Solana (SOL) price has faced significant challenges recently, dropping 21% over the last 30 days. Despite this decline, SOL remains the 6th largest cryptocurrency in the market, with a market capitalization of approximately $90.8 billion.

Technical indicators such as BBTrend, DMI, and EMA lines suggest that while the downtrend persists, its strength has diminished, and the price is currently consolidating. Whether SOL price continues its bearish trajectory or begins a recovery depends on key support and resistance levels and shifts in market momentum.

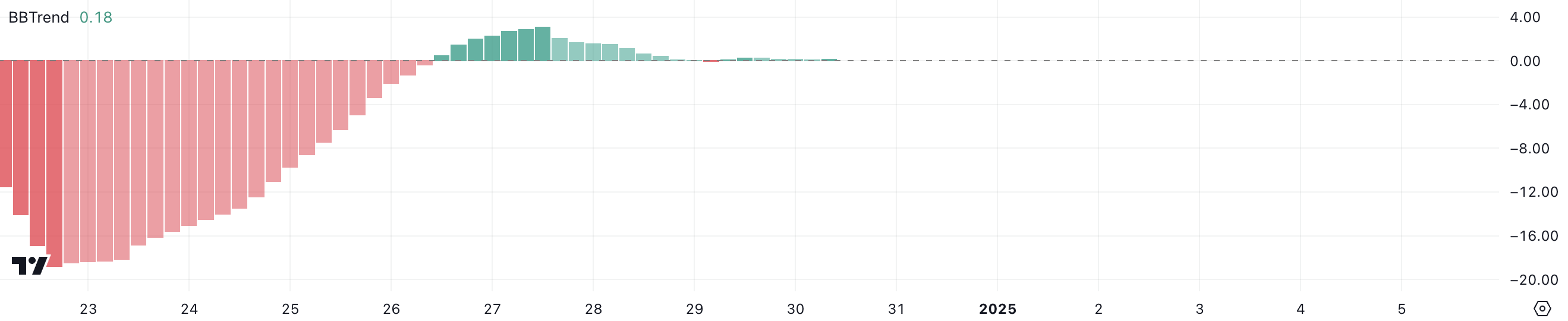

SOL BBTrend Is Nearing Zero

SOL BBTrend is currently at 0.18, indicating a neutral stance after recovering from deep negative levels beginning on December 23.

The indicator briefly peaked at a positive value of 3.09 on December 27, signaling short-term bullish momentum. However, it has since declined and stabilized around 0.18, suggesting the absence of a strong directional bias in the current price action.

The BBTrend is a technical indicator derived from Bollinger Bands that measures the strength and direction of a trend. Positive BBTrend values typically indicate upward momentum, while negative values suggest downward momentum. When the BBTrend is near zero, as it currently is for SOL, it reflects a neutral or range-bound market, with no strong trend dominance.

In the short term, Solana BBTrend at 0.18 suggests a potential consolidation phase, where price volatility may decrease until a clearer trend emerges.

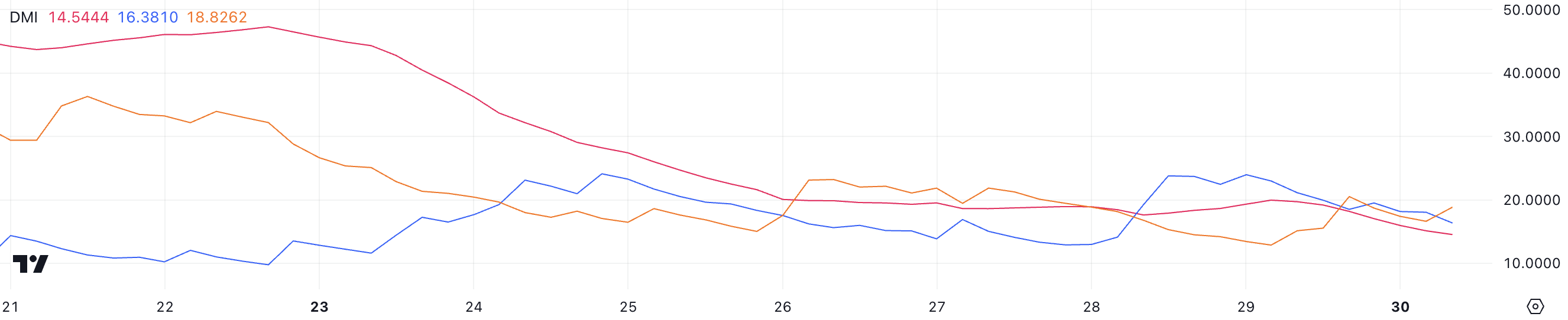

Solana Bears Are Still Here

Solana DMI chart shows that its ADX is currently at 14.5, declining from nearly 20 just a day ago. This drop reflects a weakening trend strength, indicating that the recent market momentum is losing steam.

Meanwhile, the +DI (Directional Indicator) is at 16.2, and the -DI is at 19.7, suggesting that bearish pressure remains slightly dominant as the -DI is higher than the +DI. This configuration highlights that SOL price is still struggling to reverse its downtrend fully.

The Average Directional Index (ADX) measures the strength of a trend, regardless of its direction, on a scale of 0 to 100. Values above 25 indicate a strong trend, while readings below 20, like SOL current 14.5, signal weak or absent trend strength. With the +DI below the -DI, the bearish trend still holds, but the declining ADX suggests that this trend lacks significant momentum.

In the short term, SOL may continue to consolidate or move sideways unless there’s a shift in momentum that pushes the +DI above the -DI, accompanied by a rising ADX to indicate a stronger trend

SOL Price Prediction: Will the Downtrend Persist?

Solana EMA lines continue to show a bearish setup, as the short-term EMAs remain below the long-term EMAs. This alignment reflects ongoing downward momentum, with no immediate signs of a bullish reversal.

The bearish EMA configuration suggests that selling pressure is likely to persist, especially if the price approaches the next strong support level at $182. Should this support fail, the downtrend could intensify, potentially pushing Solana price down to $176.

On the other hand, if SOL price manages to reverse its current trend and establish an uptrend, it could test the resistance at $201. Breaking above this level would indicate growing bullish momentum and could pave the way for further upward movement.

However, for such a shift to occur, the EMA lines would need to begin converging and eventually flip into a bullish setup, with short-term EMAs crossing above the long-term ones. Until then, the bearish EMA structure continues to signal caution for the short term.

The post Fading Momentum Pushes Solana (SOL) to 21% Monthly Loss: What’s Next appeared first on BeInCrypto.