CoinShares‘ latest report on the weekly digital fund flows shows that Bitcoin had the largest outflow since June of 2021. Last week, institutional investors took out Bitcoin (BTC) valued at $133 million.

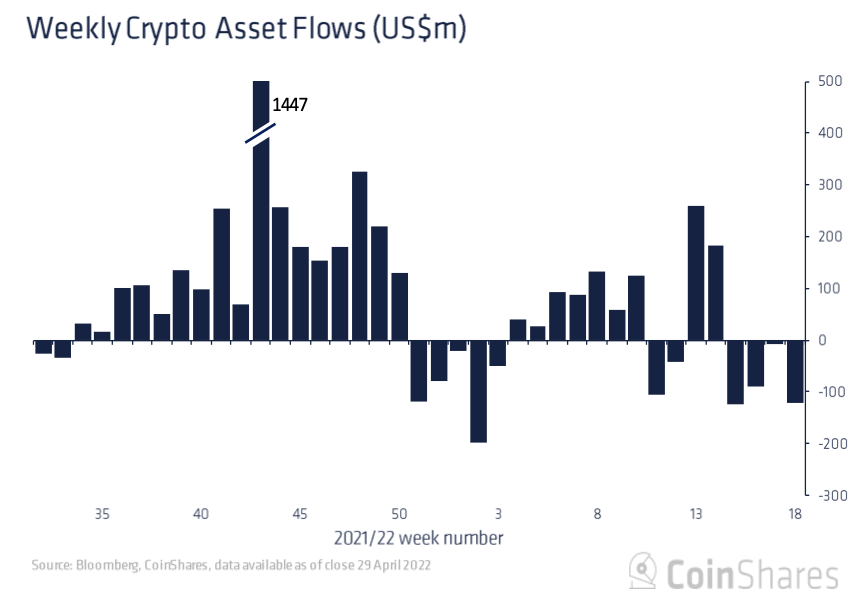

According to the data provided by CoinShares, outflows from digital asset investment products totaled US$120 million, increasing the total outflows in this 4-week period to US$339 million. A majority of these outflows were seen by Bitcoin (BTC). The beginning of the year saw $467 million in outflows, which is close to the current figure, although currently the bearish outlook is not in the same level as that in January.

America was responsible for 41% of this volume, with Europe at 59%.

Source: CoinShares

According to CoinShares, it is difficult to pinpoint the exact reason for this, but a good guess is the expectancy of a hawkish move from the US Federal Reserve. The Federal Reserve is likely to raise interest rates for the second time since 2018, by a half-percentage point leading to an environment of uncertainty at the moment.

Source: CoinShares

An outflow of institutional Bitcoin (BTC) at such a time can be read into a bearish trend. The possibility of a dump could be looming around the horizon. At press time, Bitcoin (BTC) was trading at $38,410.92.

On the other hand, Bitcoin’s hash rate continues to grow, solidifying the asset’s security.

Coins apart from Bitcoin

In regards to Ethereum (ETH) only five of the seventeen weeks this year have experienced outflows, seeing outflows of US$25 million last week. Year-to-date outflows have amounted To $194 million.

While most altcoins saw minor outflows, FTX Token, on the other hand, defied the bearish trend, attracting US$38 million in inflows. Terra (LUNA) and Fantom (FTM) too saw minor inflows of $0.39 million and $0.25 million respectively.

Source: CoinShares

Moreover, blockchain equities succumbed to the bearish sentiment, with last week’s withdrawals totaling US$27 million, the third week of outflows this year.