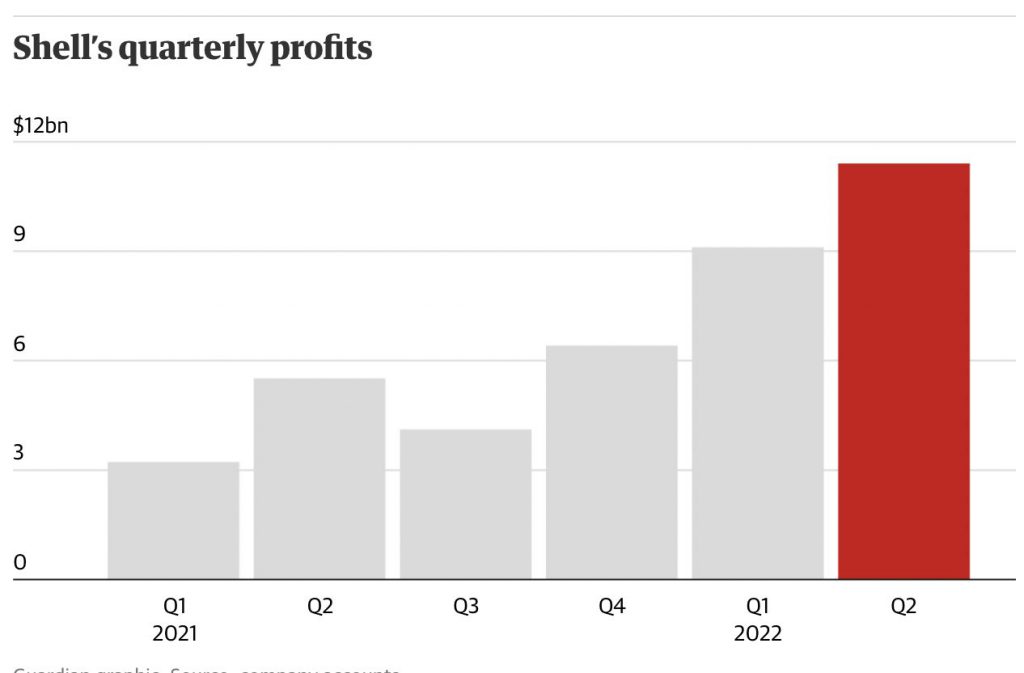

2022 emerged as a year full of surprises. The world witnessed a major geopolitical unveiled: the Russia – Ukraine war. During this, several other issues took the front stage; one was a massive spike in gas prices. The globe has been dreading the increase in the prices of oil, gas, and other refined petroleum products. On the other hand, Shell pocketed significant profits in the second quarter of 2022.

The pandemic took a toll on almost every industry. However, energy companies seemed to be on a roll. On Thursday, Europe’s oil giant, Shell, announced its significant surge to $11.5 billion in profits. It should be noted that the increased gas trading and refining profit did contribute.

The entire year seemed eventful for the firm as it recorded profits of $9.1 billion in the first quarter. Shell doubled its earnings of $5.5 billion that it recorded a year ago.

In addition, Shell reportedly shed light on a $6 billion share buyback program. However, the firm did not meddle with its dividend of 25 cents per share.

Shell garners increased backlash; Here’s why

After the firm’s Q2 earnings release, the outrage was sparked among the community. The oil and gas price surge has made life hell for the working class. Therefore, the general secretary of the Trades Union Congress, Frances O’Grady, stated,

“These eye-watering profits are an insult to the millions of working people struggling to get by because of soaring energy bills. Working people are facing the longest and harshest wage squeeze in modern history. It’s time working people got their fair share of the wealth they create, starting with real action to bring bills down.”

When asked if there would be any oil and gas prices plummet, Ben van Beurden, Shell’s CEO, suggested that the firm could “perform miracles.”