Bitcoin Magazine

9 Ways MSCI’s Proposed Digital Asset Rule Could Undermine Index Neutrality

A major rule change is being considered by MSCI, one of the most influential index providers in global markets. If adopted, it would materially alter how public companies that hold digital assets—particularly Bitcoin—are classified and included in major equity indexes.

For companies, investors, asset managers, and anyone who depends on index-based benchmarks, this proposal raises fundamental questions about how markets define operating businesses and what role balance sheets should play in index eligibility.

Join the call for MSCI to withdraw its digital asset exclusion rule.

Here’s what’s at stake—and why it matters.

1. MSCI Is Proposing a New 50% Balance-Sheet Threshold

At the center of the proposal is a simple rule:

If digital assets make up 50% or more of a company’s total assets, that company would be excluded from MSCI’s Global Investable Market Indexes.

MSCI’s rationale is that crossing this threshold allegedly changes the company’s “primary business,” making it more fund-like rather than operational.

This single ratio would override all other indicators of what the company actually does.

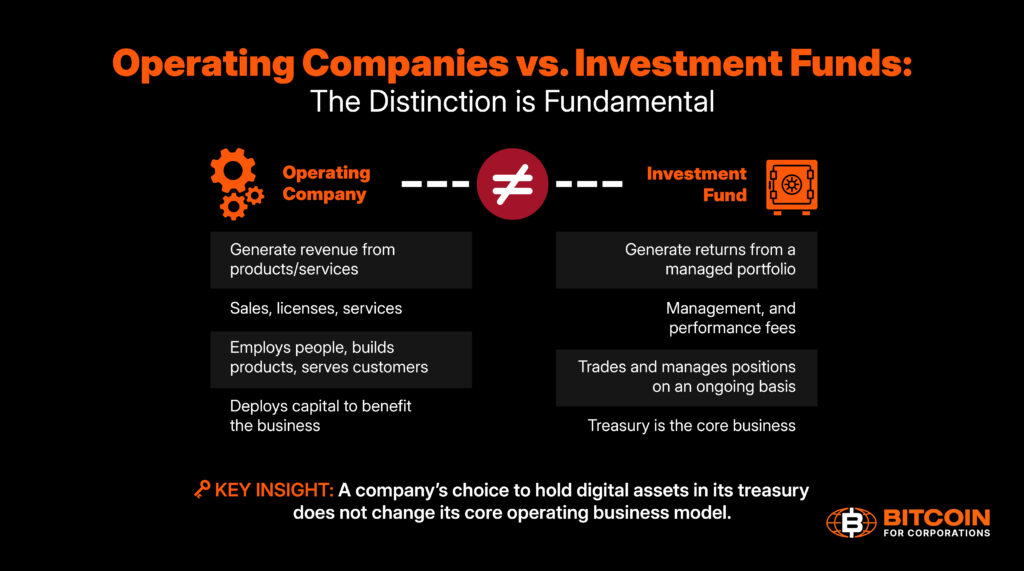

2. The Proposal Misclassifies Operating Companies as Investment Funds

The core objection is straightforward:

holding Bitcoin on a balance sheet does not transform an operating company into an investment fund.

- Operating companies generate revenue from products and services

- They employ people, invest in R&D, and serve customers

- Treasury assets exist to support long-term capital strategy

By contrast, investment funds exist solely to manage portfolios for return.

Treating these two structures as equivalent—based on a balance-sheet ratio alone—collapses a distinction that has long been foundational to corporate and securities law.

If your organization relies on clear, fundamentals-based definitions of operating companies, this misclassification matters. Bitcoin For Corporations is asking MSCI to withdraw the proposal and engage on a more principled framework. You can add your name to the open letter here.

3. Treasury Strategy Does Not Redefine Core Business Activity

A company can change how it stores excess capital without changing what it does.

- A manufacturer that holds cash remains a manufacturer

- A software firm holding foreign currency remains a software firm

- A company holding Bitcoin as treasury reserve remains an operating company

Treasury allocation is a capital management decision, not a change in business model.

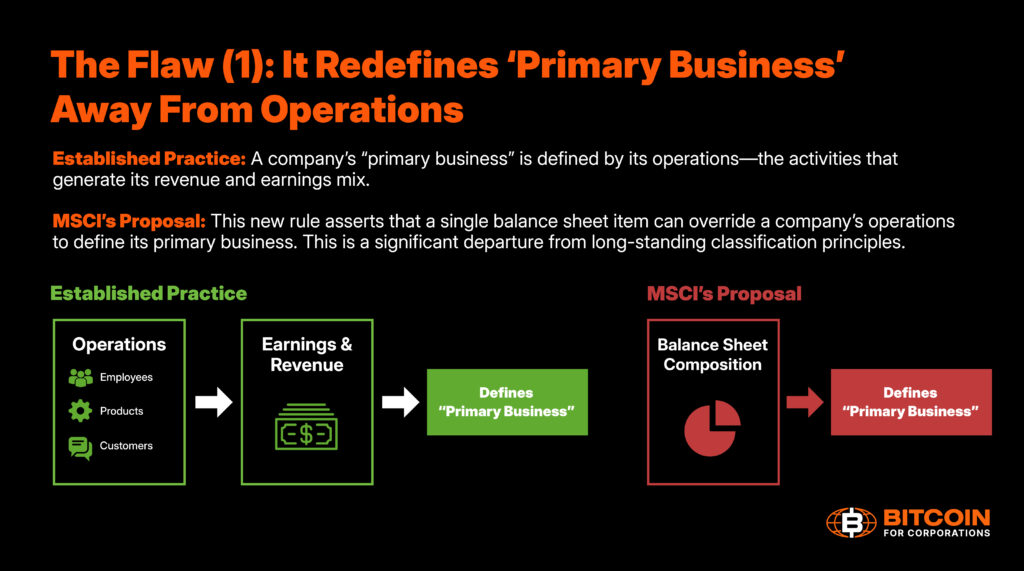

4. This Would Be a Radical Departure From Decades of Index Practice

Historically, index classification has been driven by operational reality, not asset composition alone.

Primary business determination has relied on:

- Revenue sources

- Earnings contribution

- Ongoing commercial activity

This proposal replaces that holistic approach with a single market-price-driven metric on the asset side of the balance sheet—something never applied consistently across asset classes before.

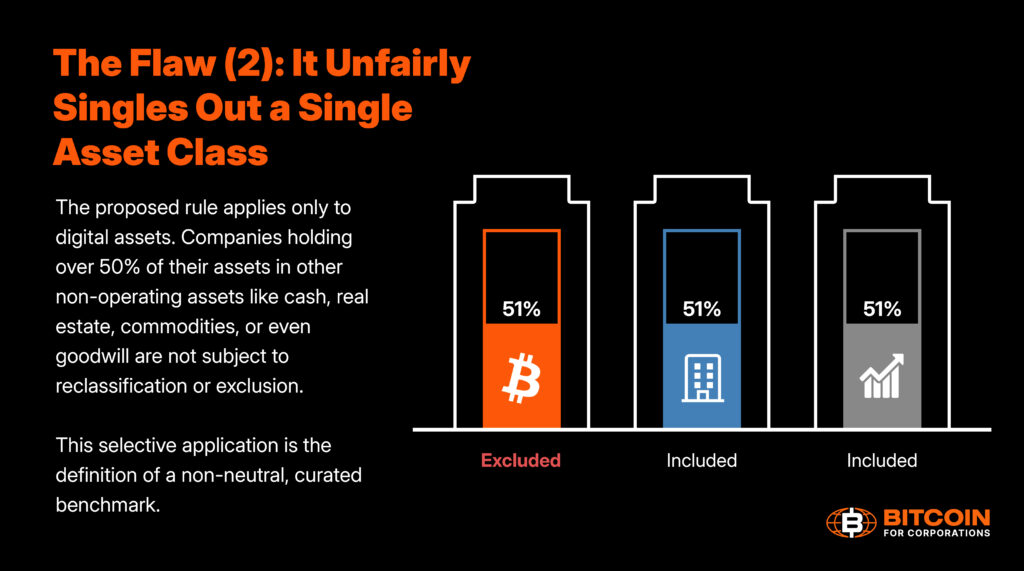

5. Digital Assets Are Being Singled Out—Uniquely

Under the proposal:

- A company with 51% of assets in Bitcoin → excluded

- A company with 51% in real estate → included

- A company with 51% in equities or commodities → included

No equivalent rule exists for other treasury assets.

This lack of neutrality directly conflicts with the principles that global indexes are supposed to uphold.

6. The Proposal Conflicts With Core Index Principles

MSCI’s benchmarks are built on three foundational ideas:

- Neutrality – no asset-class favoritism

- Representativeness – reflecting real economic activity

- Stability – avoiding unnecessary churn

A rule that reclassifies companies based on volatile market prices undermines all three.

7. The Rule Would Introduce Structural Instability Into Indexes

Consider a company with:

- 45% of assets in digital form → eligible

- No operational change

- Normal market appreciation pushes it to 51%

Under the proposal, that company would suddenly be excluded—despite:

- No change in revenue

- No change in operations

- No change in business strategy

This creates a scenario where companies could flip in and out of indexes purely due to price movement, forcing unnecessary rebalancing, costs, and tracking error for index-linked funds.

This kind of mechanical instability would impose real costs on index-tracking funds, issuers, and long-term investors—without improving market clarity. That’s why companies and market participants are urging MSCI to withdraw the proposal and revisit it with industry input. Join the call for MSCI to withdraw this rule proposal, and add your signature to the open letter here.

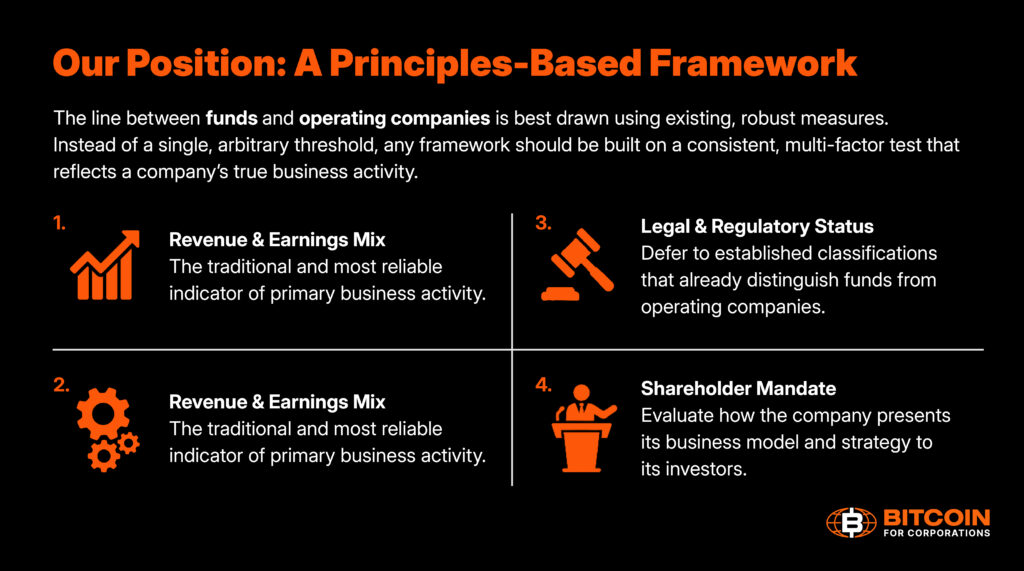

8. A More Robust Alternative Already Exists

The issue is not classification—it’s how classification is done.

A principles-based, multi-factor framework would evaluate:

- Revenue and earnings mix

- Legal and regulatory status

- Core corporate activities (employees, R&D, capex)

- Public disclosures and stated strategy

This approach reflects the entire business, not a single fluctuating ratio.

9. The Coalition’s Ask Is Clear and Constructive

Market participants are calling for a two-step solution:

- Withdraw the current proposal due to its structural flaws

- Engage with the market to develop a neutral, principles-based framework that preserves index integrity

The goal is not special treatment—but consistent treatment aligned with long-standing market norms.

Why This Matters

Indexes are not academic exercises. They:

- Guide trillions of dollars in capital allocation

- Shape passive investment flows

- Influence cost of capital for public companies

If index rules become arbitrary, unstable, or asset-specific, they stop reflecting the real economy—and start distorting it.

Final Thought

If your organization depends on fundamentals-based equity benchmarks, this proposal affects you—whether or not you hold digital assets today.

Indexes only work when they remain neutral, stable, and grounded in operating reality. Market participants are asking MSCI to withdraw the proposed digital asset rule and work toward a principles-based alternative.If you or your organization depend on fair and consistent equity benchmarks, adding your signature to the open letter helps ensure those standards are preserved.

Index integrity relies on clear principles, not price-driven thresholds.

Engagement now helps ensure global benchmarks remain neutral, stable, and representative for everyone who relies on them.

Disclaimer: This content was prepared on behalf of Bitcoin For Corporations for informational purposes only. It reflects the author’s own analysis and opinion and should not be relied upon as investment advice. Nothing in this article constitutes an offer, invitation, or solicitation to purchase, sell, or subscribe for any security or financial product.

This post 9 Ways MSCI’s Proposed Digital Asset Rule Could Undermine Index Neutrality first appeared on Bitcoin Magazine and is written by Nick Ward.