The Shiba Inu (SHIB) ecosystem has been making headlines for a lot of reasons. Following the asset’s massive success over the past month, SHIB was seen taking a backseat. However, several analysts have revealed that the meme coin’s setback isn’t all that bad. A notable uptick is reportedly expected in the coming days. Analyst Ali Martinez explains why.

Also Read: 3 Commodities To Invest in 2025 For Top Returns

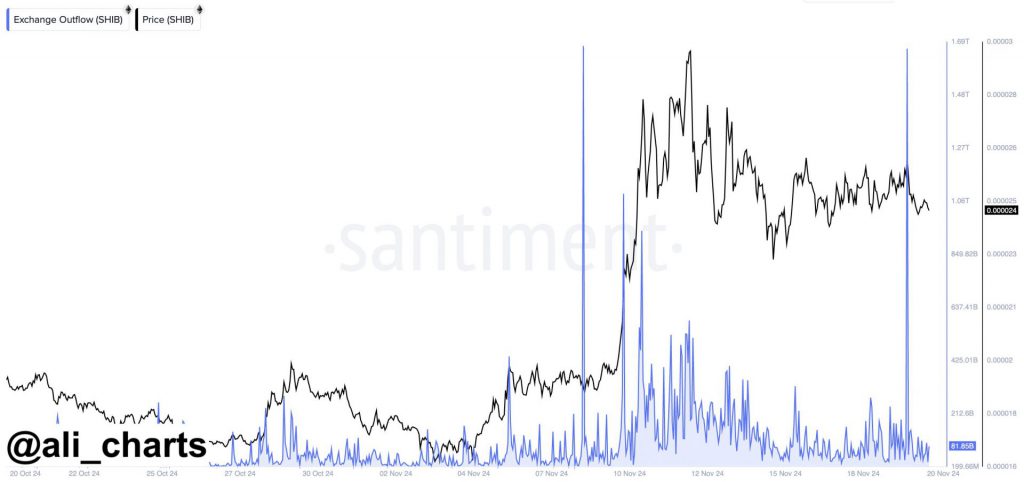

Shiba Inu Records Major Outflow

Data on Shiba Inu exchange outflows reveals a huge rise, meaning that 1.67 trillion SHIB, or around $41 million, had been taken out of exchanges. In the past, the meme currency saw a huge rally when SHIB saw a comparable rise in exchange outflow. Martinez further shed light on this activity and reminded the market that SHIB recorded a 62% rise in its price.

It should be noted that SHIB is currently 72% below its all-time high of $0.00008845. The meme coin reached this peak back in 2021 about three years ago. In order to reach the 1 cent mark, Shiba Inu has to surge by a much higher margin. Once SHIB begins its upward trend, the asset might rise as high as 1 cent.

Also Read: Shiba Inu: Can SHIB Hit $0.0001 If Bitcoin Hits $125,000?

Current Price Status

The second largest meme coin was recording a 2.18% drop over the past 24 hours. The asset was trading at $0.00002409, at press time. The past couple of days have been challenging for Shiba Inu as it recorded a 7% decline. But it is worth nothing SHIB has surged by a staggering 32% throughout the last month.

In addition to investors taking SHIB off exchanges, there are several factors that could impact the price of the asset. Shiba Inu has been closely following the trajectory of Dogecoin (DOGE). The OG meme coin is expected to rise further as Elon Musk, an avid supporter of DOGE is now part of the Trump administration. Given that Dogecoin tripled following large rallies, SHIB may show a comparable upward rise.

Also Read: De-Dollarization: How Long Will the US Dollar Remain Global Currency?