2 dollar store retailers that provide steep discounts to investors have seen their stock prices soar in 2025, and have even outperformed Nvidia. They have nothing to do with tech firms like Meta, Amazon, Apple, Nvidia, and Microsoft, among others. However, they have everything to do with the real scenario of the US economy, as they deal closely with the general public. Dollar store stocks surging in value indicates that the Average Joe is now struggling to make ends meet.

Also Read: Tesla: Cathie Wood Dumps TSLA Stock, Price Dip Soon?

Nvidia Stock Gets Outperformed By Dollar Stores

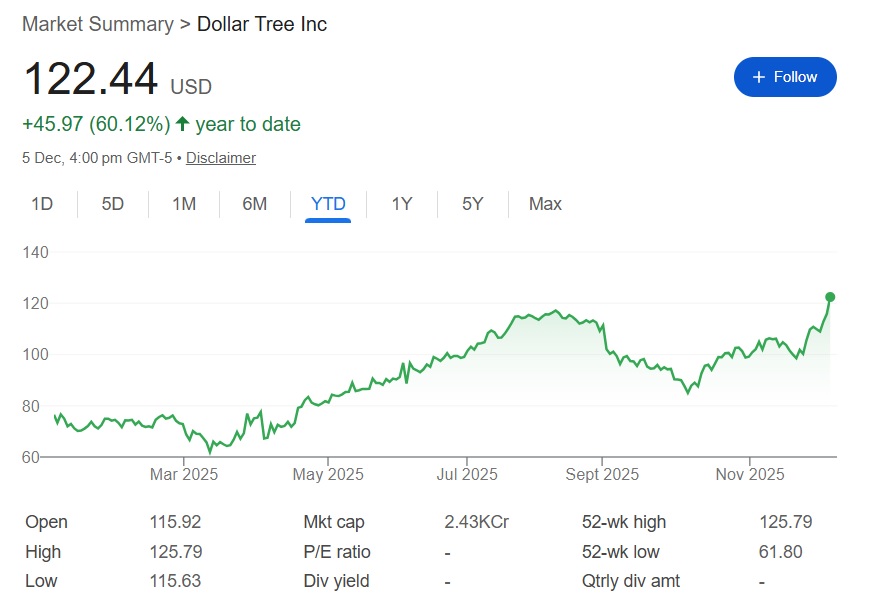

Dollar Tree Inc. (NASDAQ: DLTR) and Dollar General Corp (NYSE: DG) have seen their stock prices go above Nvidia. While Dollar General has soared more than 75% year-to-date, Dollar Tree is up nearly 60% YTD. Both equities have sustainably scaled up in the charts, posting robust sales figures as shoppers continue buying products with bigger discounts.

Surprisingly, the majority of their shoppers earn more than $100,000 per year and still cannot afford regular products. The rest of their customers come from a lower-income background. The development highlights that even the middle class is unable to sustain itself in the current economy. The high dependency on dollar stores for discounts has made their stocks soar more than those of Nvidia.

Also Read: Strategy MSTR Stock Target Cut By 60%, Buy the Dip?

“Approximately 60% of these incremental shoppers came from higher-income households, those earning over $100,000, 30% from middle-income households, those earning between $60,000 to $100,000, with the rest from lower-income households, those earning under $60,000,” said Dollar Tree CEO Michael Creedon. Therefore, buying Dollar Store stocks rather than Nvidia could be a better bet in this economy.

“At the same time, higher-income households are trading into Dollar Tree, lower-income households are depending on us more than ever,” he said. “For example, the average spend for lower-income households grew more than twice as fast in the third quarter as the average spend for higher-income households,” he summed it up.