Ethereum is in the final stages of its consensus mechanism shift, and the mining process would become redundant post the Merge, eliminating miners from the ecosystem.

For now, it seems like The Merge is on track to take place in September. Quite recently, Tim Beiko, the lead developer at Ethereum, shared details about the final testing phase of the upgrade. As outlined in a recent article, for the last testnet PoS transition, Ethereum’s Goerli will merge with Prater, and the same is expected to fruition in the coming days.

Read More: Ethereum: The Merge isn’t priced yet, states Vitalik Buterin

How have Ethereum miners been faring?

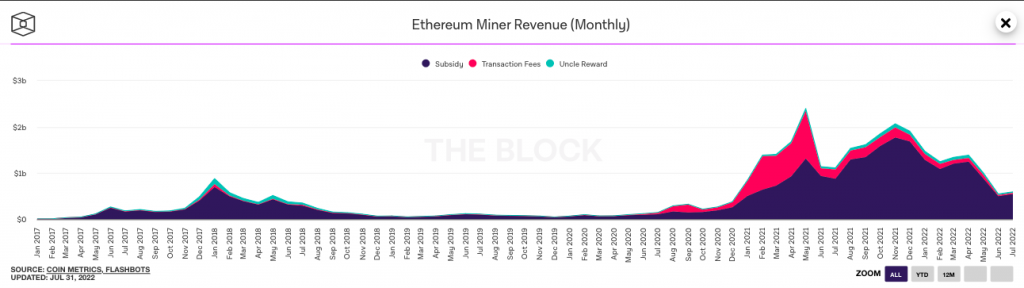

Ethereum miners earned a total of $596.3 million in July. Most of it, as usual, came via the subsidy route [$547.4 million]. Transaction fees and uncle rewards contributed the remaining [$25.01 million and $23.88 million, respectively].

Source: The Block

Over the past few months, the Ethereum miner revenue has been down. However, in July, there was a slight uptick. As far as absolute numbers are concerned, miners earned a total of $549.58 million in June, implying that July’s numbers are up by around 8.5%. The inclination is visible in the chart attached above.

Here it is worth recalling that Ethereum’s gas fee numbers revolved around its lowest price since 2020 at the beginning of July. The same had incentivized users to use the blockchain to carry out more-than-usual transactions. Resultantly, the said rise can be speculatively attributed to the said factor. On the macro-frame, however, the current revenue seems to be pretty low, indicating that miners do not have many reasons to stay within the Ethereum ecosystem.

How has the protocol been faring?

Ethereum earns the most revenue compared to its other blockchain/dApp counterparts. Per data from Token Terminal, over the past 30 days, the Ethereum protocol has earned $80.9 million. The closest competitor was dYdX; however, it stood way behind at $23.6 million.

Source: Token Terminal

On the individual front, nonetheless, Ethereum’s total revenue has been on the fall. Over the past 30 days, the same has dipped by 47%, while it’s down by 67% on the quarterly timeframe, bringing to light the macro-choppiness.

Source: Token Terminal