Pi Network (PI) is perhaps the most hyped altcoin of 2025. Its price has skyrocketed more than 200% in the last seven days, almost touching $3 in the last few days. Despite this impressive rally, technical indicators suggest that the uptrend may be losing momentum.

The DMI shows that buyers are still in control, but the narrowing gap between the +DI and -DI signals weakening bullish pressure. Meanwhile, PI’s RSI has cooled off from extreme overbought levels, and its EMA lines hint at a potential trend reversal, putting its bullish outlook at risk.

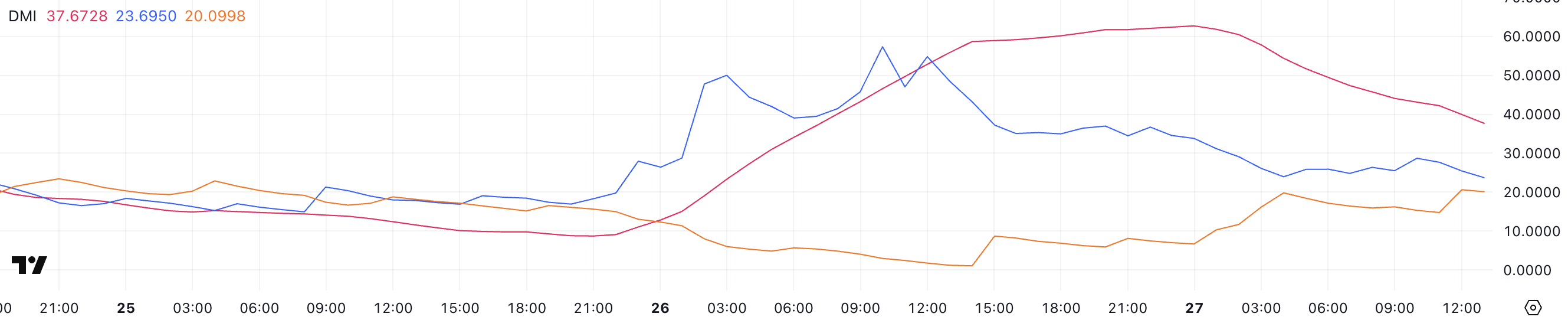

PI DMI Shows Buyers Are Still In Control, But This Could Change Soon

PI’s DMI chart shows that its ADX is currently at 37.6, after surging from 9 to 62.7 between yesterday and today. The Average Directional Index (ADX) measures the strength of a trend without indicating its direction.

It ranges from 0 to 100, with values above 25 signaling a strong trend and values below 20 suggesting a weak or non-trending market.

PI’s +DI is at 23.6, down from 57 yesterday, indicating weakening bullish pressure. The -DI has risen to 20 from 1, showing an increase in bearish sentiment.

Despite this shift, the +DI remains above the -DI, confirming that PI is still in an uptrend. However, the narrowing gap between the directional indicators suggests that the uptrend is losing strength. If the +DI continues to decline and crosses below the -DI, it could signal the beginning of a trend reversal.

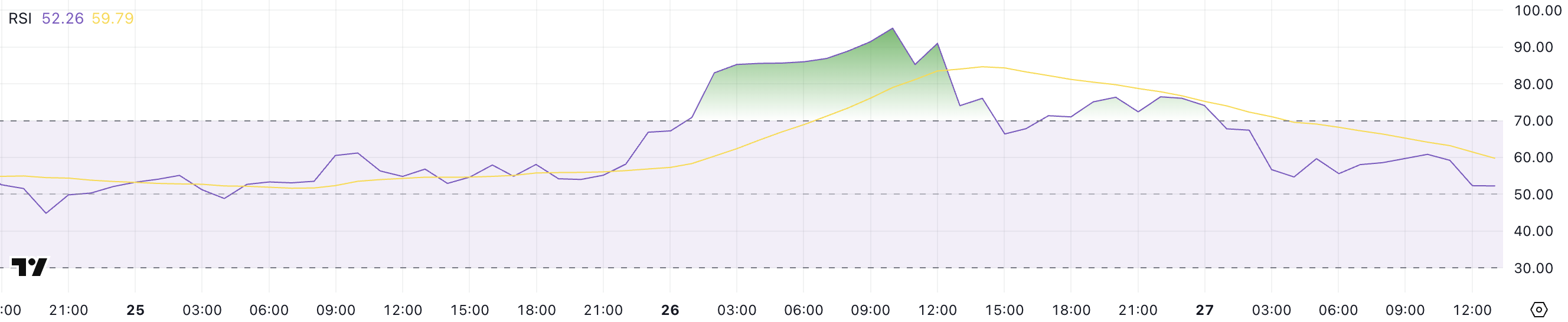

Pi Network RSI Is Back to Neutral After Staying In Overbought Levels

PI’s RSI is currently at 52.2, after reaching an extreme high of 95 yesterday and staying above 70 for several hours on February 26. The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements, ranging from 0 to 100.

Values above 70 indicate overbought conditions, suggesting that the asset may be overvalued and due for a pullback, while values below 30 indicate oversold conditions, signaling potential for a price rebound.

An RSI between 30 and 70 is generally considered neutral, with no strong directional bias.

PI’s RSI dropping to 52.2 after staying above 70 and peaking at 95 suggests that the intense buying pressure has cooled off. This decline reflects a loss of bullish momentum and may indicate that PI is entering a consolidation phase.

The sharp pullback from extreme overbought levels suggests that profit-taking is occurring, increasing the likelihood of a temporary price correction.

However, as the RSI is now in the neutral zone, the next price movement will depend on whether buying interest resumes or selling pressure continues to build.

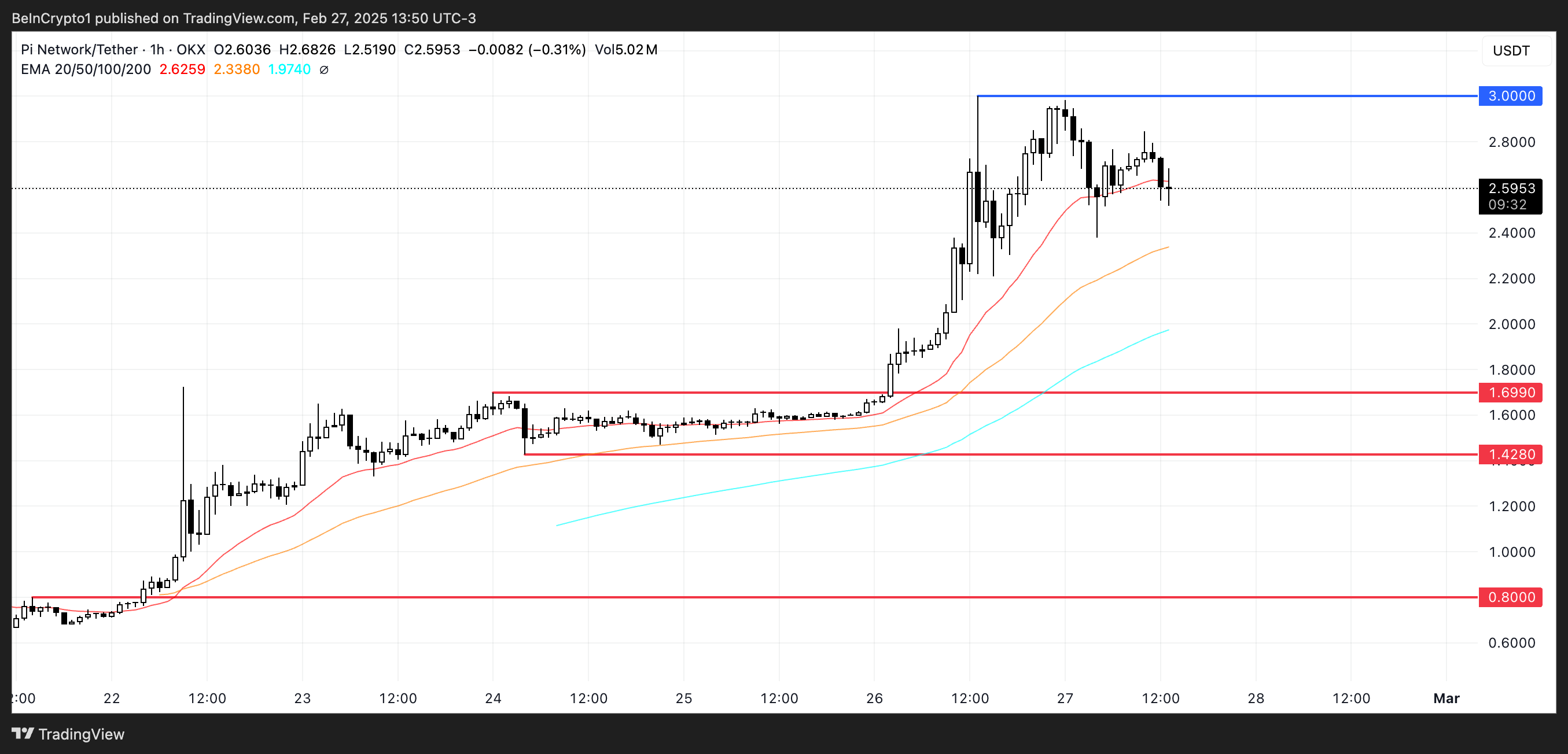

Pi Network Could Correct By 68% Soon

PI’s EMA lines remain bullish, with short-term lines above long-term ones, indicating that the uptrend is still intact. However, the recent movement suggests that this uptrend could be losing momentum, as confirmed by the latest DMI and RSI values.

PI continues to be one of the most hyped coins in the market, making headlines repeatedly. Recently, Moonrock Capital CEO Simon Dedic Alleges Wash Trading in Pi Network. Before that, the coin surged after Florida Businesses Started Accepting PI Coins.

The weakening buying pressure and rising bearish sentiment indicate a potential shift in the positive market sentiment of the last days. If the EMA lines continue to converge, it could signal an impending trend reversal, putting PI’s bullish outlook at risk.

If PI can regain the strength of its uptrend, it could rise to test levels above $3 for the first time, possibly reaching $3.5.

However, if the trend reverses, the PI price could test support at $1.69. If this level is lost, it could continue to decline to $1.42. If even that support fails, Pi Network could drop as low as $0.8, marking a significant 68% correction.

The post Pi Network (PI) Indicators Suggest a Strong Correction Could Happen Soon appeared first on BeInCrypto.