The whole concept of decentralized finance has been garnering a lot of traction of late. Leaving aside users, even regulators have started eying this novel fin-tech niche. Simply put, decentralized finance is nothing but financial apps built using blockchain tech that enables digital transactions between multiple parties.

DeFi eliminates intermediaries and dApps ultimately give users more control of their funds. As a result, participants reap the direct benefit using the various available mechanisms—right from lending and swapping to staking and farming.

Virginia Pension Funds Consider DeFi Farming

At this stage, even traditional institutions are stepping into the world of DeFi. In what is the latest development, Virginia’s Fairfax County is considering diverting pension fund money into two yield-farming centric funds. Per Bloomberg, the funds—if approved in the coming days—will be used to provide liquidity on decentralized cryptocurrency exchanges, according to Katherine Molnar, chief investment officer at the Fairfax County Police Officers Retirement System.

Fairfax County and Crypto’s Affair

Interestingly, Fairfax County was one of the first U.S. counties to put pension money into crypto-linked investments in 2019. Back then, two pension plans in the county were anchor investors in a then-novel $40 million venture-capital fund.

In fact, Fairfax made a much more overt bet on cryptos last year. The Fairfax County Police Officers Retirement System and Fairfax County Employees’ Retirement System invested $50 million into Parataxis Capital Management LLC’s main fund, which buys crypto derivatives and digital tokens.

Now, Molnar expects yield farming to fetch a return of at least 9%. She highlighted that Fairfax’s crypto-focused investments add up to more than 8% of its portfolio. She asserted,

“We view this as a growth investment.”

Wall Street proprietary trading firm Jane Street said on Tuesday that it will borrow through a DeFi app.

Where US stands in terms of DeFi adoption

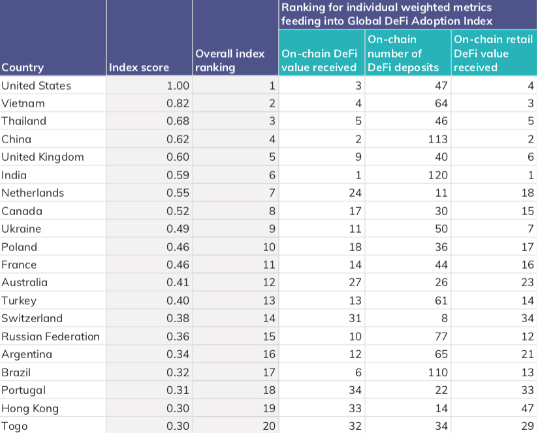

Well, as expected, the US ranked one on last year’s Global DeFi Adoption Index. As such, the said index keeps an account of countries with the highest grassroots adoption. As illustrated below, DeFi adoption, to a fair extent, is strong in high-income countries that already have a substantial cryptocurrency usage, especially among traders and institutional investors.

Fairfax jumping onto the bandwagon only makes US’ DeFi adoption case much stronger.