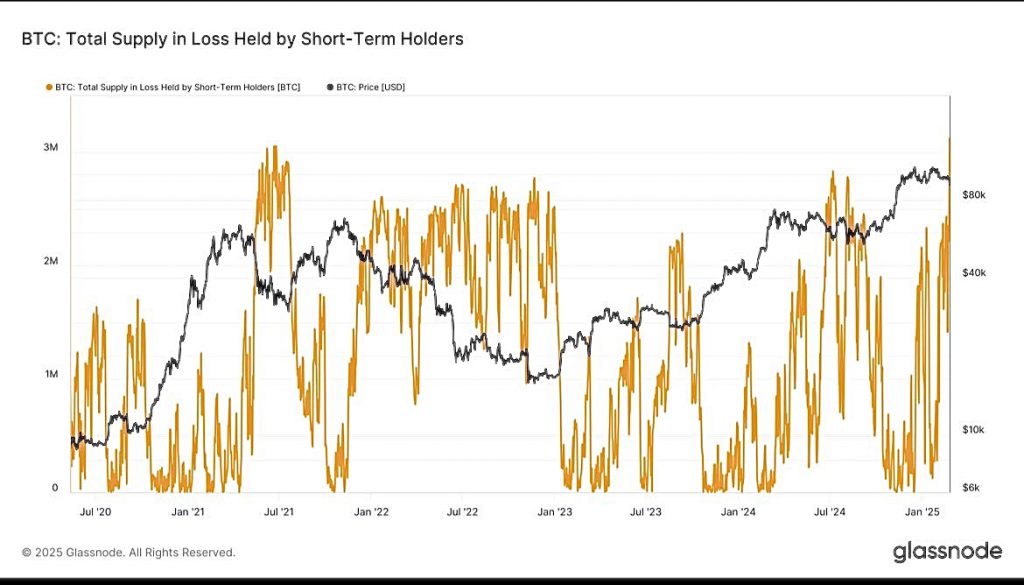

Currently, 3,000,000 BTC are losing money, which is the highest since 2018. This implies that a sizable percentage of Bitcoin owners are now at a loss. This is most likely a result of recent price adjustments. Such circumstances have historically accompanied market recoveries. But it is unclear if Bitcoin will be able to reach new highs in March.

Also Read: Cardano: How High Can ADA Rise In March 2025

March Price Prediction

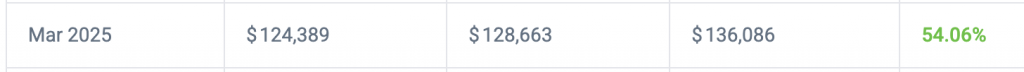

Data from CoinCodex highlights a positive prediction for the king coin. In comparison to present rates, analysts predict that the price of Bitcoin will increase by 45.66% in March. The asset may average about $128,663 between a high of $136,086 and a low of $124,389, respectively. This is notable as the king coin is set to record a new all-time high. With a possible ROI of 54.06%, several traders might make big bucks in the coming month.

Also Read: Ethereum Buyers Pile In as Aya Miyaguchi Takes Over—Will ETH Rebound?