Solana (SOL) Total Value Locked (TVL) recently hit $9.90 billion, the lowest level since November 2024, before recovering slightly to $10.3 billion. Despite this bounce, SOL’s TVL remains down nearly 30% from January 18, reflecting ongoing concerns about its ecosystem.

SOL’s price is also under pressure, down more than 8% in the last seven days and over 31% in the past 30 days. Technical indicators are showing signs of recovery, but bearish trends are still dominant, with SOL trading below key resistance levels.

Solana TVL Reached Its Lowest Levels Since November 2024

Solana’s Total Value Locked (TVL) is currently at $10.3 billion, recovering from a low of $9.90 billion on February 17, the lowest level since November 14, 2024. Despite this rebound, TVL is still down nearly 30% from $14.2 billion on January 18, reflecting decreased investor confidence.

This decline coincides with controversies surrounding Solana ecosystem, including accusations of being too extractive and criticism over the launch of the meme coin LIBRA, which has contributed to the outflow of capital.

Tracking TVL is important because it shows the total capital locked in a blockchain’s DeFi ecosystem, indicating liquidity and investor confidence. Although Solana’s TVL has recovered slightly, the sharp drop over the past month highlights ongoing concerns.

If these issues aren’t addressed, continued capital outflows could pressure SOL’s price and slow its recovery. Conversely, if confidence is restored, a rising TVL could signal renewed interest and support for SOL.

Solana Indicators Are Still Bearish But Recovering

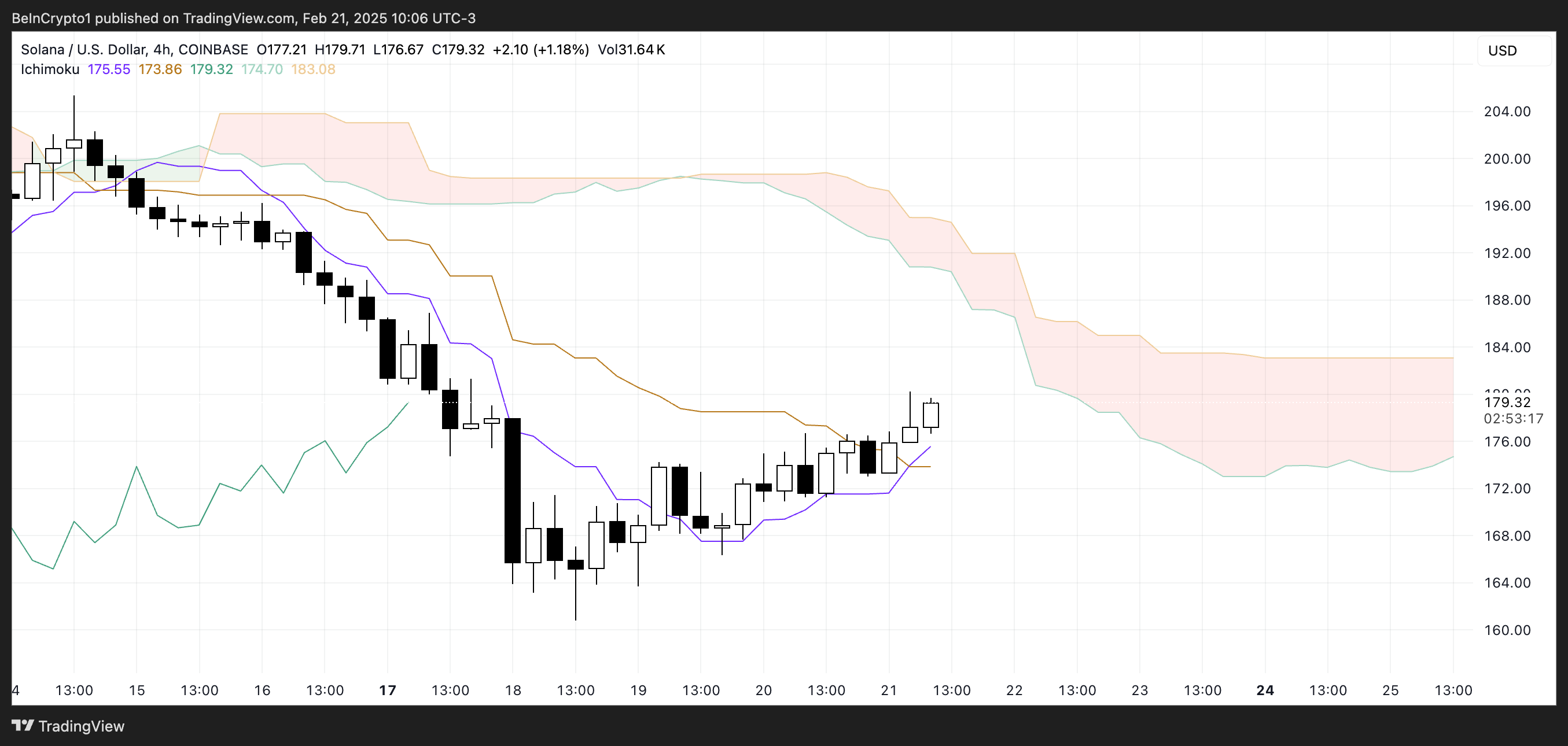

Solana’s Ichimoku Cloud chart shows that the price is currently below the red cloud, indicating that the bearish trend is still dominant. However, the price is now trading above the blue Tenkan-sen (conversion line) and the orange Kijun-sen (base line), suggesting that bearish momentum is weakening.

This could indicate a potential short-term recovery as buyers are starting to gain some control. Nevertheless, the thick red cloud overhead acts as a strong resistance, which Solana would need to break through to confirm a bullish reversal.

In this case, the fact that Solana remains under the red cloud suggests that the overall downtrend is not yet reversed.

However, if the price can break above the cloud, it would be a strong bullish signal. Conversely, failure to break the resistance could lead to renewed selling pressure, continuing the bearish trend.

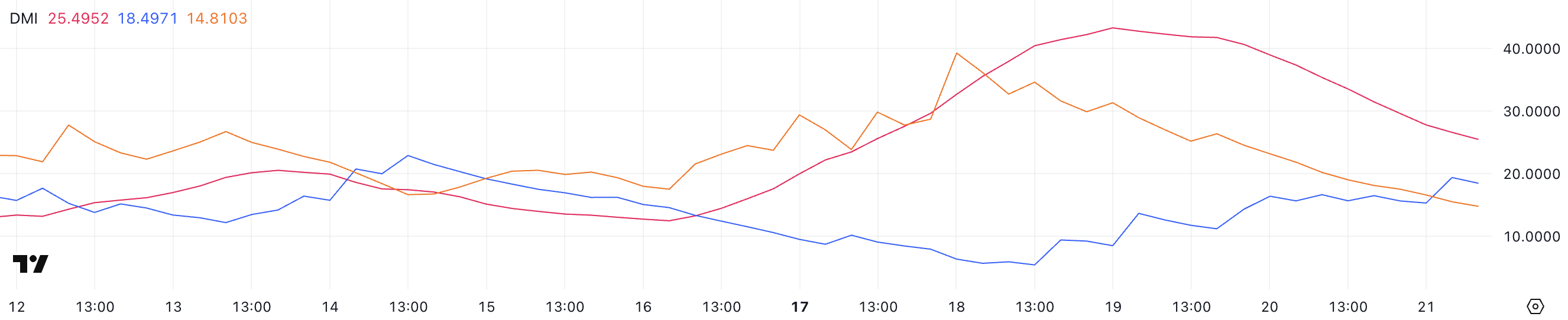

Solana’s Directional Movement Index (DMI) chart shows that its Average Directional Index (ADX) is currently at 25.4, down from 43 just two days ago when SOL’s price dropped to around $165.

This decline in ADX indicates that the strength of the downtrend is weakening, although the trend itself is still present. An ADX above 25 typically signals a strong trend, but the decreasing value suggests that bearish momentum is losing power. This could potentially lead to a consolidation phase.

Meanwhile, the +DI is at 18.4, rising from 5.4 three days ago, while the -DI is at 14.8, dropping from 39.2 over the same period. This shift shows that buying pressure is gradually increasing as selling pressure declines. If +DI continues to rise above -DI, it could indicate a potential trend reversal.

However, since SOL is still in a downtrend, it would need sustained buying momentum to break the bearish pattern. If +DI fails to maintain its upward movement, the downtrend could resume.

Solana Can Reclaim $200 Levels If The Downtrend Is Reverted

Solana’s Exponential Moving Average (EMA) lines still indicate a bearish trend, as the short-term EMAs are below the long-term ones. However, the direction of these lines has started to shift slightly since yesterday, with Solana price rising by 4%.

This suggests that selling pressure is weakening and that buying interest is gradually returning. If this momentum continues, it could lead to a trend reversal. However, that would require the short-term EMAs to cross above the long-term ones.

If SOL can fully reverse the current downtrend, it could first test the resistance at $183. A successful break above this level would signal a stronger bullish momentum, potentially pushing the price to the next resistance at $197.

If buying pressure continues to build, SOL price could even target $220, representing a significant recovery.

Conversely, if the downtrend persists and selling pressure intensifies, SOL could retest the support at $159.

A break below this level would indicate a continuation of the bearish trend. That would possibly lead to a drop towards $147, its lowest level since October 2024.

The post Solana (SOL) Shows Signs of Recovery as Bearish Trend Loses Strength appeared first on BeInCrypto.