Net outflows for US spot Bitcoin ETFs (exchange-traded funds) approached the $1 billion threshold on Tuesday. It marks the extension of these losses, with weekly outflows approaching $1.5 billion.

The Bitcoin ETF outflows come amid a broader market sell-off, hugely provoked by macroeconomic concerns after President Trump’s tariff threats.

Bitcoin ETF Net Outflows Near $1 Billion

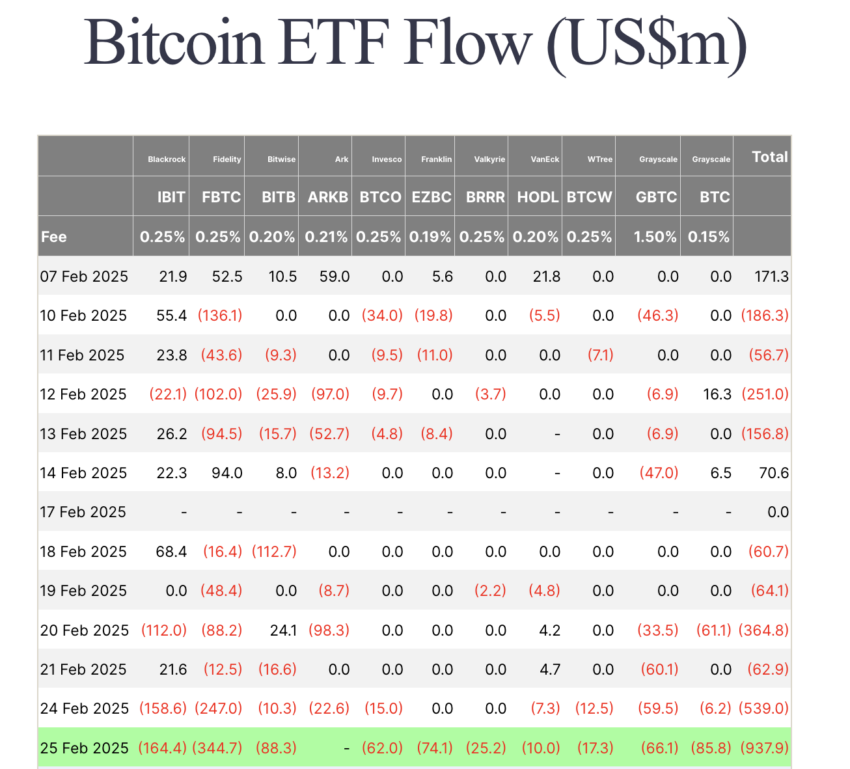

Data on Farside Investors and Trader T’s analysis show that Bitcoin ETF net outflows reached $937 million on Tuesday. Fidelity’s FBTC led these outflows with $344 million, followed by BlackRock’s IBIT at $164 million in redemptions.

Similarly, Bitwise’s BITB and Grayscale’s BTC each recorded $88 million and $85 million in net outflows, respectively. Franklin Templeton’s EZBC lost $74 million, while Grayscale’s GBTC and Invesco’s BTCO declined by $66 million and $62 million, respectively.

In the same way, Valkyrie, WisdomTree, and VanEck’s funds also reported net outflows, with BRRR, BTCW, and HODL posting $25 million, $17 million, and $10 million, respectively.

These outflows surpass thresholds set on December 19, when the US spot Bitcoin ETFs saw nearly $672 million in withdrawals after Bitcoin slipped below $97,000.

According to crypto investor Dissolve DC on X (Twitter), the turnout suggests widespread panic on Wall Street. Notably, the spot Bitcoin ETF financial instrument provides institutional investors indirect access to BTC.

“We asked Wall Street to join the party this is what we get,” remarked the investor.

Experts ascribe the panic to concerns about President Trump’s tariff confirmations, which triggered up to $1 billion in liquidations across crypto markets. As BeInCrypto reported, President Trump reactivated talks of tariffs on goods from Mexico and Canada, reigniting inflation fears and pushing investors away from risk assets.

“We’re on time with the tariffs, and it seems like that’s moving along very rapidly…We’ve been mistreated very badly by many countries, not just Canada and Mexico. We’ve been taken advantage of,” Reuters reported, citing Trump at the White House.

In the immediate aftermath, BTC lost the crucial support at $91,000 before extending a leg down to trade for $88,928 as of this writing. These concerns were also reflected in last week’s outflows from digital asset investment products.

Bitcoin Price Outlook: Key Levels To Watch

On the daily timeframe, the BTC/USDT trading pair shows a shift in market structure. This follows Bitcoin price dropping below a key bearish breaker level (formerly demand zone) around the $93,700 area. This flip adds to the overhead pressure on BTC, as the supply zone at $103,991 remains a strong resistance level.

The price is approaching the 200-day EMA at $85,696, which provides crucial support. A breakdown below this could accelerate bearish momentum. If the 200 EMA fails, the next major support lies in the $67,797–$70,000 demand zone, where buyers may step in.

The RSI (Relative Strength Index) is at 29.80, indicating oversold conditions for BTC but with no clear reversal signal. The MACD (Moving Average Convergence Divergence) shows a bearish crossover with deep negative histogram values, reinforcing the downtrend.

Similarly, a high-volume node (grey for bears) exists around $91,000, acting as immediate resistance. The low-volume area below the current price suggests a potential sharp move downward.

Overall, Bitcoin is at a crucial support level. If buyers (yellow bars for bulls) defend the 200 EMA, a rebound toward $91,000 is possible. However, a break lower could lead to $70,000 in the coming weeks.

IntoTheBlock’s Global In/Out of the Money metric corroborates the outlook. It shows Bitcoin faces immediate resistance (red). Any efforts to move the price up would be countered by selling pressure from approximately 6.11 million addresses, which bought 4.1 million BTC at an average price of $98,050.

Meanwhile, Bitcoin’s initial strong support lies around the $72,500 level, where 6.76 million addresses hold approximately 2.65 million BTC bought at an average price of $65,304.

The post Bitcoin Drops To $88,000 Range As ETF Net Outflows Approach Record $1 Billion appeared first on BeInCrypto.