Since its inception, Cardano has taken its development game quite seriously. Compared to other top projects, it has been able to stay a few steps ahead on most occasions in the recent past. In June, the network surpassed its competitors and rose to the top. However, when weighed against its past performance, Cardano was seen lagging.

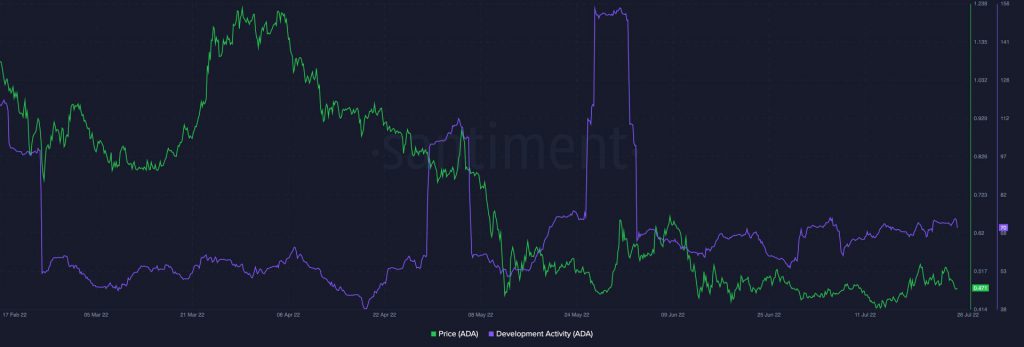

As illustrated below, Cardano’s development activity metric peaked during the end of May and hovered above 150 for a couple of days. Right after that, however, it noted a free-fall, and by 3 June, it was down to 65. By the end of the month, it stooped even lower to 55.

Nonetheless, the said state did not last for long. With developers on-field prepping the network for the upcoming Vasil hard fork, the form of this metric started improving. Post noting a modest recovery, this metric’s reading is back above 70.

Source: Santiment

Apart from the upslope on the metric chart, there are tangible exhibits of Cardano’s improvement on this front. A few days back, the first-ever untyped Plutus core program was entirely generated and serialized only using the programming language TypeScript.

This new milestone implies that developers can write smart contracts on Cardano using the said language. Essentially, the Cardano blockchain was built using the Haskell functional programming language, but TypeScript provides other advantages that will help to improve the overall smart contract development experience.

Reacting to the said development, Cardano founder Charles Hoskinson remarked, “Pretty cool.”

Extending Cardano’s DeFi tangent

Well, things look satisfactory from the development end of DeFi for Cardano. But, what is going on at the users’ end? Well, per on-chain data, the smart contract has been settling around 70k transactions daily. And alongside, the activity on Cardano’s native DEXes has also been decent.

On the platform’s multi-pool DEX Miniswap, the cumulative worth of assets locked has noted a 5% incline over the past month. AMM DEX WingRiders, on its part, stated a minor change in the said period.

However, the performance of Cardano’s first DEX seems to be concerning. The TVL on SundaeSwap has noted a 13% fall over the past month, indicating that users have been withdrawing their assets from the platform.

Source: DeFiLlama

As far as the big picture is concerned, the total value locked on Cardano has not been declining. It has, instead, been able to remain static at around $125 million of late, implying that the performance of the likes of Miniswap and other liquidity protocol projects has been capable of out-weigh that of SundaeSwap and co., putting Cardano in a relatively better position.

Source: DeFiLlama