A significant amount of bitcoin changed hands on the United States’ most dominant spot exchange, Coinbase, as investors look to buy the dip.

The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

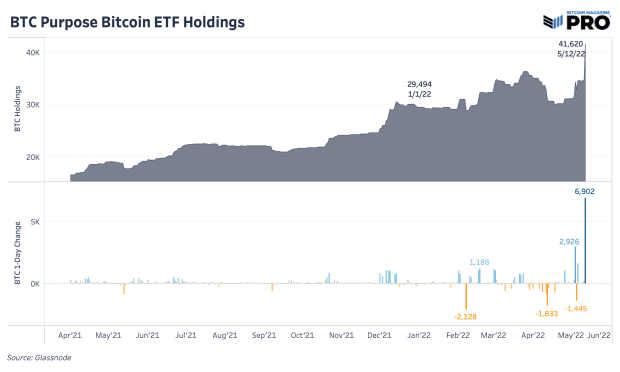

Thursday, May 12, 2022, was one of the most exciting and active days in the bitcoin/crypto market in months, with no shortage of volatility and fear from market participants. On the bitcoin side of things, the price plummeted to a low of $25,300 on large volume, before quickly rebounding and closing the daily candle at $28,900. With the fall came a strong response from opportunistic investors looking to buy the dip, as shown by the Canadian Purpose Bitcoin ETF, which saw its largest day of inflows ever, adding 6,902 BTC worth nearly $207 million.

Canadian Purpose bitcoin spot ETF holdings

Similarly, Thursday saw the largest amount of bitcoin volume traded in a day on Coinbase since May 19, 2021, signaling that a significant amount of bitcoin changed hands on the United States’ most dominant spot exchange. Looking at Coinbase 3-day volume bars for bitcoin, large spikes are typically signals of inflection points near local bottoms or tops. While there is obviously a whole confluence of variables that need to be taken into account when looking for absolute market bottoms, a large volume spike in spot markets and subsequent bounce above $30,000 for bitcoin is a promising sign.

Bitcoin price and volume on Coinbase

This aligns with our macro view that the U.S. economy is in the midst of a large stagflationary slowdown, which damages asset prices and leads to diminishing liquidity in financial markets as the Federal Reserve tightens monetary policy. As consumers continue to get their wallets squeezed, the slowdown of economic activity will compound in a positive feedback loop of diminishing growth and economic activity.

Our core thesis is that this will inevitably lead to additional fiscal and monetary stimulus, as the global economy cannot handle a sustained economic slowdown due to the mechanics of the debt-based monetary system we find ourselves in today, with a record amount of debt that needs to be serviced and refinanced.

Subscribe to access the full Bitcoin Magazine Pro newsletter.