Transactions in the crypto market have swollen up over the past 24 hours. The cumulative trading volume surpassed $93 billion, making it the highest this week. Per data from CMC, Bitcoin was one of the most significant contributors, for it fostered a total of $35.2 billion in volume over the past day. The rising price, on its part, has enabled Bitcoin to climb 9% higher on its price charts to $23k.

NUPL rebounds

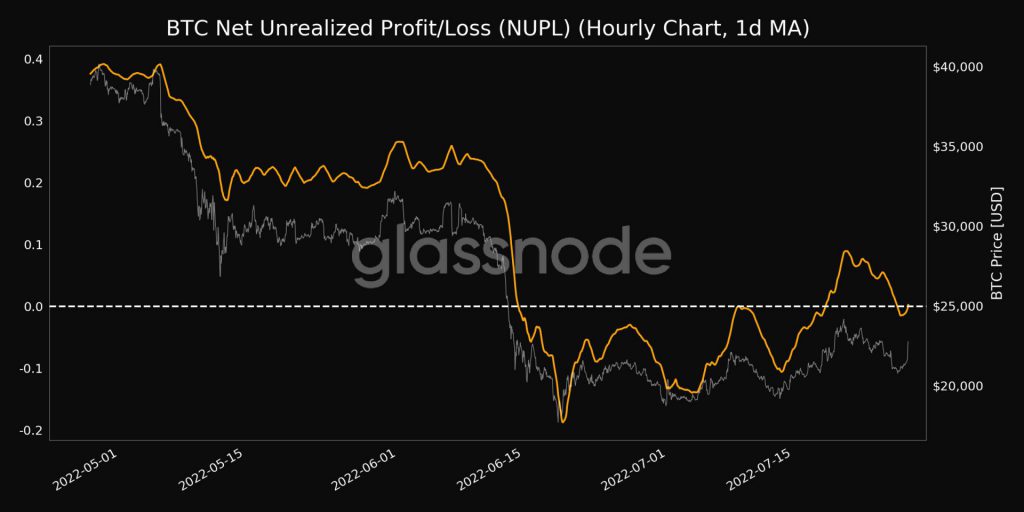

A few hours back, the NUPL metric crossed 0. Previously it stood at -0.001, but at press time, it reflected a value of +0.002. This indicator basically looks at the difference between unrealized profit and unrealized loss to determine if the network, as a whole, is in a state of profit or loss. Values below zero indicate that the network is in a state of net loss and vice versa. So, the current rebound is fundamentally a good sign, for it signals that the network is in a state of net profit.

Source: Glassnode

Now, even though the recent inclination noted is meager, it might aid in the extension of BTC’s short-term green spree.

The upcoming options expiry

Alongside the aforementioned fundamental positive, another important factor that might play a crucial role in dictating Bitcoin’s price is tomorrow’s monthly options expiry. This time, the stars are sort of aligned in BTCs favor, for most traders are optimistic for BTC at $22k and above.

Per Skew’s data, the 29 July expiry involves 89.8k BTC. The snapshot attached below [right] shows that market participants remain to be fairly dispersed w.r.t. their bets. The number of calls and put contracts seems to be more or less equal.

However, when the OI by strike price chart is viewed [left], it becomes fairly clear that buy contracts dominate the proceedings in the price bands extending from $22k and beyond. However, Traders are strongly bearish below $22,000.

Source: Skew

Does Bitcoin have a ‘good’ chance of rising or falling?

So, as long as Bitcoin’s price continues to revolve around its current range, there’s not much to worry about. More so, because at the time of expiry, call traders will be triggered to exercise their option of buying their respective coins. So, if such a scenario materializes, then Bitcoin’s rally would likely get extended.

On the flip side, if its price ends up deflating over the next few sessions and hovers around $21k or below at the time of expiry, then the de-railing might continue.

Here, it’s interesting to note that in a band between $21.7k and $22.3k, BTC has quite a strong support. And as highlighted by analyst Ali Martinez, as long as this demand zone holds, Bitcoin has a “good chance” of rising to $27k. Midway, however, it’d be tested for around $23.8k.

So, keeping the number of call bets placed in higher ranges and Bitcoin hovering around one of its most vital support, it is likely that we might note a short-term respite over the next couple of days before the hype fizzles out.