Federal Reserve Chair Jerome Powell adopted a hawkish stance during his Wednesday press conference after the December Fed meeting, sparking a market bloodbath as the New York session headed to the close.

Although the Federal Reserve lowered interest rates by 0.25% to a range of 4.25%-4.5%, as widely anticipated, the updated economic projections suggest just two potential rate cuts in 2025 — down from four projected in September and fewer than the three anticipated by markets before the meeting.

Powell described the shift as “a new phase” for monetary policy, emphasizing that after 100 basis points of rate cuts in 2024, rates are now significantly closer to a neutral stance.

Stocks tumbled across the board, the U.S. dollar soared to two-year highs and Bitcoin (CRYPTO: BTC) cratered over 5%, as investors digested the reality of a shift in the monetary policy stance by the Federal Reserve.

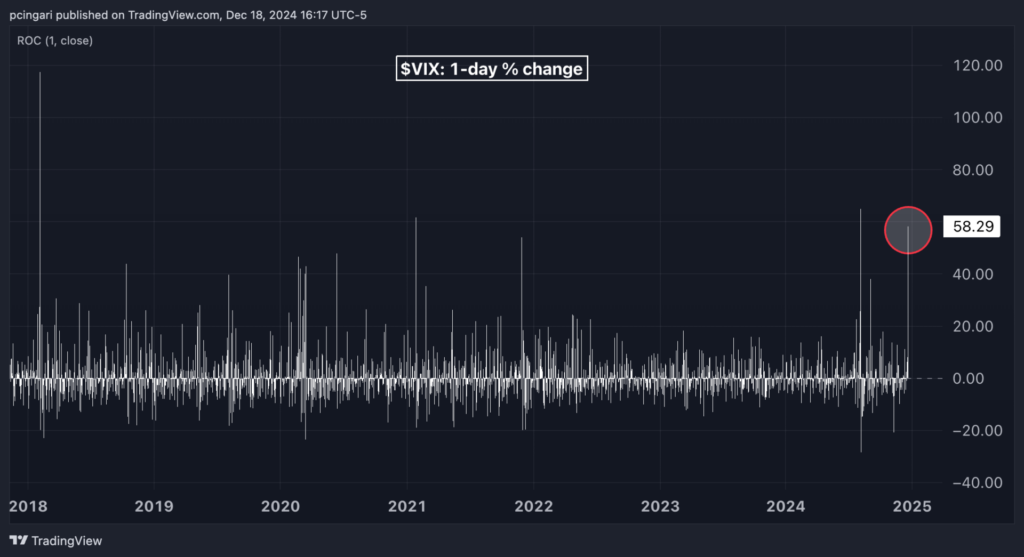

The CBOE Volatility Index, known as the VIX and Wall Street’s fear gauge, skyrocketed 58% to 25, reflecting a spike in investor uncertainty and heightened anxiety over the future of interest rates.

Wall Street …

Full story available on Benzinga.com