In a massive Wall Street development, chipmaker Nvidia (NVDA) has officially booted Intel (INTC) from the Dow Jones Index after a 25-year run. Indeed, the chipmaker has surged more than 175% in 2024. That has culminated in it replacing the tech company that has struggled mightily to find its footing in an ever-changing market.

The news pushed Intel down, with INTC dropping 4% on Monday. Alternatively, it only boosted the strong position of NVDA, as the stock has increased almost 2%. The move is representative of the trajectory of both companies are facing currently

Also Read: Nvidia: Can NVDA hit $200 Before 2025?

Intel Gets Kicked From Dow Jones Index: Nvidia Rides 2024 Hype to Replace It

The second half of the year has been a tough one for Intel (INTC). The company has struggled to rebound from an underwhelming Q2 earnings report. A big part of its troubles has derived from increased competition in the white-hot AI sector. In recent weeks, the stock has plummeted as much as 65%.

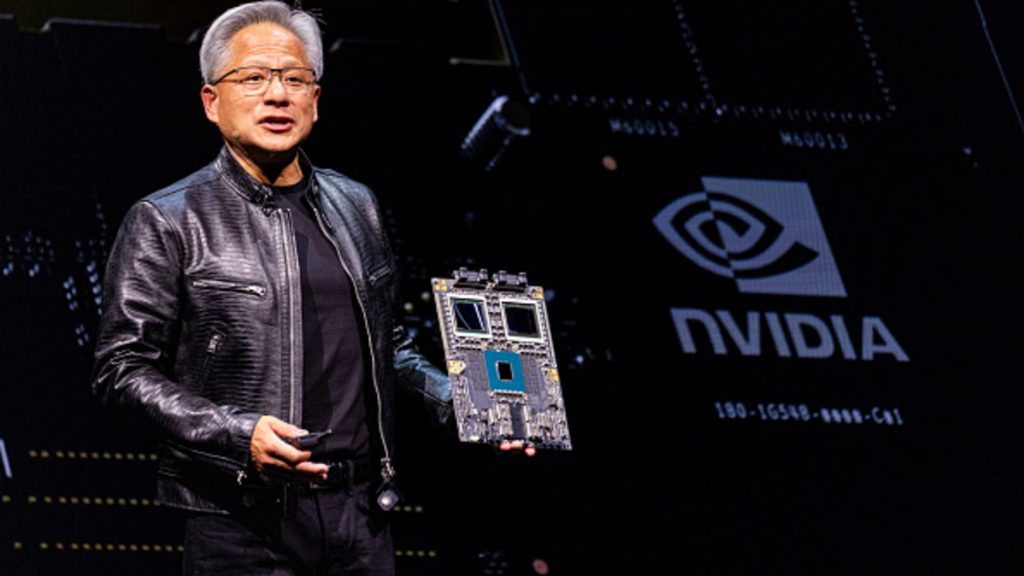

Alternatively, Nvidia has been a different story. The company has thrived, surging to its $137 price point, and eyeing continued gains through the end of the year. Moreover, the company is currently looking to be the first to reach a $4 trillion market cap. It has already surpassed Apple (APPL) to be the most valuable company on the planet.

Also Read: Intel: INTC Q3 Report Projecting Net Loss of Over $950M

That shift has ultimately led Nvidia to boot Intel from the Dow Jones Index, the indices announced. Indeed, the chipmaker has ousted INTC after a 25-year sting on the industrial average. The move is massive, as it showcases a gargantuan shift for the stock market index, and investor demands.

“The index changes were initiated to ensure a more representative exposure to he semiconductors industry,” the S&P wrote in a press release. The questions will now target Intel’s ability to weather the storm.

Down 54% this year, it has very little reason to be optimistic. Still, some experts are not ruling outa 20% boost and return to form for the stock. In recent years, it has shown a propensity to be volatile and eventually finds its way back to respectability.