Warren Buffett stocks continue to attract quite a bit of attention from investors right now as the legendary investor has made some strategic moves despite all the current market challenges we’re seeing. Through Berkshire Hathaway, Buffett actually invested around $2.6 billion in six selected stocks, and this really showcases his approach to portfolio diversification amid the market volatility that has been affecting investments lately.

Also Read: JFK Files: His War on Central Banks – Is Bitcoin (BTC) the Answer for CBDCs?

How Warren Buffett’s $26 Billion Investment Strategy Navigates Stock Market Volatility

The 6 Stocks in Buffett’s Latest Portfolio

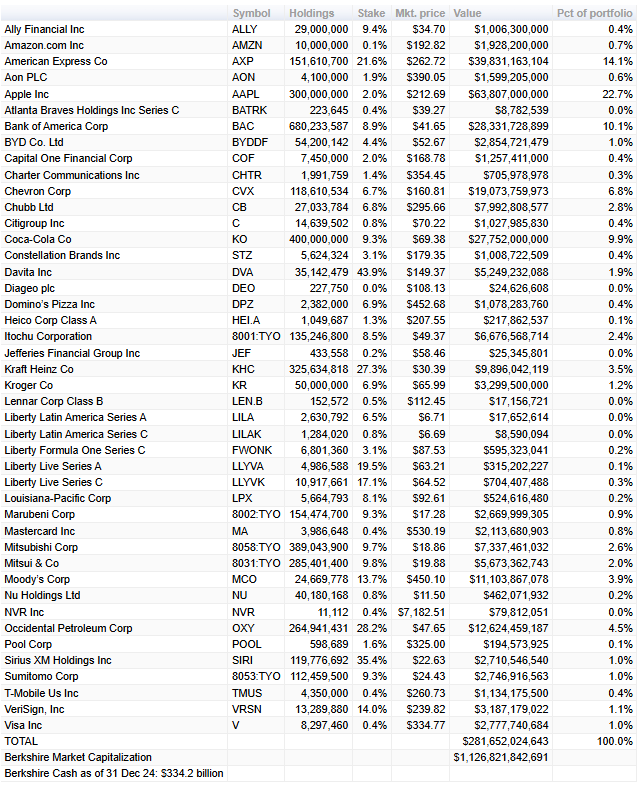

The Warren Buffett stocks added to Berkshire’s portfolio in the fourth quarter include Occidental Petroleum ($409.1 million), VeriSign ($89.9 million), Sirius XM ($296.8 million), as well as Pool Corp. (estimated $70 million), and also Domino’s Pizza (estimated $470 million), plus Constellation Brands (estimated $1.3 billion).

Warren Buffett stated in his letter to shareholders:

“Berkshire will never prefer ownership of cash-equivalent assets over the ownership of good businesses, whether controlled or only partially owned.”

Navigating Financial Risks

The market volatility that we’ve been experiencing recently has definitely influenced Buffett’s approach to stock investment. In 2024, Berkshire actually sold over $143 billion worth of equities, and then used those proceeds to pay taxes and also increase cash reserves. Despite these rather substantial sales, Warren Buffett stocks continue to reflect his ongoing commitment to identifying good value opportunities in today’s challenging environment.

Also Read: Bitcoin Acquisitions: Strategy’s $500 Million Stock Sale Targets 100,000+ BTC

Constellation Brands: The Value Opportunity

Among the Warren Buffett stocks recently acquired, Constellation Brands stands out as a particularly promising option at the moment. The company does face some financial risks from industry headwinds such as the new tariffs against Mexico and changing consumer preferences, yet it still maintains pretty strong growth projections for its beer business going forward.

Portfolio diversification remains really central to Buffett’s strategy, with these six stocks representing different sectors and also different risk profiles. The current market volatility hasn’t really deterred him from seeking out companies with strong competitive advantages despite all the uncertainty.

Value Investing Despite Market Challenges

Buffett’s stock investment approach continues to focus on companies with solid competitive advantages even in these challenging markets we’re seeing nowadays. Constellation’s position as the dominant producer of Mexican beer in the U.S. market exemplifies the type of competitive moat that Buffett typically seeks when selecting Warren Buffett stocks for the long term.

Also Read: South Korea CBDC Pilot: 100,000 Users to Test Digital Won in April

The financial risks present in today’s market haven’t actually deterred Buffett from seeking out value opportunities that fit his criteria. His portfolio diversification strategy adapts to the current conditions while maintaining the core principles that have guided Berkshire’s success through various market cycles over the years.