In regions that experience significant economic volatility and currency devaluation, stablecoins provide a lifeline. This stability makes them an appealing alternative for individuals and businesses in countries where their wealth is subject to inflation.

Unlike conventional currencies, which can experience rapid fluctuations, stablecoins maintain a consistent price by being pegged to assets such as the US dollar or commodities. This price stability drives their increasing adoption in regions like Sub-Saharan Africa and Latin America.

The Role of Stablecoins in Local Economies

Different financial institutions, businesses, and individuals leverage stablecoins to streamline processes like international payments and liquidity management and use them to mitigate debilitating currency fluctuations.

Kash Razzaghi, Circle’s chief business officer, explained in an interview with BeInCrypto that these instances drive global stablecoin adoption by facilitating faster and more cost-effective transactions than traditional financial systems.

“In emerging markets, the regulatory environment for cryptocurrencies and stablecoins is evolving,” he said.

The introduction of stablecoins in 2014 effectively merged the technological advantages of blockchain with the financial stability needed for widespread adoption.

While blockchain technology facilitates transparency and efficiency, the stablecoin itself addresses the issue of cryptocurrency price volatility. As a result, stablecoins attract an audience beyond financial trading and speculative investors, reaching retail and institutional sectors.

In the coming years, stablecoin adoption will spread even further, Razzaghi added.

“Over time, we expect more formalized licensing regimes, robust KYC/AML frameworks and potential integration with broader CBDC strategies are likely, as policymakers seek to balance innovation with financial stability and compliance,” he said.

Razzaghi particularly referred to countries in Sub-Saharan Africa as driving forces behind stablecoin adoption.

As of 2021, a World Bank index reported that less than half of the region’s adult population had a bank account. As a result, cryptocurrency became highly appealing to nations like Nigeria, Ethiopia, Kenya, and South Africa.

DeFi Adoption in Africa

Beyond the rise of stablecoins, local DeFi initiatives are gaining significant traction in African countries like Nigeria, a leading force in global cryptocurrency adoption. Nigeria exemplifies this trend, witnessing over $30 billion in value received by DeFi services last year, according to a recent Chainanalysis report.

“As the DeFi ecosystem expands, stablecoin-based lending, saving products and remittance solutions are increasingly accessible to users in emerging markets. This empowers especially individuals historically excluded from traditional banking systems to access financial products and services, fostering inclusivity and allowing them to engage with the global economy,” Razzaghi emphasized.

Yellow Card, a Nigerian-born stablecoin on/off ramp, actively provides customers across greater Africa secure, liquid, and cost-effective access to stablecoins such as USDT and USDC and tokens like BTC and ETH, making direct transactions using local currencies easier

Other countries in the region have also created phone-friendly services for users who lack internet access. In 2020, Kenya’s leading mobile network operator, Safaricom, and communications company, Vodacom Group, established M-PESA Africa.

The platform allows users to access stablecoin-fiat services such as Binance. It has also extended its operations to other African countries, including Tanzania, Mozambique, Ethiopia, Egypt, and Ghana.

“Stablecoin solutions are adapting to the challenges of limited internet access and infrastructure by developing mobile-friendly platforms and other transaction capabilities. For example, some projects are exploring the use of SMS-based transactions and partnerships with local telecom providers to extend their reach to underserved communities,” Razzaghi told BeInCrypto.

These efforts aim to increase access to stablecoin services for underserved communities in rural areas, thereby fostering financial inclusion.

Stablecoins in High-Inflation Countries

In Argentina, where hyperinflation exceeds 100%, citizens use dollar-pegged stablecoins like USDT and USDC to protect their savings from devaluation. Stablecoin demand surges on local exchanges whenever the peso weakens or governments impose new currency controls.

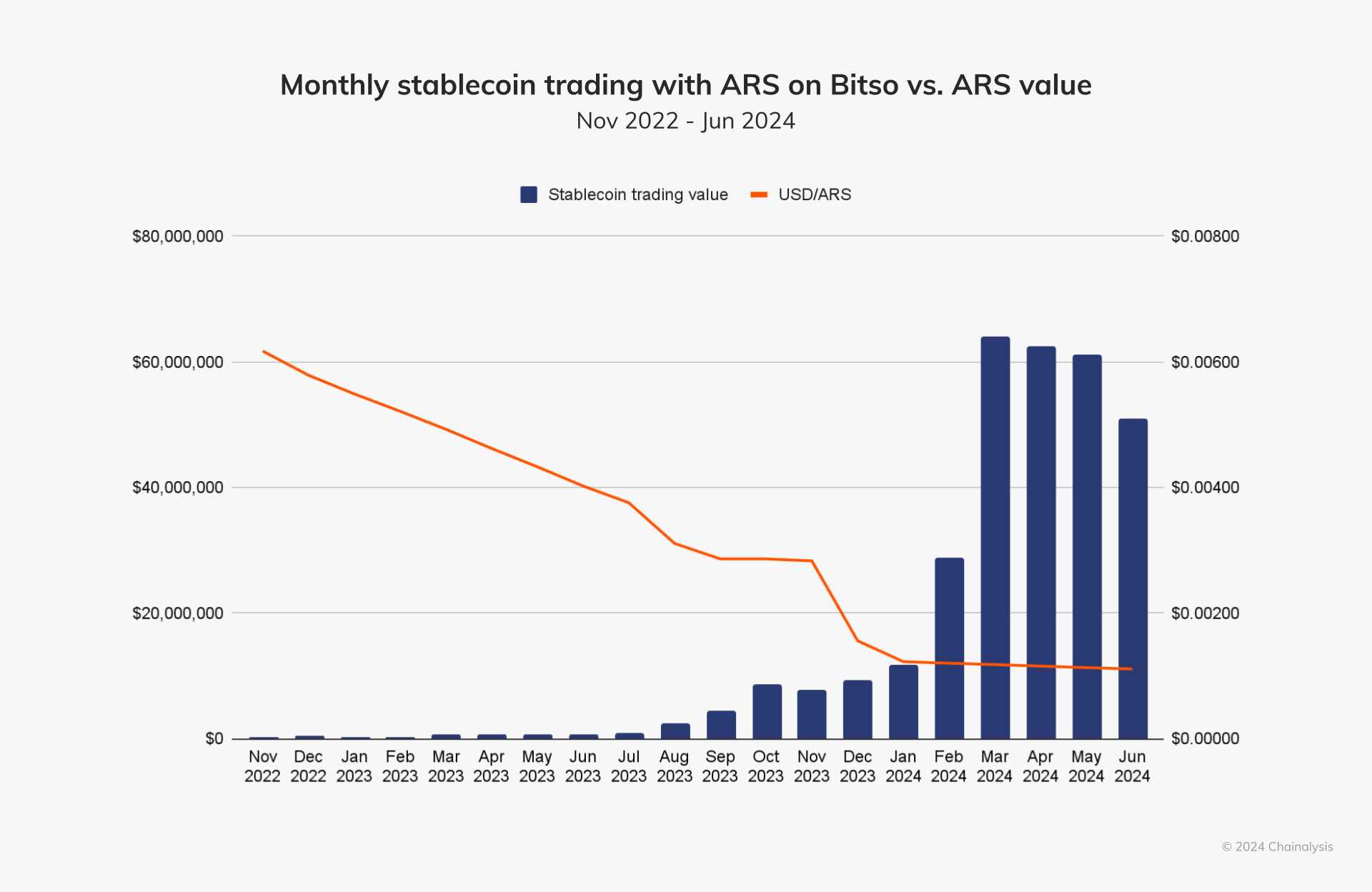

According to a 2024 Chainalysis report, when the value of Argentina’s peso fell below $0.004 in July 2023, the monthly stablecoin trading value surged to over $1 million in the following month. The same thing happened in December 2023 when President Milei announced he would devalue the currency by 50% as part of his initial austerity plan. That month, the Argentine peso dropped below $0.002, and the stablecoin trading value exceeded $10 million the following month.

In Venezuela, stablecoins have also become a primary medium of exchange, replacing the hyper-inflated bolivar. Individuals actively use peer-to-peer platforms to conduct everyday transactions, including purchasing goods and services and leveraging stablecoins for stability.

“With a high demand for US dollars, Latin America has become a hub for digital asset use cases, with people using dollar-pegged stablecoins like USDC as a store of value,” explained Razzaghi.

Nearly a million developers contribute to this growth, many working on offshore projects for US companies. This skilled workforce drives local innovation, with fintechs and neobanks significantly improving financial access and reducing costs for Latin American consumers.

“This strong adoption is partly due to the fact that three-quarters of the region’s 30 million digital bank customers are individuals and small and medium-sized enterprises that were previously unbanked or underbanked,” Razzaghi said.

Razzaghi highlighted Airtm, a fintech provider offering USDC-powered accounts, as an example of successful stablecoin integration. These accounts enable businesses to make low-cost payments quickly and allow recipients to convert USDC to their local currency easily.

“This can be particularly helpful for businesses in the region that struggle with high cross-border payment costs and unstable local currencies, while allowing workers to be paid quickly and affordably in US dollars,” he added.

As a result, local crypto exchanges enable individuals to maintain economic activity amidst challenging local financial conditions.

Challenges Facing Stablecoin Adoption

Despite several benefits, certain conditions can complicate widespread stablecoin adoption, particularly in developing countries. While DeFi projects have made it easier to sidestep regulatory uncertainty in some countries, a broader implementation is difficult without the accompanying framework.

Beyond that, individuals who live in rural areas experience limited internet access. Financial literacy gaps across different regions also make accessibility more difficult. As a result, informational workshops and educational resources have become indispensable for adopting stablecoin.

“Stablecoin projects and local communities are actively working on educational initiatives such as workshops, webinars, and community outreach programs to raise awareness and provide practical knowledge on how to use digital assets safely and effectively. These educational initiatives are crucial in building trust and promoting the adoption of stablecoins in regions with low financial literacy,” Razzaghi told BeInCrypto.

Some of these initiatives continue to be active. Nigeria’s Yellow Card, for example, designed an academy that provides free digital asset courses to individuals and organizations across Africa.

SMS transactions via platforms like M-Pesa also help streamline transaction capabilities for underserved communities. However, additional barriers, such as lack of access to mobile devices and computers, render these initiatives deficient.

“Over time, clearer policies, broader connectivity, and continued financial literacy efforts are poised to drive broader stablecoin usage, thereby capitalizing on the inherent benefits of security and global access offered by stablecoins,” Razzaghi added.

Greater implementation of like-minded efforts is crucial for the widespread adoption of stablecoin.

Stablecoins vs. Central Bank Digital Currencies

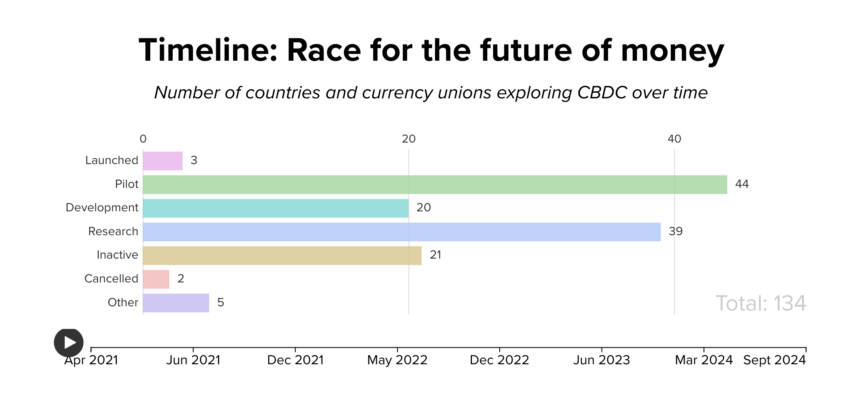

Another aspect that raises uncertainty around stablecoin adoption is the recent incorporation of Central Bank Digital Currencies (CBDCs). These currencies are a digital form of money issued and regulated by a central bank. It’s not intended to replace physical cash but rather to coexist with it.

A key distinction between CBDCs and cryptocurrencies lies in their issuers. CBDCs are issued and backed by governments, ensuring their value is stable and supported by the issuing nation. In contrast, private entities issue and manage cryptocurrencies, making their value subject to significant market fluctuations.

According to the Atlantic Council’s CBDC tracker, the Bahamas, Jamaica, and Nigeria are among the nations that have fully launched CBDCs. In Nigeria and the Bahamas, CBDC issuance witnessed significant growth. All three countries are currently prioritizing the expansion of their retail CBDC adoption within their respective markets.

Every G20 country is also exploring a CBDC, with 19 in the advanced stages of CBDC exploration. Of those, 13 countries are already in the pilot stage, including Brazil, Japan, India, Australia, Russia, and Turkey.

Though CBDCs and stablecoins could compete for dominance in digital payments, each mechanism has its unique advantage.

“We see a lot of areas for synergies between compliant stablecoins like USDC and CBDCs, with stablecoins playing a crucial role in powering peer-to-peer cross-border transactions for instance, a feature which hasn’t been included in the core design of most CBDC’s in development,” he said.

Nonetheless, Razzaghi believes the two systems can co-exist rather than compete.

“USDC and other private-sector innovations are already achieving what a CBDC would hope to offer. Many of the benefits of a CBDC are already being met by private-sector innovations, through blockchain-based payment systems,” Razzaghi added.

Examining these dynamics sheds light on how emerging markets adopt stablecoins and CBDCs, highlighting their potential to reshape the global financial sector with greater inclusivity.

The post Circle Chief Business Officer Explains How Stablecoins Reshape High-Inflation Economies appeared first on BeInCrypto.