Crypto-related products recorded a remarkable $44.2 billion in inflows last year—almost four times higher than the previous all-time high of $10.5 billion set in 2021.

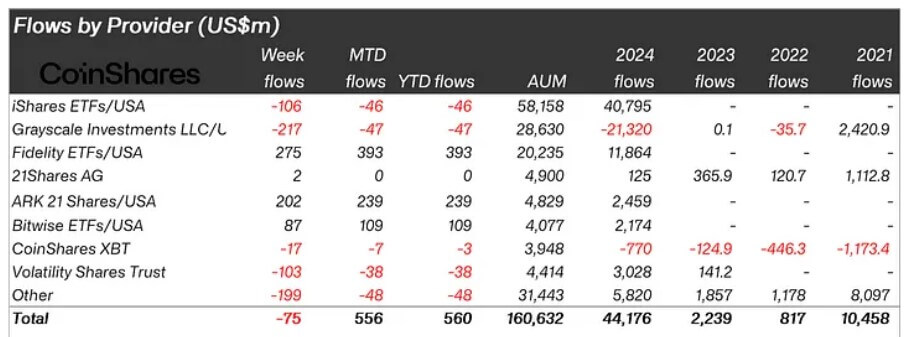

According to CoinShares’ latest report, this record-breaking performance is attributed to the introduction of US spot-based exchange-traded funds (ETFs), which significantly influenced global investments.

Bitcoin ETFs dominate

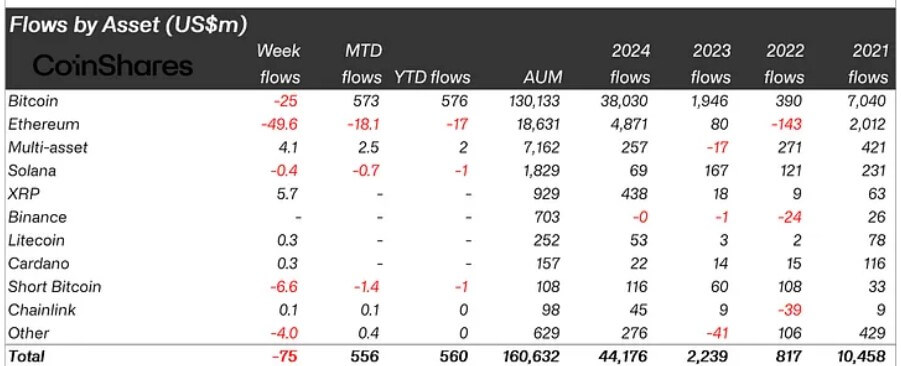

Bitcoin dominated the scene, drawing $38 billion in inflows and accounting for 29% of the total assets under management (AuM).

This significant inflow also resulted in a notable increase in Bitcoin ETFs’ holdings, which surpassed one million BTC in less than a year of their launch.

Leading products like BlackRock’s IBIT and Fidelity’s FBTC attracted the most interest. Notably, IBIT became the most successful ETF launch in the past decade by outperforming nearly 3,000 other ETFs.

On the other hand, Grayscale’s GBTC saw the most outflows last year as investors withdrew more than $21 billion from the fund for cheaper alternatives.

Nevertheless, the ETF products’ positive flows resulted in the US leading global inflows, as it attracted almost all of the $44.4 billion, followed by Switzerland with $630 million.

However, significant outflows from Canada and Sweden—totaling $707 million and $682 million, respectively—partially offset these gains.

James Butterfill, CoinShares head of research, pointed out that the outflows suggest a shift in investments from these regions to US-based products, underscoring the growing appeal of the American crypto market.

He also noted that Bitcoin climb to a new all-time high of more than $100,000 last year resulted in short BTC products seeing inflows of $116 million.

Ethereum resurgence

Ethereum also stood out for its performance, especially for its resurgence in the latter part of the year.

The digital asset secured $4.8 billion in inflows as its ETH spot-based ETFs ended the year strongly. This inflow represented 26% of its AuM, which is 2.4 times higher than its 2021 total and vastly exceeds its 2023 performance.

Meanwhile, Ethereum’s gains outpaced its eternal rival Solana, which managed $69 million in inflows, representing just 4% of its AuM.

Other large-cap alternative coins, such as Polkadot, Cardano, XRP, and others, collectively attracted $813 million, accounting for 18% of their AuM.

2025 flows

Meanwhile, this year has started on a positive note for Bitcoin investment products in the US, with inflows reaching $666 million in the first two trading days.

However, according to Farside data, Jan. 3 saw a $908 million inflow in a single day, with Fidelity leading at $357 million, just ahead of BlackRock and Ark Invest at $253 million and $222 million, respectively.

The post US Bitcoin ETFs see $903 million inflow as 2024 confirmed $44.2 billion gain globally appeared first on CryptoSlate.