The crypto market witnessed a significant downturn, erasing over $850 million due to liquidations. This event followed the Federal Reserve’s announcement of a 25 basis point reduction in its benchmark policy rate.

Although the markets anticipated a modest rate cut, Federal Reserve Chair Jerome Powell’s indications of a conservative approach to future rate adjustments in 2025 spurred market uncertainty and widespread sell-offs.

Bitcoin Dip Liquidates Nearly 300,000 Crypto Traders

During a press conference, Powell noted that while inflation has been “steadily” decreasing, its decline has been “slower than hoped.” Consequently, the Fed revised its inflation forecast for 2025 upwards to 2.5%, suggesting a potential tightening of economic conditions that could restrict liquidity in financial markets, including crypto.

“Inflation has made progress toward the Committee’s 2 percent objective but remains somewhat elevated. The economic outlook is uncertain, and the Committee is attentive to the risks to both sides of its dual mandate,” Federal Reserve said in a press release.

This shift in monetary policy led to a sharp decline in Bitcoin, which fell below $99,000—a drop of more than 8% from its all-time high of $108,000. Similarly, the broader crypto market, including major currencies like Ethereum (ETH), suffered significant losses.

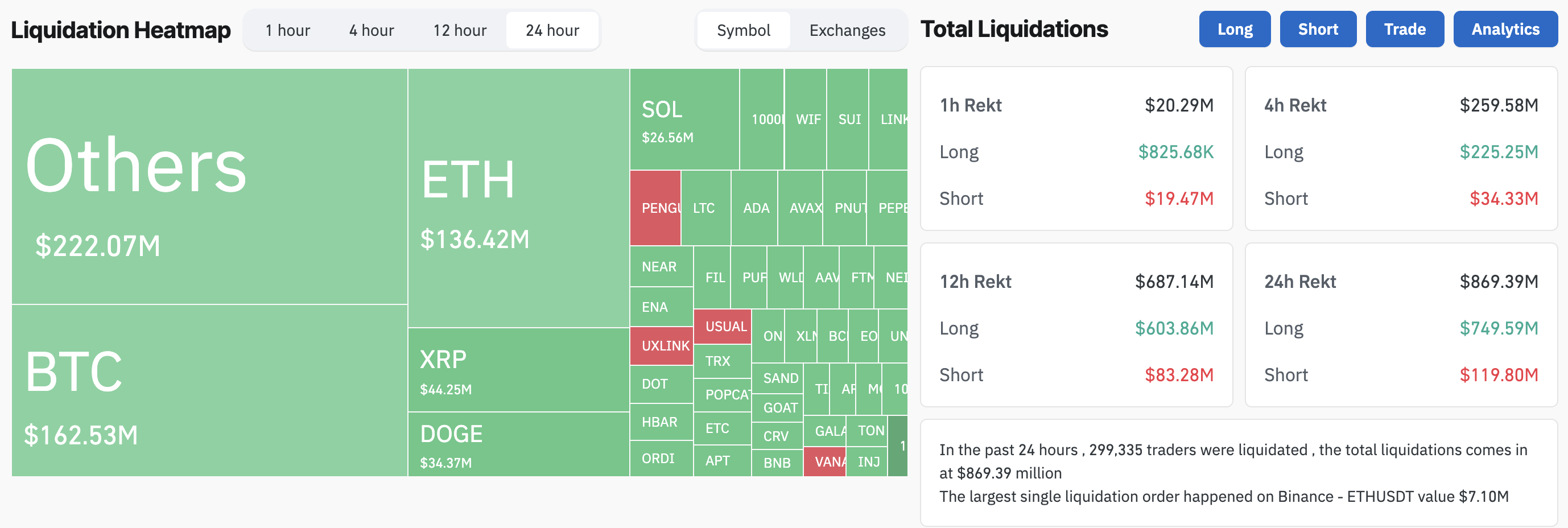

According to Coinglass, the past 24 hours saw a staggering $869.39 million wiped out through liquidations, with $749.59 million from long positions and $119.80 million from shorts. Notably, altcoins bore the brunt of the impact, accounting for over $222 million of the liquidated assets.

Amid these market movements, a total of 299,335 traders were caught off guard. The largest single liquidation order happened on Binance, involving an Ethereum trade worth $7 million.

Despite these setbacks, the sentiment among crypto traders remains surprisingly resilient. The crypto fear and greed index is currently at 75, reflecting a strong bullish outlook amid market volatility. This sentiment highlights the continued allure of cryptocurrencies as an investment, even in turbulent times.

Reinforcing this optimism, Bitcoin-related investment vehicles saw notable inflows. The iShares Bitcoin Trust by BlackRock, for example, recorded $359.6 million in new investments on Wednesday alone. While, the combined inflow for all spot Bitcoin ETFs reached $275.3 million.

These developments—reflecting a cautious Federal Reserve and an optimistic crypto market—demonstrate a complex interaction between macroeconomic policies and crypto markets. Investors seem to be hedging against economic uncertainty by bolstering their stakes in digital assets, which, despite their inherent volatility, are perceived as a viable strategy for portfolio diversification.

The recent market activity highlights the influence of US monetary policy on the crypto sector. As the Federal Reserve continues to navigate challenges related to inflation, the crypto market’s response remains swift and pronounced.

The post Crypto Market Tumbles Following Fed’s Rate Cut, Over $850 Million Liquidated appeared first on BeInCrypto.