Pantera Capital Management’s Bitcoin Fund just hit a milestone: a 1,000-fold gain in the value of its crypto holdings since launch.

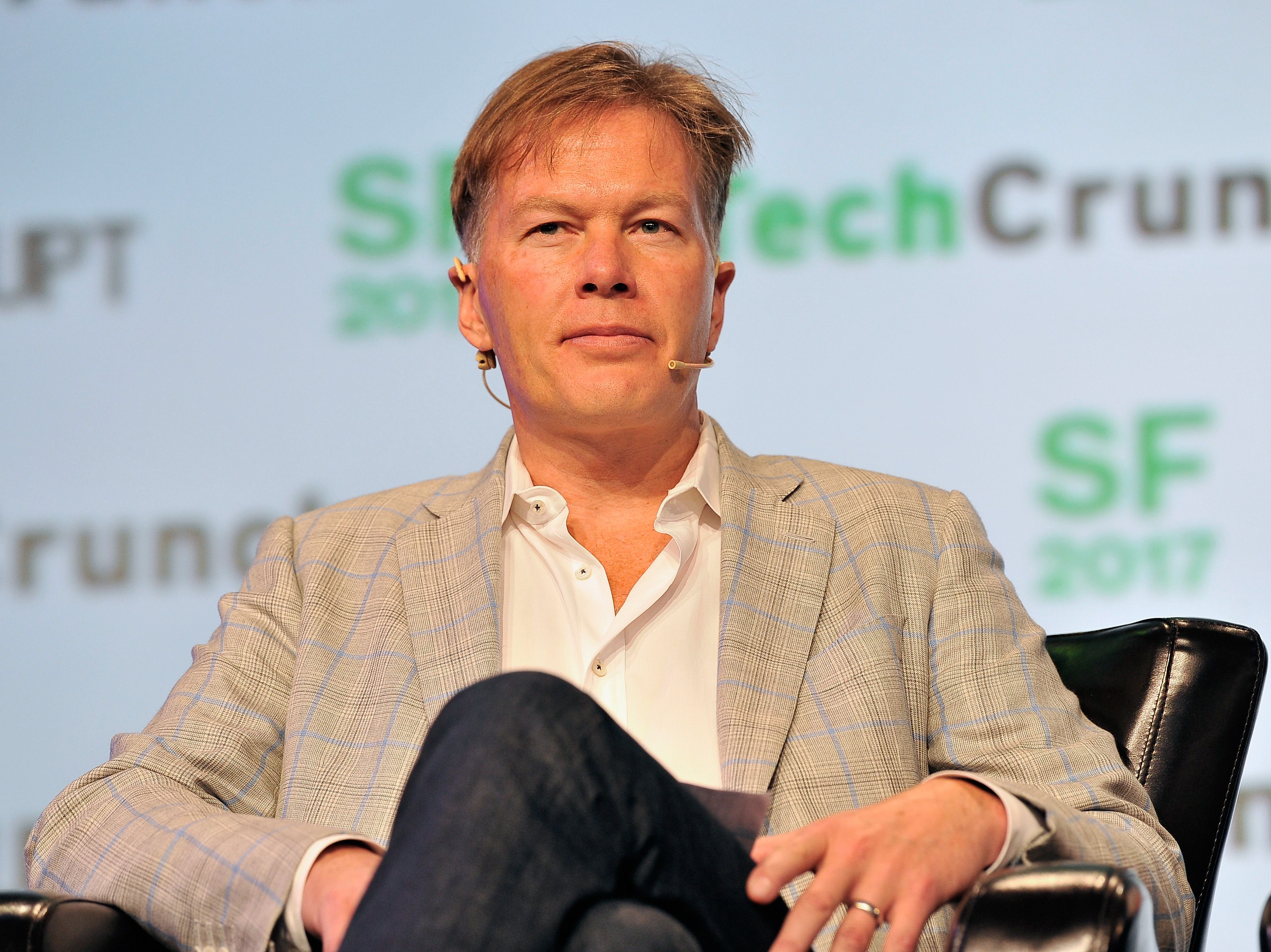

Started in 2013 as one of the first investment products exposing customers to crypto, the fund has returned 131,165% after expenses and fees. As noted by founder Dan Morehead on X, the fund saw a huge surge following Donald Trump’s election as U.S. president this month.

To get started in bitcoin investing, the Bitcoin Fund bought 2% of the world’s bitcoin (BTC) supply when the cryptocurrency’s price was around $74. BTC has skyrocketed over 120% in this past year alone, pushing it to a new all-time high just below $100,000.

“I think we should buy aggressively now,” Morehead wrote in a letter dated July 5, 2013, that he shared publicly Tuesday. “The price is going WAY UP. It’s going to squeeze up like a watermelon seed.”

Years later, bitcoin is “still squeezing up like a watermelon seed,” Morehead wrote in a memo on Tuesday.

He predicts that the cryptocurrency could reach $740,000 by April 2028, which would translate into a $15 trillion market capitalization, due to the fact that 95% of financial wealth has not yet addressed blockchain, he said.

Morehead gave credit to institutional managers like BlackRock and Fidelty, both which launched spot bitcoin and ether (ETH) exchange-traded funds earlier this year, for easing access to the industry and allowing exposure to their tens of millions of clients.

He also said that blockchain’s 15-year regulatory headwinds will now finally turn into tailwinds with the first pro-blockchain U.S. president taking office in January.