Nvidia is a world-renowned company, a precious one on top of it, as it has recently outpaced tech behemoth Apple in valuation metrics. In addition, Nvidia’s tightened grip on the AI sector is commendable.

Still, at the same time, it enables companies to explore rather “explosive” ideas by capitalizing on Nvidia’s exemplary growth. According to a recent report, certain companies have been using Nvidia GPUs as collateral to raise loans and funds and curate new fundraising ideas.

Also Read: US Election Frenzy Could Send Bitcoin (BTC) To $100K, Here’s When?

Nvidia Chips Are Being Used As Collaterals

According to the Financial Times, certain companies have started purchasing Nvidia’s graphics and AI chips in bulk to raise money. The report stated that companies like Coreweave, Crusoe, and Lambda Labs have been exploring lucrative methods of earning money by lending Nvidia chips and graphics as effective collaterals.

These companies have loaned these chips and graphics to other firms, helping them power their AI-centric endeavors. These companies have reportedly been investing heavily in Nvidia GPUs and are lending them out later to raise money in record time.

The report mentions Coreweave as one of the companies exploring this arrangement. The firm initially started as a crypto mining firm but eventually shifted towards AI as the sector’s demand blossomed to new highs. Later, the firm started to stash Nvidia GPUs, hoarding nearly 45,000 Nvidia GPUs across North America.

However, experts have also shared certain alarming signals, adding that such practices could bode unfavorable results for the realm as a whole. With competitors like Meta entering the AI sector, Nvidia could face new challenges ahead in the future, which could jeopardize its positioning in the long haul.

Also Read: Donald Trump Wins 2024 Presidential Election

The AI’s Firm Stock Surge To $200: Is It Possible?

Nvidia stocks are among the most trending US stocks to explore at the moment. The firm has recently outpaced Apple in valuation metrics, boasting a stellar $3.43 trillion market cap.

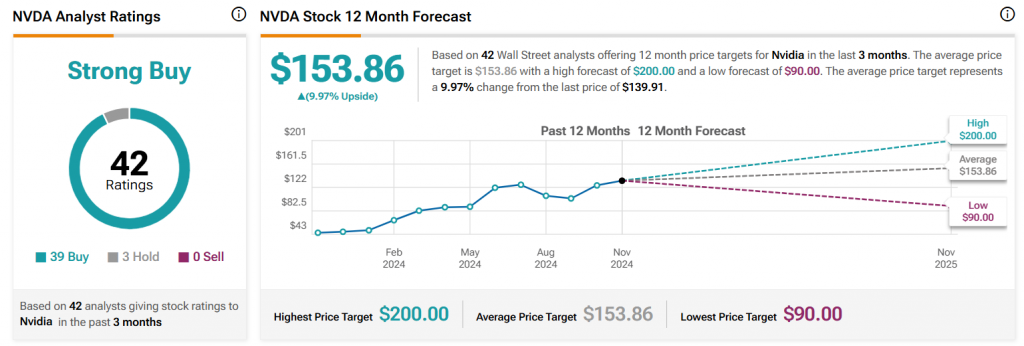

Per TipRanks, Nvidia (NVDA) stocks may reach a new high of $200 within the next 12 months. Nvidia stocks have risen 850% since 2022 and continue to earn heavy returns.

“The average price target for NVDA is $153.86. This is based on 42 Wall Street Analysts 12-month price targets issued in the past 3 months. The highest analyst price target is $200.00; the lowest forecast is $90.00. The average price target represents a 9.97% increase from the current price of $139.91.”

Also Read: Can US Election Results Propel Bitcoin (BTC) Towards $80K?