Quick Take

Jim Bianco, a macro expert, recently shared his views on why Bitcoin ETFs have failed to drive adoption among TradFi investors, or “boomers.” He highlighted several factors explaining this shortfall while highlighting the shift from inflows to outflows and record losses for ETF holders.

Bianco noted that Bitcoin ETF holders are facing a substantial $2.2 billion in unrealized losses, as the average purchase price for BTC ETFs stands at $61,000, based on Friday’s Spot BTC close of $52.9k.

Average Purchase Price of Bitcoin ETFs: (Source: Bianco research)

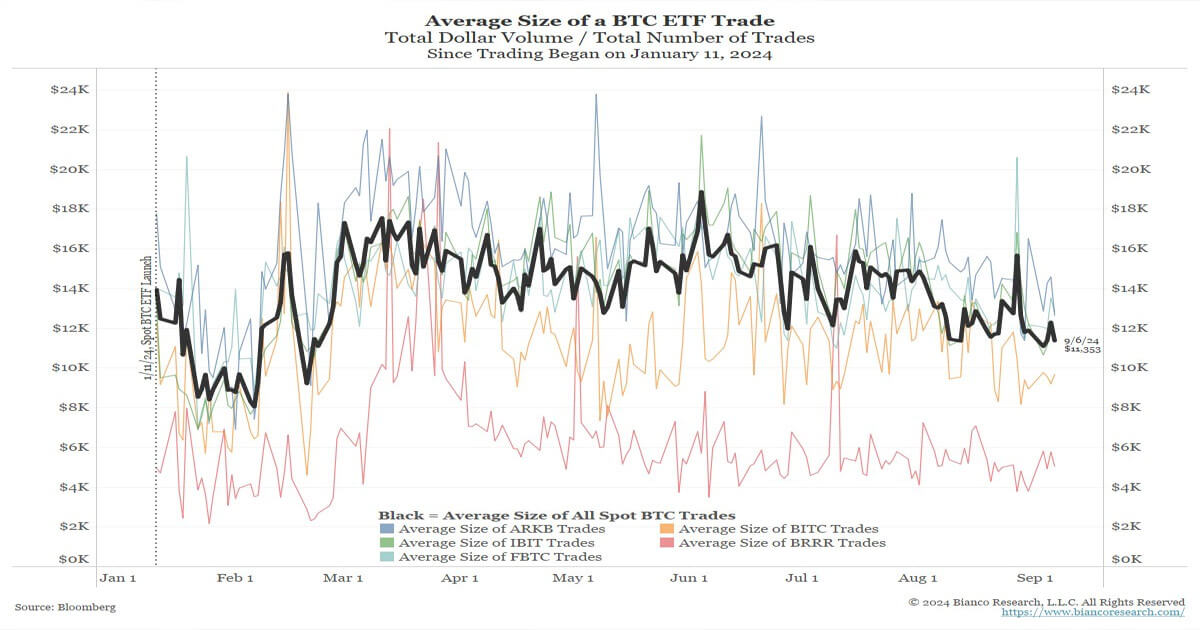

According to Bianco, the average trade size for BTC ETFs has dropped below $12,000, the lowest level since March 2024. This is much smaller than comparable ETFs like SPY and QQQ, signaling a lack of significant institutional involvement. This trend suggests that Bitcoin ETFs have primarily attracted smaller retail investors rather than larger institutional players.

Average Trade Size of a BTC ETF: (Source: Biancoresearch)

Bianco also emphasized the lack of adoption from investment advisors. 85% of Bitcoin ETF activity is not from TradFi institutions. BlackRock has confirmed this, according to Bianco, stating that 80% of the inflows for its Bitcoin Trust (IBIT) come from self-directed online accounts rather than institutional investors.

The post Jim Bianco says Bitcoin ETFs have failed to attract TradFi or ‘boomer’ investors appeared first on CryptoSlate.